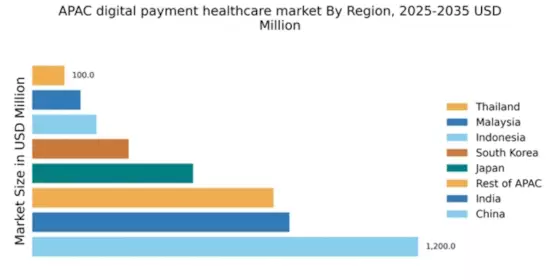

China : Rapid Growth and Innovation

China holds a commanding market share of 40% in the APAC digital payment-healthcare sector, valued at $1200.0 million. Key growth drivers include a burgeoning middle class, increasing smartphone penetration, and government initiatives promoting digital health solutions. Demand trends show a shift towards online consultations and telemedicine, supported by regulatory policies that encourage digital transformation in healthcare. Infrastructure improvements, particularly in urban areas, further bolster this growth.

India : Digital Transformation in Healthcare

India's digital payment-healthcare market is valued at $800.0 million, accounting for 25% of the APAC market. The growth is fueled by increasing internet access, mobile payment adoption, and government initiatives like Digital India. Demand for telehealth services is rising, particularly in urban centers, as consumers seek convenient healthcare solutions. Regulatory frameworks are evolving to support digital health innovations, enhancing the overall market landscape.

Japan : Integration of AI and Payments

Japan's market, valued at $500.0 million, represents 15% of the APAC digital payment-healthcare sector. Key growth drivers include an aging population and a strong emphasis on technological integration in healthcare. Demand for seamless payment solutions is rising, particularly in urban areas like Tokyo and Osaka. Government policies are increasingly supportive of digital health initiatives, fostering innovation and infrastructure development in the sector.

South Korea : Smart Technology Adoption

South Korea's digital payment-healthcare market is valued at $300.0 million, capturing 10% of the APAC market. The growth is driven by high smartphone penetration and a tech-savvy population. Demand for digital health services is increasing, particularly in cities like Seoul and Busan. Regulatory support for telemedicine and digital health applications is strong, creating a favorable environment for market players to thrive.

Malaysia : Government Support and Investment

Malaysia's market is valued at $150.0 million, representing 5% of the APAC digital payment-healthcare sector. Key growth drivers include government initiatives to enhance digital health infrastructure and increasing consumer acceptance of online healthcare services. Demand is particularly strong in urban areas like Kuala Lumpur. The competitive landscape features both local and international players, with a focus on mobile health applications and telemedicine services.

Thailand : Healthcare Accessibility Improvements

Thailand's digital payment-healthcare market is valued at $100.0 million, accounting for 3% of the APAC market. Growth is driven by increasing smartphone usage and government efforts to improve healthcare accessibility. Demand for digital health services is rising, especially in Bangkok. The competitive landscape includes both local startups and established international players, focusing on telehealth and mobile payment solutions.

Indonesia : Youth Population Driving Growth

Indonesia's market is valued at $200.0 million, representing 7% of the APAC digital payment-healthcare sector. Key growth drivers include a large youth population and increasing internet penetration. Demand for digital health services is growing, particularly in urban centers like Jakarta. The competitive landscape features a mix of local and international players, with a focus on mobile health applications and telemedicine solutions.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC market is valued at $750.0 million, accounting for 25% of the overall digital payment-healthcare sector. Growth drivers vary significantly across countries, influenced by local regulations, infrastructure, and consumer behavior. Demand trends show a mix of traditional and digital healthcare services, with varying levels of adoption. The competitive landscape includes both regional players and global firms, each adapting to local market dynamics.