Emphasis on Enhanced User Experience

The digital payment-healthcare market in India is increasingly focusing on enhancing user experience to attract and retain customers. Healthcare providers are recognizing the importance of a seamless payment process, which is crucial for patient satisfaction. As of 2025, it is projected that around 75% of healthcare facilities will prioritize user-friendly digital payment interfaces. This emphasis on user experience includes simplifying payment processes, offering multiple payment options, and ensuring quick transaction times. Additionally, the integration of customer feedback mechanisms is likely to play a vital role in refining payment systems. By prioritizing user experience, the digital payment-healthcare market aims to foster loyalty among patients and encourage the adoption of digital payment solutions, ultimately driving market growth.

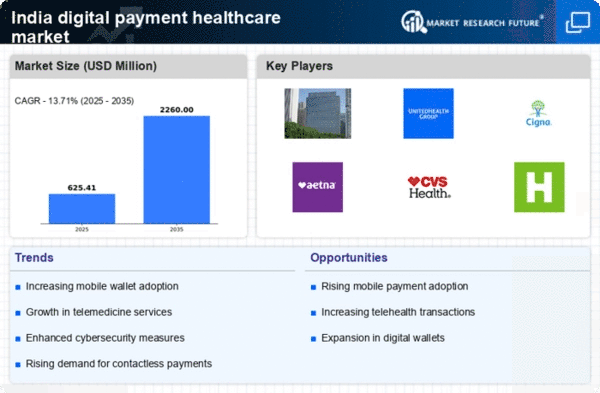

Growing Acceptance of Digital Wallets

The digital payment-healthcare market in India is witnessing a growing acceptance of digital wallets as a preferred payment method. With the proliferation of digital wallet providers, consumers are increasingly utilizing these platforms for healthcare transactions. As of November 2025, it is estimated that digital wallets account for approximately 40% of all digital payments in the healthcare sector. This trend is fueled by the convenience and speed that digital wallets offer, allowing patients to complete transactions swiftly without the need for cash or cards. Furthermore, partnerships between healthcare providers and digital wallet companies are likely to enhance the integration of these payment solutions within healthcare systems. As a result, the digital payment-healthcare market is expected to expand, as more patients opt for the ease of digital wallet transactions.

Rising Demand for Contactless Transactions

The digital payment-healthcare market in India experiences a notable surge in demand for contactless transactions. This trend is driven by the increasing consumer preference for convenience and safety in financial transactions. As of 2025, approximately 70% of healthcare transactions are expected to be conducted through contactless methods, reflecting a significant shift in payment behavior. The integration of Near Field Communication (NFC) technology in healthcare facilities facilitates seamless transactions, enhancing patient experience. Moreover, the Indian government's push for a cashless economy further propels this trend, as it encourages healthcare providers to adopt digital payment solutions. Consequently, the digital payment-healthcare market is likely to witness substantial growth, as both patients and providers embrace the efficiency and safety of contactless payments.

Government Initiatives Supporting Digital Payments

The digital payment-healthcare market in India benefits from various government initiatives aimed at promoting digital transactions. Programs such as Digital India and the National Digital Health Mission are designed to enhance the adoption of digital payment solutions in the healthcare sector. These initiatives provide the necessary infrastructure and support for healthcare providers to implement digital payment systems. As of November 2025, it is estimated that over 60% of healthcare facilities have integrated digital payment options, largely due to these government efforts. Furthermore, the introduction of incentives for both patients and providers to use digital payments is likely to further stimulate growth in the market. This supportive regulatory environment is crucial for the ongoing evolution of the digital payment-healthcare market, fostering innovation and accessibility.

Increased Internet Penetration and Smartphone Usage

The digital payment-healthcare market in India is significantly influenced by the rapid increase in internet penetration and smartphone usage. As of 2025, over 800 million people in India are expected to have access to the internet, with a substantial portion utilizing smartphones for various services, including healthcare. This widespread connectivity enables patients to access healthcare services and make payments digitally, thereby streamlining the payment process. The convenience of mobile applications for healthcare payments is likely to enhance user engagement and satisfaction. Additionally, the growing trend of telemedicine further complements this driver, as patients increasingly prefer digital consultations that require efficient payment methods. Consequently, the digital payment-healthcare market is poised for robust growth, driven by technological advancements and changing consumer behavior.