Market Trends

Key Emerging Trends in the Industrial Fermentation Chemicals Market

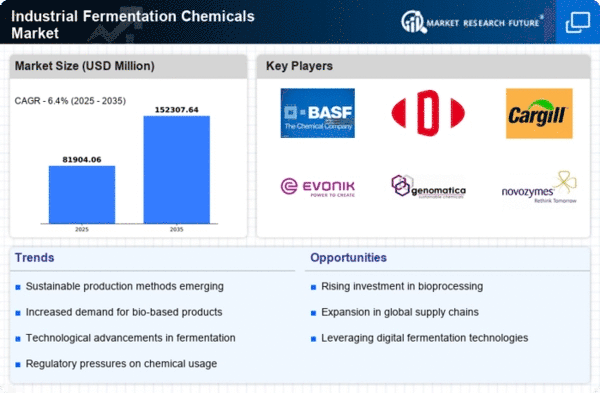

The Industrial Fermentation Chemicals market is undergoing significant trends that highlight the pivotal role of fermentation in various industrial processes, ranging from food and beverages to pharmaceuticals and biofuels. Industrial fermentation chemicals play a crucial role in facilitating and optimizing fermentation processes, contributing to the production of a wide array of valuable products.

One noteworthy trend in the Industrial Fermentation Chemicals market is the increasing demand for bio-based and sustainable products. As the global focus on sustainability intensifies, industries are seeking eco-friendly alternatives to traditional chemical processes. Industrial fermentation offers a sustainable pathway, and the demand for fermentation chemicals derived from renewable sources is on the rise. This trend aligns with the broader push toward green and environmentally conscious practices in manufacturing.

The food and beverage industry is a major consumer of Industrial Fermentation Chemicals, particularly in the production of various additives, flavors, and preservatives. Fermentation is a key process in the development of food ingredients such as enzymes, amino acids, and vitamins. The market is witnessing a trend toward natural and clean-label products, prompting manufacturers to explore fermentation as a natural and sustainable method for ingredient production.

The pharmaceutical and healthcare sectors are experiencing growth in the Industrial Fermentation Chemicals market. Fermentation processes are integral to the production of antibiotics, vaccines, and therapeutic proteins. The pharmaceutical industry's emphasis on biopharmaceuticals and personalized medicine is driving the demand for fermentation-derived chemicals that meet stringent quality and regulatory standards.

The Asia-Pacific region is emerging as a key player in the global Industrial Fermentation Chemicals market. Countries such as China and India are witnessing rapid industrialization and economic growth, leading to increased demand for fermentation-based products. The region's expanding population and rising consumer awareness contribute to the growth of fermentation-related industries, propelling the demand for fermentation chemicals.

Technological advancements in fermentation processes are shaping trends in the Industrial Fermentation Chemicals market. Continuous research and development efforts focus on improving the efficiency, yield, and scalability of fermentation processes. Innovations such as strain engineering, process optimization, and the use of advanced bioreactors contribute to the advancement of fermentation technologies, influencing the overall market dynamics.

The production of biofuels is driving the demand for Industrial Fermentation Chemicals in the energy sector. Fermentation is a key process in the conversion of biomass into biofuels such as ethanol and biodiesel. With increasing emphasis on renewable energy sources and the desire to reduce reliance on fossil fuels, the demand for fermentation chemicals in biofuel production is expected to grow, contributing to the market's expansion.

Market trends indicate a growing interest in specialty and high-value products derived from fermentation. As industries seek to diversify their product portfolios and meet evolving consumer preferences, there is an increased focus on the production of specialty chemicals, enzymes, and bio-based polymers through fermentation processes. This trend underscores the versatility of fermentation in generating a wide range of valuable compounds.

The Industrial Fermentation Chemicals market is witnessing strategic collaborations and partnerships among key players. Companies are entering into alliances to leverage each other's strengths, share resources, and enhance their capabilities in research and development. These collaborations aim to accelerate innovations, improve market competitiveness, and address the diverse needs of end-users across different industries.

Market participants are exploring the potential of synthetic biology in fermentation processes. Synthetic biology techniques, including the design and engineering of microorganisms for enhanced performance, offer opportunities to optimize fermentation pathways and increase the production of desired chemicals. The integration of synthetic biology principles into industrial fermentation is expected to drive advancements in the field.

Fluctuations in raw material prices, particularly those related to feedstocks for fermentation, impact the Industrial Fermentation Chemicals market. The availability and cost of sugars, grains, and other raw materials influence the overall cost structure of fermentation processes. Market participants are closely monitoring these raw material dynamics to manage potential cost fluctuations and maintain competitiveness.

Leave a Comment