Geopolitical Tensions

Geopolitical tensions across various regions are significantly influencing the Global Infrared Search & Track (IRST) System Market Industry. Heightened security concerns and regional conflicts prompt nations to bolster their defense capabilities, particularly in surveillance and reconnaissance. Countries in Eastern Europe and the Asia-Pacific region are increasingly investing in IRST systems to counter perceived threats. This strategic focus on enhancing military readiness is expected to drive market growth, as nations seek to acquire advanced technologies that provide a tactical edge. The ongoing geopolitical landscape suggests a sustained demand for IRST systems in the coming years.

Rising Defense Budgets

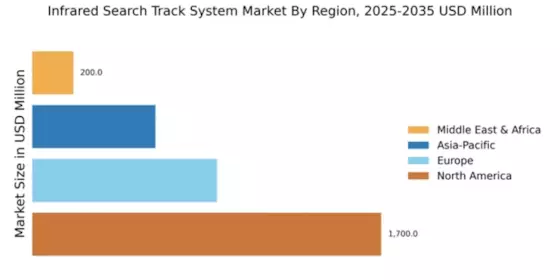

The Global Infrared Search & Track (IRST) System Market Industry is experiencing growth driven by increasing defense budgets across various nations. Countries are prioritizing advanced surveillance and tracking systems to enhance their military capabilities. For instance, the United States has allocated substantial funds for modernizing its defense systems, which includes investments in IRST technologies. This trend is mirrored in nations such as India and China, which are also ramping up their military expenditures. The anticipated market value of the Global Infrared Search & Track (IRST) System Market is projected to reach 5.02 USD Billion in 2024, indicating a robust demand for these systems.

Market Growth Projections

The Global Infrared Search & Track (IRST) System Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 5.02 USD Billion in 2024 and 9.23 USD Billion by 2035, the industry is poised for a robust expansion. The anticipated compound annual growth rate of 5.69% from 2025 to 2035 reflects the increasing investments in advanced military technologies and the growing demand for enhanced surveillance capabilities. This growth is indicative of the broader trends in defense spending and technological innovation, positioning the IRST market as a critical component of future military strategies.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Infrared Search & Track (IRST) System Market Industry. Innovations in sensor technology, data processing, and integration capabilities are enhancing the effectiveness of IRST systems. For example, the development of advanced infrared sensors allows for improved target detection and tracking in diverse environments. These advancements not only increase operational efficiency but also reduce the likelihood of detection by adversaries. As a result, the market is expected to grow significantly, with projections indicating a value of 9.23 USD Billion by 2035, reflecting the ongoing evolution of military technologies.

Growing Demand for Airborne Systems

The Global Infrared Search & Track (IRST) System Market Industry is witnessing a surge in demand for airborne systems, particularly in military aviation. The need for enhanced situational awareness and threat detection in aerial operations is driving this trend. Modern fighter jets and unmanned aerial vehicles are increasingly equipped with IRST systems to improve their combat effectiveness. For instance, the integration of IRST capabilities in platforms such as the F-35 Lightning II has demonstrated the strategic advantages of these systems. This growing emphasis on airborne applications is likely to contribute to a compound annual growth rate of 5.69% from 2025 to 2035.

Increased Focus on Asymmetric Warfare

The Global Infrared Search & Track (IRST) System Market Industry is also shaped by an increased focus on asymmetric warfare tactics. As military engagements evolve, there is a growing recognition of the need for advanced surveillance systems that can operate effectively in unconventional combat scenarios. IRST systems provide critical capabilities for detecting and tracking low-observable targets, which are often employed in asymmetric warfare. This shift in military strategy is likely to drive demand for IRST technologies, as armed forces seek to enhance their operational effectiveness against non-traditional threats. The market's growth trajectory appears promising as these systems become integral to modern military operations.