Health and Wellness Focus

The Industrial Hemp Market is witnessing a surge in interest related to health and wellness products. Hemp-derived CBD has gained popularity for its potential therapeutic benefits, including pain relief and anxiety reduction. In recent years, the market for CBD products has expanded significantly, with estimates suggesting that the hemp-derived CBD market could reach several billion dollars by 2025. This growth is fueled by increasing consumer awareness and acceptance of hemp-based products. Additionally, the nutritional benefits of hemp seeds, which are rich in protein and omega fatty acids, are contributing to the industry's expansion. As health-conscious consumers continue to seek natural alternatives, the Industrial Hemp Market is likely to see sustained growth in this segment.

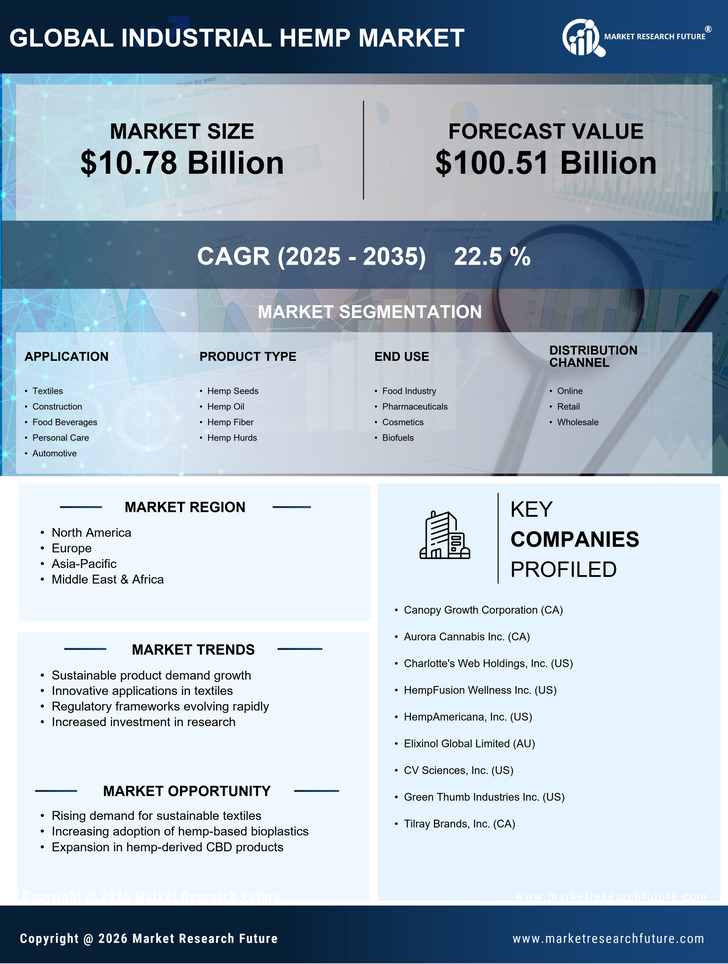

Evolving Regulatory Environment

The evolving regulatory environment surrounding hemp cultivation and production is a critical driver for the Industrial Hemp Market. Recent legislative changes in various regions have facilitated the legal cultivation of hemp, leading to increased investment and innovation within the sector. As of 2025, many countries have established frameworks that support hemp farming, which is expected to enhance market accessibility for producers. This regulatory shift not only encourages new entrants into the market but also fosters research and development initiatives aimed at optimizing hemp utilization. The clarity in regulations is likely to bolster consumer confidence, further propelling the growth of the Industrial Hemp Market.

Sustainable Material Production

The Industrial Hemp Market is experiencing a notable shift towards sustainable material production. Hemp is recognized for its rapid growth and minimal resource requirements, making it an attractive alternative to traditional crops. The versatility of hemp allows for its use in textiles, bioplastics, and construction materials, which are increasingly sought after due to environmental concerns. In 2025, the demand for sustainable materials is projected to rise, with the industrial hemp sector potentially capturing a significant share of this market. This trend is driven by both consumer preferences and regulatory pressures aimed at reducing carbon footprints. As industries seek to adopt more eco-friendly practices, the Industrial Hemp Market stands to benefit from this growing emphasis on sustainability.

Diverse Applications Across Industries

The Industrial Hemp Market is characterized by its diverse applications across various sectors. Hemp is utilized in industries ranging from automotive to construction, owing to its strength and lightweight properties. The material's adaptability allows it to be used in manufacturing biocomposites, insulation materials, and even biofuels. As industries increasingly seek sustainable alternatives, the demand for hemp-based products is likely to rise. Market analysts project that the industrial hemp sector could see substantial growth in applications such as biodegradable plastics and eco-friendly building materials. This diversification not only enhances the market's resilience but also positions the Industrial Hemp Market as a key player in the transition towards sustainable industrial practices.

Technological Advancements in Cultivation

Technological advancements in cultivation practices are significantly influencing the Industrial Hemp Market. Innovations such as precision agriculture, genetic engineering, and advanced irrigation techniques are enhancing hemp yield and quality. These technologies enable farmers to optimize resource use, reduce waste, and improve crop resilience against pests and diseases. As these practices become more widespread, the efficiency of hemp production is expected to increase, potentially lowering costs and boosting profitability for growers. By 2025, the integration of technology in hemp farming could lead to a more robust supply chain, thereby supporting the overall growth of the Industrial Hemp Market.