- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

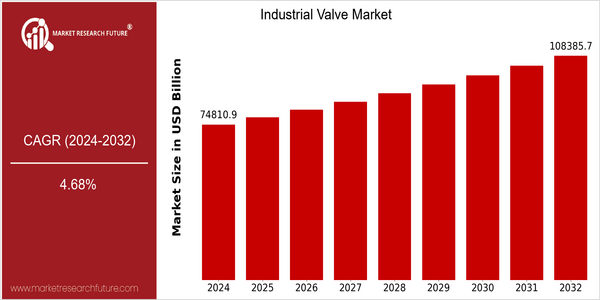

| Year | Value |

|---|---|

| 2024 | USD 74810.9 Billion |

| 2032 | USD 108385.7 Billion |

| CAGR (2024-2032) | 4.68 % |

Note – Market size depicts the revenue generated over the financial year

The global industrial valve market is expected to grow significantly. The market is expected to reach a value of $ 74,810.9 million in 2024, which is expected to grow to $ 108,385,720,800 by 2032. This growth rate is a CAGR of 4.68% from 2024 to 2032. The main driving force for this market is the increasing demand for efficient fluid control systems in various industries, such as oil and gas, water and sewage, and power generation. The trend of automation in the industry and the rising emphasis on energy conservation have also led to the increased use of advanced valves. In addition, the leading companies in the industrial valve market, such as Emerson Electric Co., Flowserve Corp., and Valmet, are investing heavily in research and development to develop new products and enhance existing products. Strategic alliances and collaborations to integrate smart valve systems have also become more common. For example, the integration of valve solutions with IoT capabilities enables real-time monitoring and preventive maintenance, which can improve operational efficiency and reduce downtime. The industrial valve market is expected to grow steadily as the industry evolves and puts more emphasis on energy conservation.

Regional Market Size

Regional Deep Dive

The Industrial Valve Market is expected to grow at a CAGR of 6% from 2019 to 2025, owing to the growing industrialization, industrialization, and construction of the market. The Industrial Valve Market is also expected to grow at a CAGR of 6% from 2019 to 2025. The market dynamics of each region are influenced by local economic conditions, regulatory frameworks, and technological advancements. The market is driven by the presence of a strong manufacturing base and the increasing investment in the energy sector in North America. Europe is characterized by stringent regulations and automation. The APAC region is experiencing rapid industrial growth, especially in emerging economies. The Middle East and Africa are mainly focused on oil and gas projects. Latin America is gradually improving its industrial capabilities, which will also drive the valve market.

Europe

- In Europe, the Industrial Valve Market is heavily influenced by the European Union's Green Deal, which aims to make Europe climate-neutral by 2050, prompting manufacturers to innovate and produce more sustainable valve solutions.

- Key players like KSB SE & Co. KGaA and Valmet are investing in smart valve technologies that integrate IoT capabilities, allowing for better monitoring and control of industrial processes, which is reshaping the market landscape.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrialization, particularly in countries like China and India, where government initiatives such as 'Make in India' are encouraging local manufacturing and increasing the demand for industrial valves.

- Technological advancements in automation and smart manufacturing are being adopted by major companies like Mitsubishi Heavy Industries and Kitz Corporation, leading to enhanced efficiency and reliability in valve operations.

Latin America

- Latin America is witnessing a gradual recovery in its industrial sector, with countries like Brazil and Mexico investing in infrastructure projects that are boosting the demand for industrial valves.

- The region is also seeing an increase in foreign direct investment, with companies like Pentair and AVK Group establishing local manufacturing facilities to cater to the growing market needs.

North America

- The North American industrial valve market is growing rapidly due to the increase in the investment in the new energy projects, especially in the United States, where Emerson Electric and Flowserve are leading the innovation in valve technology.

- Regulatory changes, such as the implementation of stricter emissions standards by the Environmental Protection Agency (EPA), are driving industries to adopt more efficient and environmentally friendly valve solutions, thereby enhancing market growth.

Middle East And Africa

- In the Middle East and Africa, the Industrial Valve Market is significantly driven by the oil and gas sector, with major projects like Saudi Aramco's expansion plans leading to increased demand for high-performance valves.

- Regulatory frameworks in the region are evolving, with governments focusing on local content requirements, which is encouraging international companies to partner with local firms, thereby enhancing market growth.

Did You Know?

“Did you know that the Industrial Valve Market is expected to see a significant shift towards smart valves, with estimates suggesting that smart valve technologies could account for over 30% of the market by 2025?” — Market Research Future

Segmental Market Size

Industrial valves are in a period of growth. They are in demand in many industries, including the oil and gas industry, water treatment, and electricity generation. The need for efficient fluid control systems and the stricter safety and environmental regulations are mainly responsible for this growth. Technological advances, such as automation and smart valves, are also boosting demand. The use of industrial valves is currently at a mature stage. The main players in the field are Emerson Electric and Flowserve. Some of the major projects in the field of smart valves are in the oil and gas industry, particularly in North America and the Middle East. Among the main applications are transport via pipelines, chemical processing, and air-conditioning. These trends are mainly a result of macroeconomic factors such as the push for digitalization and the need to meet increasingly stringent safety and environmental regulations. The Internet of Things and artificial intelligence are influencing the development of valve control and monitoring systems.

Future Outlook

The Industrial Valve Market is expected to grow from a value of about 72,810 million to a value of about 98,010 million in the period from 2024 to 2032. The annual growth rate is estimated at a compound annual growth rate of 4.68%. The growth is driven by the increasing demand for efficient fluid control systems in various industries such as oil and gas, water and sewage, and power generation. Industry is also increasingly focusing on automation and process optimization. The use of new valve technology, such as smart valves with IoT, is expected to increase efficiency and reliability. Also, stricter regulations on safety and the environment, which compel the industry to improve its existing valve systems, will help shape the future of the industrial valve market. The ongoing shift to renewable energy sources is also expected to increase the demand for special valves that can handle various media and extreme conditions. The integration of artificial intelligence in the field of predictive maintenance and the growing focus on digitalization in industrial processes will also further stimulate the market. Therefore, the industrial valve industry should be prepared for a changing market with new customer needs and innovation and take advantage of the opportunities offered by the projected growth.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 71834.5 Million |

| Growth Rate | 4.67% (2024-2032) |

Industrial Valve Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.