Declining Battery Costs

The significant reduction in battery costs is transforming the energy storage market in India. Over the past few years, the price of lithium-ion batteries has decreased by nearly 80%, making energy storage solutions more accessible and economically viable. This trend is likely to continue, driven by advancements in manufacturing processes and economies of scale. As battery prices decline, the adoption of energy storage systems in residential, commercial, and industrial applications is expected to rise. This shift not only enhances energy security but also supports the broader transition towards a sustainable energy ecosystem in India, potentially leading to a market valuation of $4 billion by 2025.

Rising Demand for Renewable Energy

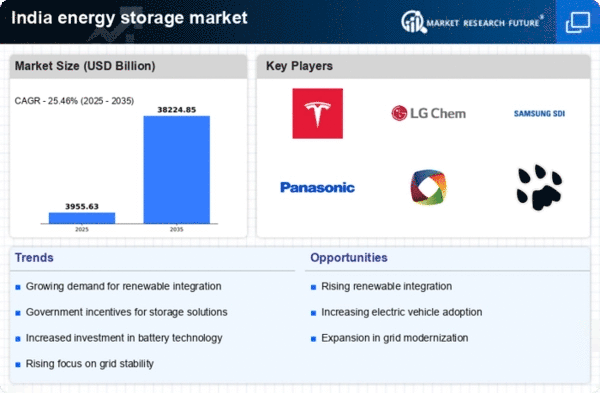

The increasing demand for renewable energy sources in India is a pivotal driver for the energy storage market. As the country aims to achieve 500 GW of renewable energy capacity by 2030, the need for efficient energy storage solutions becomes paramount. Energy storage systems facilitate the integration of intermittent renewable sources like solar and wind into the grid, ensuring a stable energy supply. This demand is reflected in the projected growth of the energy storage market, which is expected to reach approximately $5 billion by 2025. The ability to store excess energy generated during peak production times and release it during high demand periods is crucial for maintaining grid stability and reliability.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in propelling the energy storage market in India. The Indian government has introduced various policies aimed at promoting energy storage technologies, including financial incentives for manufacturers and consumers. Programs such as the National Electric Mobility Mission Plan (NEMMP) and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are designed to encourage the adoption of energy storage solutions. These initiatives are expected to stimulate market growth, with projections indicating a compound annual growth rate (CAGR) of around 20% in the energy storage market over the next five years. Such support is vital for overcoming initial cost barriers and fostering innovation in the sector.

Urbanization and Increased Energy Demand

Rapid urbanization in India is driving an unprecedented increase in energy demand, which in turn fuels the energy storage market. As urban populations grow, the demand for reliable and uninterrupted power supply escalates. Energy storage systems can effectively address this challenge by providing backup power during peak hours and enhancing grid resilience. The energy storage market is likely to benefit from this trend, with urban areas accounting for a significant portion of the projected $5 billion market size by 2025. Furthermore, the integration of energy storage solutions in smart city initiatives is expected to enhance energy efficiency and sustainability, aligning with national goals for urban development.

Technological Innovations in Energy Storage

Technological innovations are reshaping the energy storage market in India, leading to the development of advanced storage solutions. Innovations such as solid-state batteries, flow batteries, and hybrid systems are emerging, offering improved efficiency, safety, and longevity. These advancements are crucial for meeting the diverse energy needs of various sectors, including transportation, residential, and industrial applications. The energy storage market is anticipated to experience substantial growth as these technologies become commercially viable. With ongoing research and development efforts, the market could see a surge in new entrants and products, potentially increasing its value to $5 billion by 2025. This dynamic landscape underscores the importance of continuous innovation in driving market expansion.