E-commerce Growth

The rise of e-commerce platforms is transforming the Global India Organic and Natural Tampons Market Industry by providing consumers with greater access to a variety of organic products. Online shopping offers convenience and the ability to compare products, which is particularly appealing to health-conscious consumers. This trend is expected to contribute to the market's growth, with projections indicating a compound annual growth rate of 15.33% from 2025 to 2035. E-commerce not only enhances product visibility but also allows smaller brands to compete effectively in a market that is becoming increasingly crowded.

Sustainability Trends

Sustainability is a pivotal driver in the Global India Organic and Natural Tampons Market Industry. As environmental concerns gain prominence, consumers are increasingly favoring products that are biodegradable and made from sustainable materials. This trend is evident as the market is expected to grow to 1200 USD Million by 2035, reflecting a growing commitment to eco-friendly practices. Brands that emphasize their sustainable sourcing and production methods are likely to attract environmentally conscious consumers, thereby enhancing their market presence. The integration of sustainability into product offerings could significantly shape the competitive landscape of the industry.

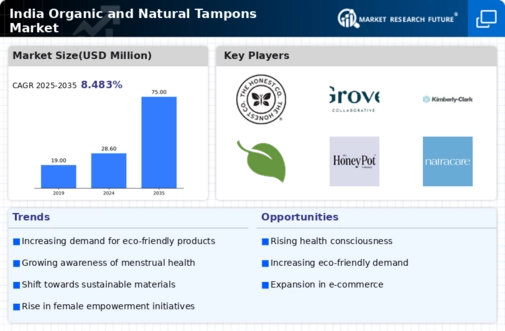

Market Growth Projections

The Global India Organic and Natural Tampons Market Industry is poised for substantial growth, with projections indicating a market value of 250 USD Million in 2024 and an anticipated increase to 1200 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 15.33% from 2025 to 2035, highlighting the increasing acceptance and demand for organic and natural alternatives in menstrual hygiene products. Such projections reflect a broader shift in consumer behavior towards sustainable and health-conscious choices, which are likely to shape the future landscape of the industry.

Rising Health Consciousness

The Global India Organic and Natural Tampons Market Industry is experiencing a surge in demand driven by increasing health consciousness among consumers. As awareness of the potential health risks associated with synthetic materials grows, many women are opting for organic and natural alternatives. This shift is reflected in the projected market value of 250 USD Million in 2024, as consumers seek products that align with their health and wellness values. The preference for organic materials, which are perceived as safer and more environmentally friendly, is likely to continue influencing purchasing decisions, thereby propelling market growth.

Changing Consumer Preferences

Changing consumer preferences are significantly influencing the Global India Organic and Natural Tampons Market Industry. As more women prioritize natural and organic products, brands are adapting their offerings to meet these demands. This shift is indicative of a broader trend towards holistic health and wellness, where consumers are more discerning about the products they use. The market's anticipated growth to 1200 USD Million by 2035 underscores the importance of aligning product development with evolving consumer values. Companies that successfully cater to these preferences are likely to gain a competitive edge in this dynamic market.

Government Initiatives and Support

Government initiatives aimed at promoting menstrual health and hygiene are contributing to the growth of the Global India Organic and Natural Tampons Market Industry. Policies that encourage the use of organic products and provide education on menstrual health are fostering a more informed consumer base. Such initiatives may lead to increased accessibility and affordability of organic tampons, thereby expanding the market. As governments recognize the importance of menstrual hygiene, the support for organic alternatives is likely to strengthen, facilitating a more robust market environment.

Leave a Comment