Industrial Insulation Size

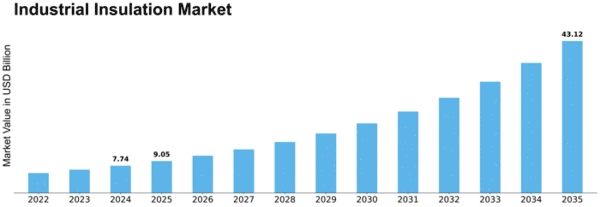

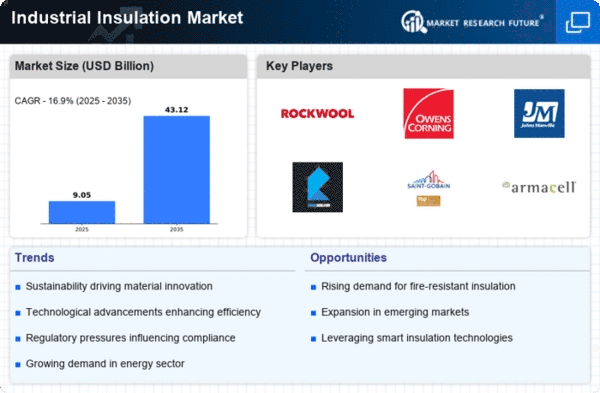

Industrial Insulation Market Growth Projections and Opportunities

Insulation of materials is necessary to reduce heat transfer and to deal with high-temperature issues. The higher energy consumption rate plays an essential role in industrial processes as its high demands for insulating products. These factors are further driving the Industrial Insulation Market Growth.

Different industrial material transferring processes are done through pipes, vessels, boilers, storage tanks and others; these types of equipment are being insulated with insulation wraps and sheets, coatings and adhesives and sealants material which further reduces the energy consumption rate to maintain the natural temperature of the material. Energy conservation is a focal point for all industrial verticals, including power, food and beverage, and petrochemical. Insulation materials play a significant role in dealing with various heat transfer operations in industries. Proper usage of insulation materials leads to less heat loss and cost savings.

In the highly competitive Industrial Insulation Market, companies employ various strategies to position themselves effectively and gain a larger share of the market. One prevalent strategy is differentiation, where companies focus on offering unique features or benefits in their insulation products to stand out from competitors. This could involve providing superior thermal efficiency, durability, or specialized insulation properties tailored to specific industrial applications such as petrochemical, power generation, or HVAC systems. By emphasizing these distinguishing factors, companies attract customers seeking customized solutions, thereby carving out their market share.

Moreover, pricing strategies play a significant role in market positioning within the Industrial Insulation Market. Some companies opt for a cost leadership approach, offering their products at competitive prices while maintaining acceptable quality levels. This strategy appeals to cost-conscious customers and enables companies to capture a larger market share by catering to budget-friendly segments. Conversely, premium pricing strategies target customers who prioritize quality and are willing to pay a premium for high-performance insulation solutions. Companies employing this strategy focus on innovation, superior materials, or brand reputation to justify higher prices and position themselves as leaders in the premium segment of the market.

Effective distribution channels also contribute to market share positioning in the Industrial Insulation Market. Companies strategically partner with distributors, contractors, and OEMs (Original Equipment Manufacturers) to expand their reach and accessibility to customers. By ensuring their products are readily available through multiple channels, companies can penetrate new markets, reach diverse customer segments, and strengthen their market share. Moreover, efficient distribution networks enable companies to provide timely support, enhance customer satisfaction, and foster long-term relationships, further solidifying their position in the market.

Furthermore, strategic alliances and collaborations are integral to market share positioning strategies in the Industrial Insulation Market. Companies often form partnerships with research institutions, universities, or other industry players to leverage collective expertise, share resources, and drive innovation. Collaborations enable companies to develop cutting-edge insulation solutions, address emerging market needs, and stay ahead of competitors. Additionally, strategic alliances offer opportunities for market expansion, as companies can access new technologies, enter new geographic regions, or target previously untapped customer segments through synergistic partnerships.

Marketing and branding strategies are also essential for shaping market perceptions and establishing a strong position in the Industrial Insulation Market. Companies invest in branding efforts to communicate their value proposition, build credibility, and differentiate themselves in the marketplace. This could involve highlighting product features, showcasing successful case studies, or leveraging endorsements from industry experts. Furthermore, targeted marketing campaigns help companies reach their desired audience segments, generate leads, and drive sales, thereby strengthening their market share position.

Leave a Comment