Growing E-commerce Adoption

The rapid growth of e-commerce in India is a pivotal driver for the retail analytics market. As more consumers shift to online shopping, retailers are increasingly relying on analytics to understand consumer behavior and preferences. In 2025, e-commerce sales in India are projected to reach approximately $120 billion, indicating a robust market for analytics solutions. Retailers utilize data analytics to optimize inventory management, enhance customer engagement, and personalize marketing strategies. This trend suggests that the retail analytics market will continue to expand as businesses seek to leverage data-driven insights to remain competitive in the evolving digital landscape.

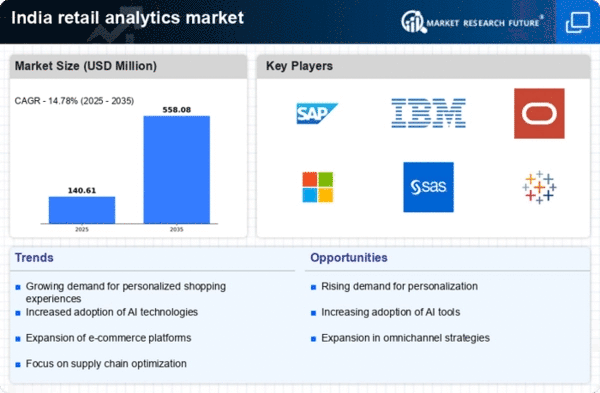

Rising Demand for Personalization

The increasing demand for personalized shopping experiences is a crucial driver for the retail analytics market. Consumers in India are seeking tailored recommendations and offers, prompting retailers to adopt analytics solutions that can analyze customer data effectively. In 2025, it is estimated that 70% of consumers prefer personalized experiences, which compels retailers to invest in analytics to meet these expectations. By leveraging data analytics, retailers can segment their customer base, predict purchasing behavior, and create targeted marketing campaigns. This trend indicates a strong growth trajectory for the retail analytics market as businesses strive to enhance customer satisfaction and loyalty.

Emergence of Omnichannel Retailing

The rise of omnichannel retailing is reshaping the landscape of the retail analytics market in India. Retailers are increasingly integrating online and offline channels to provide a seamless shopping experience. This shift necessitates the use of analytics to track customer interactions across various platforms. In 2025, it is anticipated that omnichannel sales will account for over 30% of total retail sales in India. Retailers are leveraging analytics to understand customer journeys, optimize channel strategies, and enhance overall engagement. This trend indicates a robust growth potential for the retail analytics market as businesses adapt to the complexities of omnichannel retailing.

Focus on Supply Chain Optimization

Supply chain optimization is becoming increasingly vital for retailers in India, driving the demand for analytics solutions. Retailers are utilizing analytics to streamline operations, reduce costs, and improve inventory management. In 2025, the retail sector is projected to save approximately $5 billion through enhanced supply chain efficiencies. By analyzing data related to supplier performance, demand forecasting, and logistics, retailers can make informed decisions that enhance their operational capabilities. This focus on supply chain optimization suggests that the retail analytics market will continue to grow as businesses seek to improve their overall efficiency and responsiveness.

Increased Investment in Technology

Investment in advanced technologies is significantly influencing the retail analytics market in India. Retailers are allocating substantial budgets towards analytics tools, cloud computing, and big data technologies. In 2025, the technology spending in the retail sector is expected to surpass $15 billion, reflecting a growing recognition of the value of data analytics. This investment enables retailers to harness data for better decision-making, improve operational efficiency, and enhance customer experiences. As technology continues to evolve, the retail analytics market is likely to benefit from innovations that facilitate deeper insights and more effective strategies.