Industrial Maintenance Services Size

Industrial Maintenance Services Market Growth Projections and Opportunities

Searching...

What is the current valuation of the Industrial Maintenance Services Market?

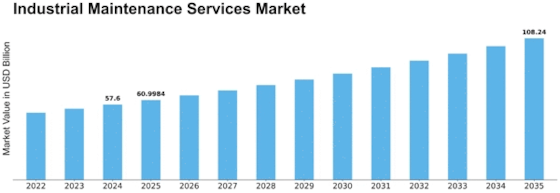

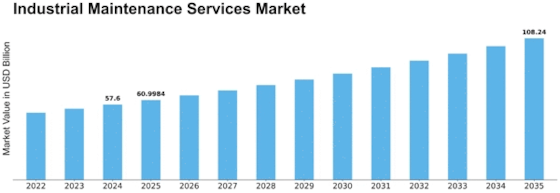

The Industrial Maintenance Services Market was valued at 57.6 USD Billion in 2024.

What is the projected market size for the Industrial Maintenance Services Market by 2035?

The market is projected to reach 108.24 USD Billion by 2035.

What is the expected CAGR for the Industrial Maintenance Services Market during the forecast period?

The expected CAGR for the market from 2025 to 2035 is 5.9%.

Which segments are included in the Industrial Maintenance Services Market?

The market includes segments such as Service, Location, and End-User Industry.

What are the projected values for the Repair segment in the Industrial Maintenance Services Market?

The Repair segment is projected to grow from 20.0 to 38.0 USD Billion by 2035.

How does the Inspection segment perform in terms of market valuation?

The Inspection segment is expected to increase from 15.0 to 28.0 USD Billion by 2035.

As per Market Research Future analysis, the Industrial Maintenance Services Market Size was estimated at 57.6 USD Billion in 2024. The Industrial Maintenance Services industry is projected to grow from 61.0 USD Billion in 2025 to 108.24 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.9% during the forecast period 2025 - 2035

The Industrial Maintenance Services Market is experiencing a transformative shift towards advanced technologies and sustainable practices.

| 2024 Market Size | 57.6 (USD Billion) |

| 2035 Market Size | 108.24 (USD Billion) |

| CAGR (2025 - 2035) | 5.9% |

| Largest Regional Market Share in 2024 | North America |

Honeywell (US), <a href="https://www.siemens.com/global/en/products/services/digital-enterprise-services/repair-services.html">Siemens</a> (DE), General Electric (US), Schneider Electric (FR), <a href="https://www.emerson.com/en-us/catalog/maintenance">Emerson Electric</a> (US), Rockwell Automation (US), ABB (CH), Mitsubishi Electric (JP), KUKA (DE)

The Industrial Maintenance Services Market is currently experiencing a transformative phase, driven by advancements in technology and an increasing emphasis on operational efficiency. Companies are increasingly recognizing the value of proactive maintenance strategies, which not only enhance equipment longevity but also reduce unexpected downtimes. This shift towards predictive maintenance, facilitated by the integration of IoT and AI technologies, appears to be reshaping traditional maintenance paradigms. Furthermore, the growing focus on sustainability and regulatory compliance is prompting organizations to adopt more environmentally friendly practices within their maintenance operations. In addition, the Industrial Maintenance Services Market is witnessing a surge in demand for skilled labor and specialized services. As industries evolve, the need for technicians who are adept in modern technologies becomes paramount. This trend suggests that training and development initiatives will play a crucial role in ensuring that the workforce is equipped to meet the challenges of a rapidly changing landscape. Overall, the market seems poised for continued growth, driven by innovation and a commitment to enhancing operational performance.

The trend towards predictive maintenance is gaining traction as organizations seek to minimize equipment failures and optimize performance. By leveraging advanced analytics and real-time data, companies can anticipate maintenance needs, thereby reducing costs and improving efficiency.

The incorporation of smart technologies, such as IoT and AI, is revolutionizing the Industrial Maintenance Services Market. These technologies enable real-time monitoring and data analysis, facilitating more informed decision-making and enhancing overall maintenance strategies.

There is a growing emphasis on sustainability within the Industrial Maintenance Services Market. Companies are increasingly adopting eco-friendly practices and materials, driven by regulatory requirements and a commitment to reducing their environmental footprint.

The growth of the manufacturing sector is a key driver for the Industrial Maintenance Services Market. As manufacturing activities expand, the need for reliable maintenance services becomes increasingly critical. The manufacturing sector has shown resilience and adaptability, with projections indicating a steady increase in production output. This growth necessitates regular maintenance to ensure machinery operates at optimal levels. Data suggests that maintenance services can enhance equipment lifespan by up to 50%, making them indispensable for manufacturers. Thus, the expansion of the manufacturing sector is expected to significantly contribute to the growth of the Industrial Maintenance Services Market.

The Industrial Maintenance Services Market experiences a notable surge in demand for operational efficiency across various sectors. Companies are increasingly recognizing the importance of minimizing downtime and enhancing productivity. This trend is driven by the need to maintain competitive advantage in a rapidly evolving marketplace. According to recent data, organizations that implement effective maintenance strategies can reduce operational costs by up to 30%. As a result, the focus on optimizing maintenance processes is likely to propel the growth of the Industrial Maintenance Services Market, as businesses seek to streamline operations and improve overall performance.

The Industrial Maintenance Services Market is significantly influenced by the increasing regulatory compliance requirements imposed on various industries. Governments and regulatory bodies are enforcing stricter standards for equipment safety and environmental sustainability. This has led organizations to prioritize maintenance services that ensure compliance with these regulations. For instance, industries such as manufacturing and energy are required to adhere to specific maintenance protocols to avoid penalties. As a result, the demand for specialized maintenance services that align with regulatory standards is likely to grow, thereby impacting the Industrial Maintenance Services Market positively.

The emphasis on sustainability and green practices is reshaping the Industrial Maintenance Services Market. Companies are increasingly adopting environmentally friendly maintenance solutions to reduce their carbon footprint and comply with sustainability initiatives. This shift is driven by consumer demand for sustainable practices and the need to adhere to environmental regulations. Recent surveys indicate that organizations implementing green maintenance strategies can achieve energy savings of up to 20%. Consequently, the focus on sustainability is likely to foster innovation within the Industrial Maintenance Services Market, as companies seek to develop and implement eco-friendly maintenance solutions.

Technological advancements play a pivotal role in shaping the Industrial Maintenance Services Market. The integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence, and machine learning is transforming traditional maintenance practices. These innovations enable predictive maintenance, which allows companies to anticipate equipment failures before they occur. Recent studies indicate that predictive maintenance can lead to a reduction in maintenance costs by approximately 25%. Consequently, the adoption of these technologies is expected to drive significant growth in the Industrial Maintenance Services Market, as organizations strive to enhance their maintenance capabilities.

In the Industrial Maintenance Services Market, the service segment is primarily dominated by the Repair service, which is the largest contributor to overall market activity. This is followed by Inspection services, which are gaining significant traction. The Repair segment benefits from consistent demand due to the necessity for regular equipment upkeep, while Inspection services have seen an uptick in relevance as industries emphasize compliance and safety inspections.

Repair (Dominant) vs. Inspection (Emerging)

Repair services are essential for maintaining machinery and ensuring operational efficiency in various industrial sectors. This segment is characterized by its established market presence, where businesses rely heavily on repair solutions to minimize downtime and enhance productivity. In contrast, Inspection services are emerging as a vital component, driven by regulatory requirements and a proactive approach to equipment upkeep. These services focus on preventive measures, identifying potential failures before they occur, which not only boosts safety but also optimizes maintenance schedules for businesses.

In the Industrial Maintenance Services Market, the market share distribution shows that On Shore services have the largest share, primarily due to their extensive application across various industries such as manufacturing, <a href="https://www.marketresearchfuture.com/reports/oil-gas-transportation-market-25008">oil and gas transportation</a>, and utilities. This segment leverages existing infrastructure, driving consistent demand for maintenance services, ensuring reliability and safety in operations. Off Shore services, on the other hand, are growing rapidly, driven by increased activities in oil exploration, renewable energy, and technological advancements that enhance maintenance capabilities in challenging marine environments.

On Shore (Dominant) vs. Off Shore (Emerging)

The On Shore segment represents the dominant market presence in Industrial Maintenance Services Market, characterized by its well-established practices and extensive customer base. Service providers focus on preventive maintenance, ensuring minimal downtime and efficiency in diverse industries ranging from heavy manufacturing to energy sectors. Conversely, the Off Shore segment is emerging as a critical player, fueled by the growing activities in oil and gas exploration, as well as increasing investments in offshore wind energy. The unique challenges of off shore maintenance demand specialized services, innovative technologies, and skilled labor, making it a dynamic and rapidly evolving area within the industry.

The Industrial Maintenance Services Market Exhibits a diverse distribution across its end-user industries. The Oil and Gas sector holds the largest market share, supported by its continuous need for maintenance due to the complex nature of operations. Close behind, the Manufacturing industry represents a significant portion of the market, driven by its constant demand for machinery upkeep and efficiency improvements. The Power Generation sector, while vital, commands a smaller share compared to Oil and Gas and Manufacturing, yet it remains an essential player in the market landscape. 'Others' encompasses various sectors that collectively contribute to the market's robustness, providing specialized services. Growth trends within the Industrial Maintenance Services Market are shaped by ongoing technological advancements and increased operational efficiency. The Manufacturing sector is experiencing the fastest growth due to the rise of automation and the need for regular maintenance of high-tech equipment. Additionally, regulatory mandates in the Oil and Gas and Power Generation industries ensure consistent demand for maintenance services. As these sectors evolve, they drive innovation in maintenance solutions, further enhancing the services offered by industry providers.

Oil and Gas: Dominant vs. Manufacturing: Emerging

The Oil and Gas sector stands as the dominant force in the Industrial Maintenance Services Market, characterized by its substantial operational complexity and the necessity for regular maintenance to prevent costly downtimes. This sector's services focus on the maintenance of drilling equipment, pipelines, and refineries, which require specialized knowledge and rigorous safety standards. On the other hand, the Manufacturing sector is emerging rapidly due to the integration of advanced technologies and automation in production processes. Maintenance services within this sector aim to enhance efficiency and reduce equipment failures, making it a pivotal area for innovative service providers. While Oil and Gas remains dominant, Manufacturing's rapid growth indicates a shift in focus towards modern maintenance practices that leverage technology and provide proactive solutions.

North America is the largest market for industrial maintenance services, holding approximately 40% of the global share. The region's growth is driven by technological advancements, increased automation, and stringent regulatory standards aimed at enhancing operational efficiency. The demand for predictive maintenance and IoT integration is rising, supported by government initiatives promoting smart manufacturing and sustainability. The United States leads the market, followed by Canada, with key players like Honeywell, General Electric, and Rockwell Automation dominating the landscape. The competitive environment is characterized by continuous innovation and strategic partnerships among major firms. The presence of advanced manufacturing facilities further strengthens the market, ensuring a robust demand for maintenance services.

Europe is the second-largest market for industrial maintenance services, accounting for around 30% of the global share. The region's growth is propelled by stringent environmental regulations and a strong emphasis on sustainability. The European Union's initiatives to promote energy efficiency and reduce carbon emissions are significant drivers, leading to increased investments in maintenance services that ensure compliance with these regulations. Germany and France are the leading countries in this market, with major players like Siemens and Schneider Electric playing pivotal roles. The competitive landscape is marked by a focus on digital transformation and smart technologies, enhancing service delivery and operational efficiency. The presence of a skilled workforce and advanced infrastructure further supports market growth.

Asia-Pacific is witnessing rapid growth in the industrial maintenance services market, holding approximately 25% of the global share. The region's expansion is driven by increasing industrialization, urbanization, and the adoption of advanced technologies. Countries like China and India are investing heavily in infrastructure development, which is expected to boost demand for maintenance services significantly. Government initiatives aimed at enhancing manufacturing capabilities further catalyze this growth. China is the largest market in the region, followed by India and Japan. The competitive landscape features key players like Mitsubishi Electric and ABB, who are focusing on innovation and service diversification. The presence of a growing number of manufacturing units and a shift towards automation are key factors driving the demand for maintenance services in this region.

The Middle East and Africa region is gradually emerging in the industrial maintenance services market, holding about 5% of the global share. The growth is primarily driven by increasing investments in infrastructure and industrial projects, particularly in oil and gas, mining, and manufacturing sectors. Government initiatives aimed at diversifying economies and enhancing industrial capabilities are also significant catalysts for market expansion. Countries like South Africa and the UAE are leading the market, with a growing presence of international players. The competitive landscape is evolving, with local firms partnering with global companies to enhance service offerings. The region's potential for growth is substantial, driven by the need for efficient maintenance solutions in various industries.

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Industrial maintenance services market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Industrial maintenance services industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Industrial maintenance services industry to benefit clients and increase the market sector. In recent years, the Industrial maintenance services industry has offered some of the most significant advantages to medicine. Major players in the Industrial maintenance services market, including Siemens AG, Total Resource Management, NAES Corporation, Marshall Industrial Technologies, Baker Hughes Company, Kirti Telnet Pvt. Ltd., Caverion Corporation, Lee Industrial Contracting, Petrofac Limited, Bell and Howell LLC, Advanced Technology Services, Inc., SGK India Engineering Pvt. Ltd., Global Offshore Engineering, Valmet Ltd., Bilfinger (Bilfinger Industrial Services Polska Sp. z o.o.), MEIDENSHA CORPORATION, Global Electronic Services, Inc. and others, are attempting to increase market demand by investing in research and development operations. Siemens AG (Siemens) focuses on technology. The automation, digitalization, and electrification fields are all covered by its operations. The company designs, develops, and manufactures goods in addition to installing complex projects and systems. Additionally, it provides a range of uniquely created solutions for various demands. Power generation and delivery, intelligent building infrastructure, and distributed energy systems are Siemens' areas of expertise. It provides medical technology, smart mobility solutions, and digital healthcare services for the road and rail transportation sectors. Siemens maintains locations for its manufacturing plants, distribution centers, and sales offices all around the world. It offers clients services in a variety of industries, such as manufacturing, infrastructure, process, and energy. Siemens has its headquarters in Munich, Bavaria, Germany. Baker Hughes Co. (Baker Hughes) is a provider of energy and industrial solutions. Among the company's product lines are drilling equipment, subsea production systems, compressors, pipe systems, electricity generators, energy recovery and storage tank systems, regulators, control systems, pumps, valves, and process control technologies. Additionally, the business offers digital solutions for sensor-based process measurement, plant controls, pipeline integrity, and non-destructive testing and inspection. The industry serves both national or state-owned oil companies and independent oil and gas companies. The company has operations in the Americas, Africa, the Middle East, and Asia. Baker Hughes is based in Houston, Texas, in the United States.

Dec-2023: Emerson Electric Co. has created a partnership with SungEel HiTech Co., Ltd., a company that specializes in lithium-ion battery recycling. Through this, the former will offer advanced automation solutions to boost sustainable production and operational efficiency at SungEel’s new lithium-ion recycling plant located in the Hydro Center complex in Gunsan, Jeollabuk-do.

May 2023: Rockwell Automation, Inc. has formed a strategic alliance with Autonox Robotics Gmbh, which specializes in automation machinery.

Apr-2023: Mitsubishi Electric Corporation has announced that its subsidiary company Mitsubishi Electric India Pvt. Ltd. is joining forces with SolidCAM GmbH, an innovative provider of CAM software for CNC machining and distribution solutions.

Honeywell International, Inc. stated that it signed an agreement with Compressor Controls Corporation (CCC) as INDICOR, LLC which offers turbomachinery control and optimization solutions. Following this deal, Honeywell International, Inc plans to acquire Compressor Controls Corporation (CCC) as part of Honeywell Process Solutions Business.

August 2023: Siemens AG launched SIRIUS 3UG5 line monitoring relays.

June 2023: Caverion Corporation acquired CRC Clean Room Control.

July 2023: Petrofac Limited secured a facilities management contract from CNR International (CNRI) offshore the Ivory Coast, West Africa for providing integrated services for the Espoir Ivoirien Floating Production Storage and Offloading (FPSO) vessel.

The Industrial Maintenance Services Market is projected to grow at a 5.9% CAGR from 2025 to 2035, driven by technological advancements, increasing automation, and a focus on operational efficiency.

New opportunities lie in:

By 2035, the market is expected to be robust, reflecting substantial growth and innovation.

| MARKET SIZE 2024 | 57.6(USD Billion) |

| MARKET SIZE 2025 | 61.0(USD Billion) |

| MARKET SIZE 2035 | 108.24(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.9% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Honeywell (US), Siemens (DE), General Electric (US), Schneider Electric (FR), Emerson Electric (US), Rockwell Automation (US), ABB (CH), Mitsubishi Electric (JP), KUKA (DE) |

| Segments Covered | Service, Location, End-User Industry, Region |

| Key Market Opportunities | Integration of predictive maintenance technologies enhances efficiency in the Industrial Maintenance Services Market. |

| Key Market Dynamics | Rising demand for predictive maintenance technologies drives innovation and competition in the Industrial Maintenance Services Market. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

What is the current valuation of the Industrial Maintenance Services Market?

The Industrial Maintenance Services Market was valued at 57.6 USD Billion in 2024.

What is the projected market size for the Industrial Maintenance Services Market by 2035?

The market is projected to reach 108.24 USD Billion by 2035.

What is the expected CAGR for the Industrial Maintenance Services Market during the forecast period?

The expected CAGR for the market from 2025 to 2035 is 5.9%.

Which segments are included in the Industrial Maintenance Services Market?

The market includes segments such as Service, Location, and End-User Industry.

What are the projected values for the Repair segment in the Industrial Maintenance Services Market?

The Repair segment is projected to grow from 20.0 to 38.0 USD Billion by 2035.

How does the Inspection segment perform in terms of market valuation?

The Inspection segment is expected to increase from 15.0 to 28.0 USD Billion by 2035.

Repair

Inspection

Maintenance

On Shore

Off Shore

Oil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Germany Outlook (USD Billion, 2018-2032)

Industrial Maintenance Services Market by ServiceRepair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Repair

Inspection

Maintenance

Industrial Maintenance Services Market by LocationOn Shore

Off Shore

Industrial Maintenance Services Market by End-User IndustryOil and Gas

Manufacturing

Power Generation

Others

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment