Rising Cybersecurity Concerns

The biometric banking market in Indonesia is experiencing growth due to escalating concerns regarding cybersecurity. As financial institutions face increasing threats from cybercriminals, the demand for advanced security measures is paramount. Biometric authentication offers a robust solution, as it is inherently more secure than traditional methods such as passwords or PINs. In 2025, it is estimated that the cost of cybercrime in Indonesia could reach $10 billion, prompting banks to invest in biometric technologies. This shift not only enhances security but also builds customer trust, which is crucial in a competitive banking landscape. The biometric banking market is thus positioned to thrive as institutions prioritize safeguarding sensitive customer information against potential breaches.

Consumer Demand for Convenience

The biometric banking market in Indonesia is also propelled by a growing consumer demand for convenience in banking services. As customers increasingly seek seamless and efficient banking experiences, biometric solutions provide a quick and user-friendly alternative to traditional authentication methods. In 2025, it is anticipated that over 60% of Indonesian consumers will prefer biometric authentication for its ease of use. This shift in consumer behavior encourages banks to integrate biometric technologies into their services, thereby enhancing customer satisfaction and loyalty. The biometric banking market is thus adapting to meet these evolving consumer preferences, positioning itself for sustained growth.

Government Initiatives and Support

Government initiatives play a crucial role in shaping the biometric banking market in Indonesia. The Indonesian government has been actively promoting digital transformation within the financial sector, recognizing the importance of secure banking solutions. Policies aimed at enhancing cybersecurity and encouraging the adoption of biometric technologies are being implemented. For instance, the government has allocated $50 million to support the development of secure digital banking infrastructures. Such initiatives not only foster innovation but also create a conducive environment for the biometric banking market to flourish. As regulatory frameworks evolve, banks are likely to embrace biometric solutions to comply with government standards.

Technological Advancements in Biometrics

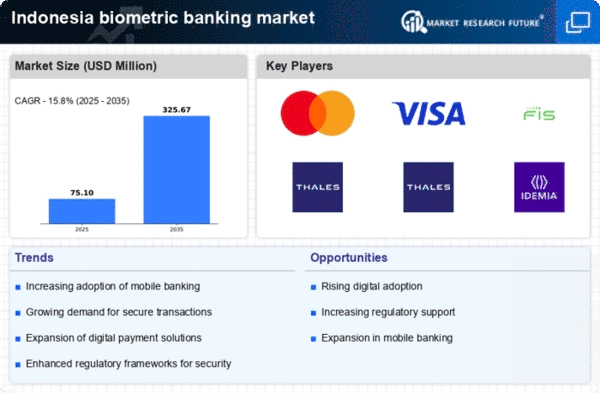

Technological innovations are significantly influencing the biometric banking market in Indonesia. The advent of sophisticated biometric systems, including facial recognition and fingerprint scanning, has made these solutions more accessible and efficient. In 2025, the market for biometric systems in Indonesia is projected to grow at a CAGR of 15%, driven by advancements in artificial intelligence and machine learning. These technologies enhance the accuracy and speed of biometric verification processes, making them more appealing to banks and customers alike. As financial institutions adopt these cutting-edge solutions, the biometric banking market is likely to expand, offering enhanced user experiences and operational efficiencies.

Competitive Pressure Among Financial Institutions

The competitive landscape among financial institutions in Indonesia is driving the growth of the biometric banking market. As banks strive to differentiate themselves and attract customers, the adoption of biometric technologies has become a strategic imperative. Institutions that implement biometric solutions can offer enhanced security and convenience, which are increasingly valued by consumers. In 2025, it is projected that banks utilizing biometric authentication will see a 20% increase in customer acquisition rates. This competitive pressure compels banks to invest in the biometric banking market, ensuring they remain relevant and appealing in a rapidly evolving financial ecosystem.