Rising Cyber Threats

The healthcare cyber-security market in India is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. With the healthcare sector being a prime target for cybercriminals, the need for robust security measures has become paramount. Reports indicate that healthcare organizations in India have faced a 30% rise in cyberattacks over the past year. This alarming trend compels healthcare providers to invest in advanced cyber-security solutions to protect sensitive patient data and maintain operational integrity. As a result, The healthcare cyber-security market is projected to grow significantly due to the urgent need to mitigate risks associated with data breaches and ransomware attacks.

Integration of IoT Devices

The proliferation of Internet of Things (IoT) devices in healthcare settings is reshaping the landscape of the healthcare cyber-security market. With the increasing use of connected medical devices, the potential for cyber vulnerabilities has escalated. Reports suggest that by 2025, the number of connected medical devices in India could reach 50 million. This rapid integration necessitates the implementation of advanced cyber-security measures to protect against unauthorized access and data breaches. Consequently, healthcare organizations are likely to invest heavily in cyber-security solutions tailored to address the unique challenges posed by IoT devices, thereby driving market growth.

Emergence of Telehealth Services

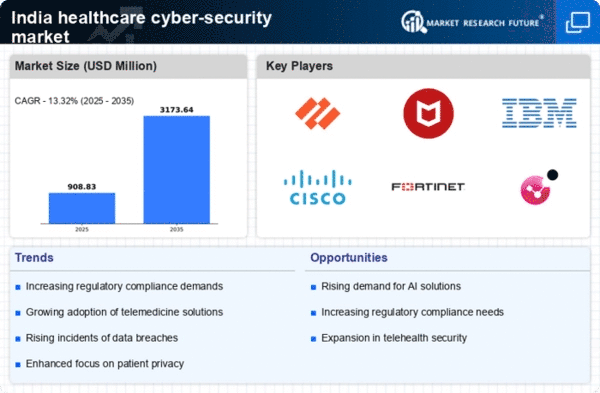

The rise of telehealth services in India is significantly influencing the healthcare cyber-security market. As healthcare providers increasingly adopt telemedicine platforms to deliver care remotely, the need for secure communication channels and data protection becomes critical. The telehealth market in India is projected to grow at a CAGR of 30% over the next five years, highlighting the urgency for robust cyber-security measures. Healthcare organizations must ensure that patient data remains confidential and secure during virtual consultations, leading to a surge in demand for specialized cyber-security solutions. This trend is likely to propel the growth of the healthcare cyber-security market as providers seek to safeguard their telehealth operations.

Growing Awareness of Data Privacy

There is a notable increase in awareness regarding data privacy among healthcare providers and patients in India. This heightened consciousness is driving the demand for comprehensive cyber-security solutions to safeguard personal health information. As patients become more informed about their rights and the importance of data protection, healthcare organizations are compelled to adopt stringent security measures. The healthcare cyber-security market is likely to benefit from this trend as organizations seek to implement solutions that comply with regulations and build trust with patients. This shift towards prioritizing data privacy is expected to contribute to a robust growth trajectory for the market.

Government Initiatives and Support

The Indian government is actively promoting initiatives aimed at enhancing cyber-security within the healthcare sector. Programs such as the Digital India initiative and the National Cyber Security Policy are designed to bolster the cyber resilience of healthcare organizations. These initiatives encourage the adoption of best practices and compliance with international standards, thereby fostering a conducive environment for the growth of the healthcare cyber-security market. Furthermore, government funding and support for cyber-security training programs are likely to enhance the skill sets of professionals in the sector, ultimately leading to improved security measures across healthcare facilities.