Rising Demand for Automation

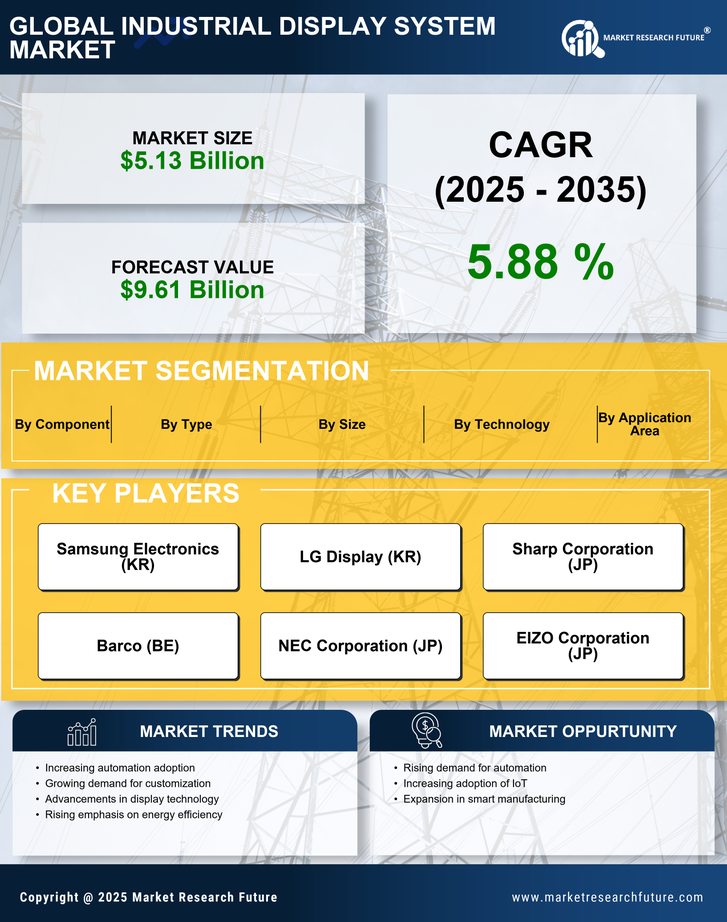

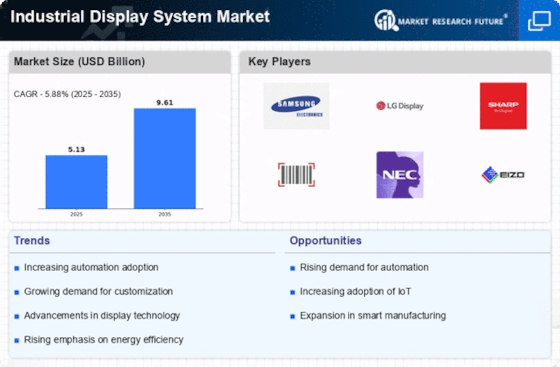

The Industrial Display System Market is experiencing a notable surge in demand for automation across various sectors. As industries strive for enhanced efficiency and productivity, the integration of advanced display systems becomes essential. Automation facilitates real-time data visualization, enabling operators to monitor processes effectively. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This growth is likely to drive the adoption of industrial display systems, as they play a crucial role in providing critical information at a glance. Consequently, manufacturers are increasingly investing in display technologies that support automation, thereby propelling the Industrial Display System Market forward.

Increased Adoption of IoT Solutions

The Industrial Display System Market is witnessing a transformative shift due to the increased adoption of Internet of Things (IoT) solutions. IoT-enabled devices facilitate seamless communication between machines and display systems, allowing for real-time data sharing and analysis. This connectivity enhances operational efficiency and decision-making processes. As industries embrace IoT technologies, the demand for compatible display systems is likely to rise. Recent projections indicate that the IoT market could reach USD 1 trillion by 2025, suggesting a substantial opportunity for the Industrial Display System Market. The integration of IoT with display systems is expected to create innovative applications, further propelling market growth.

Advancements in Display Technologies

Technological advancements are significantly influencing the Industrial Display System Market. Innovations such as OLED, LCD, and LED technologies are enhancing display quality, durability, and energy efficiency. These advancements allow for clearer visuals and better performance in challenging industrial environments. For instance, the introduction of high-resolution displays has improved the ability to convey complex data, which is vital for decision-making processes. Furthermore, the market for industrial displays is expected to reach USD 10 billion by 2026, indicating a robust growth trajectory. As industries increasingly prioritize high-performance displays, the demand for advanced display technologies is likely to escalate, further driving the Industrial Display System Market.

Customization and User-Centric Designs

Customization and user-centric designs are becoming pivotal in the Industrial Display System Market. As industries vary in their operational needs, the demand for tailored display solutions is on the rise. Manufacturers are increasingly focusing on creating displays that cater to specific user requirements, enhancing usability and functionality. This trend is reflected in the growing market for customizable display systems, which is anticipated to expand by approximately 12% annually. By offering versatile and adaptable display solutions, companies can better meet the diverse needs of their clients, thereby fostering growth in the Industrial Display System Market. The emphasis on user-centric designs is likely to shape the future of display technologies.

Growing Focus on Safety and Compliance

Safety and compliance regulations are becoming increasingly stringent across various industries, thereby impacting the Industrial Display System Market. Display systems that provide real-time monitoring and alerts are essential for maintaining safety standards. Industries such as manufacturing, oil and gas, and pharmaceuticals are particularly affected, as they require constant oversight of operations to prevent accidents and ensure compliance with regulations. The market for safety-related display systems is projected to grow significantly, with estimates suggesting a rise of over 15% in the next few years. This trend indicates that companies are investing in display systems that enhance safety protocols, thereby driving growth in the Industrial Display System Market.