Expansion of Retail Channels

The hair care market in India is benefiting from the expansion of retail channels, including both physical and online platforms. The proliferation of beauty and personal care stores, along with the growth of e-commerce, is making hair care products more accessible to consumers. Recent data indicates that online sales of hair care products have increased by over 30% in the past year, reflecting a shift in shopping behavior. This expansion allows brands to reach a wider audience and cater to diverse consumer preferences. As retail channels continue to evolve, companies that adapt their distribution strategies to include both traditional and digital platforms are likely to gain a competitive edge in the hair care market. This trend highlights the importance of a multi-channel approach in meeting consumer demands.

Increase in Disposable Income

The hair care market in India is significantly influenced by the rising disposable income of consumers. As economic conditions improve, more individuals are willing to invest in premium hair care products. This trend is particularly evident among urban populations, where disposable income has increased by approximately 10% annually in recent years. Higher income levels enable consumers to prioritize personal grooming and invest in high-quality hair care solutions. Consequently, brands that offer premium products are likely to benefit from this trend, as consumers seek effective solutions for their hair care needs. The increase in disposable income is expected to drive the overall growth of the hair care market, as consumers are more inclined to explore diverse product offerings, including specialized treatments and luxury brands.

Rising Awareness of Hair Health

The hair care market in India is experiencing a surge in consumer awareness regarding hair health and maintenance. With increasing access to information through digital platforms, consumers are becoming more educated about the importance of proper hair care routines. This heightened awareness is driving demand for specialized products, such as shampoos, conditioners, and treatments that cater to specific hair types and concerns. Market Research Future indicates that the segment for hair health products is expected to grow by approximately 12% in the coming years. As consumers prioritize hair health, brands that offer targeted solutions are likely to thrive in this evolving market landscape. This trend underscores the necessity for companies to innovate and provide products that address the diverse needs of consumers.

Growing Demand for Organic Products

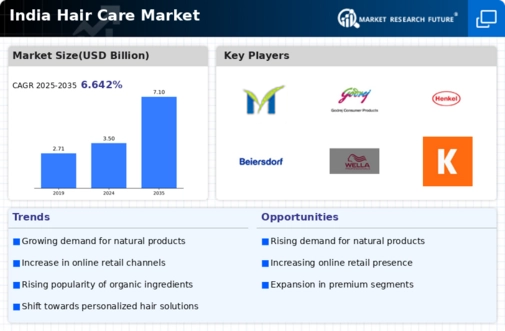

The hair care market in India is witnessing a notable shift towards organic and natural products. Consumers are increasingly aware of the harmful effects of synthetic chemicals, leading to a surge in demand for organic hair care solutions. This trend is reflected in the market data, which indicates that the organic hair care segment is projected to grow at a CAGR of approximately 15% over the next five years. The rising health consciousness among consumers, coupled with a preference for eco-friendly products, is driving this growth. Brands that emphasize organic ingredients are likely to capture a larger share of the market, as consumers seek products that align with their values of sustainability and health. This growing demand for organic products is reshaping the competitive landscape of the hair care market, compelling traditional brands to innovate and adapt their offerings.

Influence of Celebrity Endorsements

The hair care market in India is increasingly shaped by celebrity endorsements and influencer marketing. Prominent figures in the entertainment industry often promote specific hair care brands, which significantly impacts consumer purchasing decisions. This phenomenon is particularly pronounced among younger demographics, who are more likely to trust recommendations from celebrities they admire. Market data suggests that brands leveraging celebrity endorsements can experience a sales increase of up to 20% following a campaign. As social media platforms continue to grow, the influence of celebrities on consumer behavior in the hair care market is expected to intensify. This trend highlights the importance of strategic marketing partnerships for brands aiming to enhance their visibility and appeal to a broader audience.