Top Industry Leaders in the Industrial Valve Market

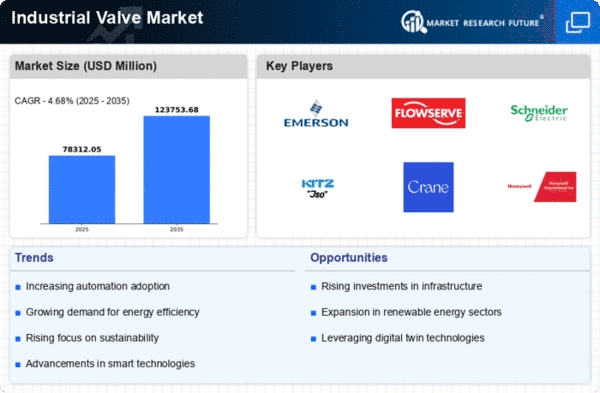

The global industrial valve market stands as a complex and dynamic landscape for industry participants, offering promising growth potential amid its fragmented nature. Successfully maneuvering this market necessitates a comprehensive understanding of key player strategies, market share dynamics, and emerging trends.

Major Players:

- Emerson (US)

- Schlumberger Limited (US)

- IMI PLC (US)

- Flowserve Corporation (US)

- Weir Group (UK)

- Crane Co. (US)

- AVK Holding A/S (Denmark)

- Kitz Corporation (Japan)

- Neway Valve (Suzhou) Co. Ltd (China)

- Conbraco Industries Inc. (US)

- Samson AG (Germany)

- Velan Inc. (Canada)

- Forbes Marshall (India)

- Dwyer Instruments Inc. (US)

- Avcon Controls (India)

- PR Valves LLC (US)

- Danfoss A/S (Nordborg), and others.

Fragmentation: A Key Characteristic: The industrial valve market is marked by a high degree of fragmentation, with the top ten players holding less than 15% of the total market share. This fragmentation manifests in numerous niche players specializing in specific valve types, materials, or end-user industries. Additionally, regionalization plays a pivotal role, with strong regional players catering to domestic and nearby markets.

Giant vs. Niche Players: Strategies Vary: Global giants such as Schlumberger, Emerson Electric, and Flowserve Corporation leverage economies of scale, extensive distribution networks, and diverse product portfolios to maintain market dominance. Their competition centers on technology, reliability, and brand reputation, with a focus on large-scale projects in sectors like oil and gas, power generation, and chemicals.

Niche players, in contrast, rely on agility, specialization, and cost-effectiveness. These entities often concentrate on specific valve types, like cryogenic valves, or serve smaller regional markets. Their competitive edge lies in innovation and delivering customized solutions tailored to unique customer needs.

Factors Shaping Market Share: Beyond Size: Market share dynamics are influenced by factors beyond size alone. Geographic presence, product variety and specialization, customer relationships, and after-sales service all play pivotal roles. Industry expertise and compliance with regional regulations emerge as significant differentiators.

New and Emerging Trends: Reshaping the Market: The industrial valve market is witnessing transformative trends:

-

Digitalization: Integration of smart valves with sensors and IoT platforms facilitates predictive maintenance, operational efficiency optimization, and downtime minimization. Companies like Emerson and Honeywell lead in this shift.

-

Material Advancements: Development of lighter, stronger materials, such as composite polymers and titanium alloys, opens new applications in challenging environments, particularly in aerospace and nuclear energy.

-

Sustainability Focus: Growing demand for eco-friendly solutions propels the adoption of energy-efficient valves and those manufactured from recycled materials. Companies like Alfa Laval and Weir Group actively pursue sustainable valve designs.

Overall Competitive Scenario: A Dynamic Balance: The industrial valve market competition reflects a delicate balance between established giants and agile niche players. While global players dominate large-scale projects, regional and specialized players remain relevant through flexibility and focus. Embracing new technologies, material advancements, and sustainability will be pivotal for future success.

Key Takeaways:

-

The industrial valve market demands diverse strategies for success due to its high fragmentation.

-

Giants compete on scale and technology, while niche players thrive on specialization and agility.

-

Market share is influenced not only by size but also by geographic reach, product offerings, and customer service.

-

Digitalization, material advancements, and sustainability are key emerging trends reshaping the market.

Understanding this dynamic landscape is crucial for companies to navigate the competitive terrain and secure their foothold in the industrial valve market.

Recent Developments and Updates:

• Crane Co. (US): Successfully completed the integration of its acquired business, becoming a leading player in the water infrastructure valve market. (Source: Crane Co. annual report 2023)

• AVK Holding A/S (Denmark): Received a major order for butterfly valves from a large renewable energy project in Europe. (Source: AVK Holding press release, November 22, 2023)

• Kitz Corporation (Japan): Developed a new type of self-cleaning valve for use in food and beverage processing, improving hygiene and efficiency. (Source: Kitz Corporation press release, October 5, 2023)

• Neway Valve (Suzhou) Co. Ltd (China): Expanding its production capacity to meet the growing demand for valves in the Chinese market. (Source: Neway Valve website, December 2023)