Market Trends

Key Emerging Trends in the Industrial Seals Market

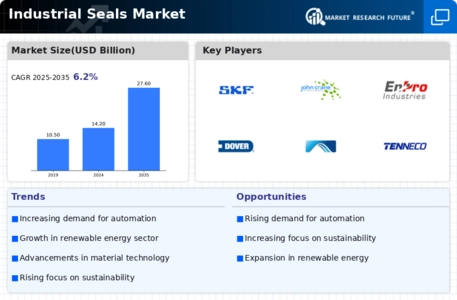

The industrial seal market is undergoing excellent adjustments stimulated by technological innovations, increasing demand for efficient sealing solutions, and the growth of numerous industries worldwide. One huge fashion shaping this market is the developing emphasis on excessive overall performance and specialized seals designed to satisfy stringent operational requirements across numerous industrial sectors. Industries, which include oil and gasoline, automobile, aerospace, prescription drugs, and manufacturing, are increasingly looking for seals that provide stronger durability and resistance to excessive temperatures, chemical substances, and pressure, making sure reliable overall performance in challenging environments. Moreover, there's an important shift towards the adoption of advanced substances and production techniques within the manufacturing of industrial seals. Manufacturers are exploring revolutionary substances together with thermoplastic elastomers, fluoropolymers, and composite substances to broaden seals with advanced sealing properties and prolonged service life. Additionally, innovations in manufacturing technologies like additive manufacturing (3D printing) are enabling the production of complex and customized seals, presenting tailored solutions to meet unique industry necessities. Additionally, the marketplace is experiencing elevated integration of smart and IoT-enabled seals, specifically in sectors like manufacturing and predictive preservation. Smart seals prepared with sensors and monitoring capabilities permit real-time monitoring of seal performance, taking into account proactive preservation and minimizing downtime. These IoT-enabled seals offer precious data insights that facilitate predictive protection strategies, optimize operational performance, and lower usual protection charges for business equipment. In the end, the industrial seal market is undergoing giant alterations propelled by the aid of technological innovations, industry-precise needs, and the growing emphasis on sustainability. The future of industrial seals appears to be centered on high-performance, specialized seals that cater to stringent industrial necessities while embracing superior materials, clever technologies, and environmentally friendly answers. As industries continue to evolve and demand higher performance, sturdiness, and reliability from sealing structures, manufacturers will, in all likelihood, maintain innovating to satisfy those dynamic market needs.

Leave a Comment