Rising Awareness of Preventive Healthcare

There is a notable shift towards preventive healthcare in India, with an increasing emphasis on early diagnosis and intervention. This trend is significantly influencing the ultrasound gastroscopes market, as healthcare professionals advocate for regular screenings and check-ups to identify gastrointestinal issues at an early stage. The market is likely to experience growth as patients become more proactive about their health, seeking out advanced diagnostic options like ultrasound gastroscopes. Educational campaigns and health initiatives aimed at promoting awareness of gastrointestinal health are expected to further drive demand. As a result, the ultrasound gastroscopes market may see a surge in utilization, reflecting the changing attitudes towards health management among the Indian population.

Supportive Government Policies and Initiatives

The Indian government is actively promoting healthcare initiatives that support the growth of the ultrasound gastroscopes market. Policies aimed at enhancing healthcare access, affordability, and quality are creating a conducive environment for the adoption of advanced medical technologies. Initiatives such as the Ayushman Bharat scheme, which aims to provide health insurance to millions of citizens, are likely to increase the demand for diagnostic services, including ultrasound gastroscopes. The market stands to gain from these supportive measures, as they encourage healthcare facilities to invest in modern diagnostic equipment. Furthermore, regulatory frameworks that facilitate the approval and distribution of medical devices are expected to bolster the growth of the ultrasound gastroscopes market in India.

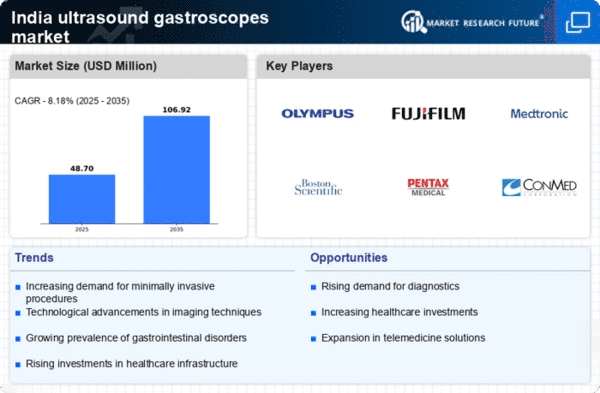

Growing Investment in Healthcare Infrastructure

India's healthcare infrastructure is undergoing significant transformation, with substantial investments aimed at enhancing medical facilities and technologies. The government and private sector are increasingly allocating funds to improve diagnostic capabilities, which directly impacts the ultrasound gastroscopes market. Reports indicate that healthcare expenditure in India is projected to reach $370 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 22%. This influx of capital is likely to facilitate the acquisition of advanced ultrasound gastroscopes, thereby improving diagnostic accuracy and patient care. As hospitals and clinics upgrade their equipment, the ultrasound gastroscopes market stands to gain from the enhanced availability and accessibility of these essential diagnostic tools.

Technological Innovations in Imaging Techniques

The ultrasound gastroscopes market is being propelled by continuous technological innovations in imaging techniques. Advancements such as high-definition imaging, real-time visualization, and enhanced portability are making ultrasound gastroscopes more effective and user-friendly. These innovations are crucial in improving diagnostic accuracy and patient comfort, which are essential factors in the competitive healthcare landscape. The market is likely to benefit from the introduction of next-generation ultrasound gastroscopes that offer superior imaging capabilities and ease of use. As healthcare providers increasingly adopt these advanced technologies, the demand for ultrasound gastroscopes is expected to rise, reflecting the industry's commitment to improving patient care through innovation.

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders in India is a primary driver for the ultrasound gastroscopes market. Conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and inflammatory bowel disease are becoming more common, leading to a heightened demand for diagnostic tools. According to recent health statistics, approximately 20% of the Indian population experiences some form of gastrointestinal issue, which necessitates effective diagnostic solutions. The ultrasound gastroscopes market is poised to benefit from this trend, as healthcare providers seek advanced imaging technologies to enhance patient outcomes. Furthermore, the increasing awareness of gastrointestinal health among the population is likely to contribute to the growth of this market, as more individuals seek medical attention for their symptoms.