Health and Wellness Trends

The increasing focus on health and wellness is influencing consumer choices in the fragrance Market. Many consumers are now seeking fragrances that are not only pleasant but also made from natural and organic ingredients. This trend aligns with a broader movement towards sustainability and personal well-being. The fragrance Market industry is responding by developing products that emphasize clean and eco-friendly formulations. As consumers become more health-conscious, the demand for fragrances that promote relaxation and well-being is likely to rise. This shift may lead to the introduction of innovative scent profiles that cater to the evolving preferences of health-oriented consumers.

Growing Middle-Class Population

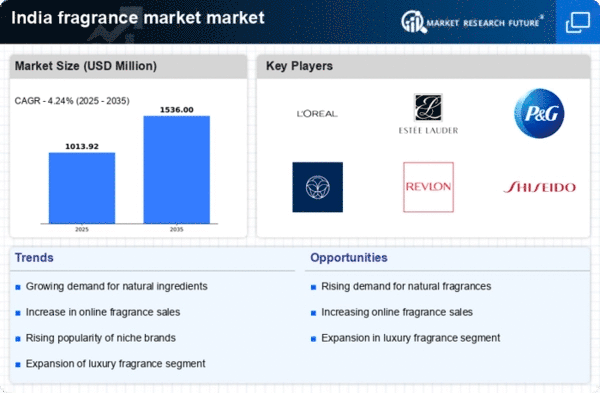

The expanding middle-class population in India is a significant driver for the fragrance Market. As disposable incomes rise, consumers are increasingly willing to spend on personal care and luxury items, including fragrances. The fragrance Market industry is experiencing a shift, with more individuals seeking premium and niche products that reflect their lifestyle choices. This demographic shift is expected to contribute to a market growth rate of around 12% in the coming years. The increasing awareness of global fragrance trends and the desire for personal expression further fuel this demand, making the fragrance Market a lucrative sector for both established and emerging brands.

Rise of Online Retail Platforms

The proliferation of online retail platforms has transformed the fragrance Market in India. E-commerce provides consumers with easy access to a wide variety of fragrances, often at competitive prices. This shift towards online shopping is expected to account for approximately 30% of total fragrance sales by 2026. The fragrance Market industry is adapting to this trend by enhancing digital marketing strategies and offering exclusive online products. Additionally, the convenience of home delivery and the ability to compare prices and reviews have made online shopping increasingly appealing to consumers. As a result, brands are investing in their online presence to capture this growing segment of the market.

Cultural Significance of Fragrance

The fragrance Market in India is deeply intertwined with cultural practices and traditions. Fragrances are often used in religious ceremonies, festivals, and daily rituals, which enhances their importance in Indian society. The market is projected to grow at a CAGR of approximately 10% over the next few years, driven by the increasing demand for traditional and contemporary scents. This cultural significance not only boosts sales but also encourages brands to innovate and create products that resonate with local customs. As consumers seek to express their identity through fragrance, the fragrance Market industry is likely to see a surge in demand for products that reflect regional preferences and heritage.

Influence of Celebrity Endorsements

Celebrity endorsements play a pivotal role in shaping consumer preferences within the fragrance Market in India. High-profile figures often launch their own fragrance lines, which can lead to increased visibility and desirability among consumers. The fragrance Market industry benefits from this trend, as it creates a perception of luxury and exclusivity. In recent years, the market has witnessed a rise in collaborations between celebrities and established fragrance brands, resulting in innovative products that appeal to a broader audience. This strategy not only enhances brand recognition but also drives sales, as consumers are more likely to purchase fragrances associated with their favorite personalities.

Expansion of the Perfume Industry in India

The perfume industry in India is benefiting from a cultural shift toward Western grooming habits and lifestyle aspirations. The perfume market in India is no longer limited to metro cities, with tier-2 and tier-3 towns showing remarkable growth potential. The perfume market size in India is expected to witness double-digit growth as brands focus on affordable luxury segments, gender-neutral fragrances, and digital-first marketing strategies. Additionally, the rise of indigenous perfume brands offering India-inspired scents is creating a unique market niche that resonates with local consumers.