- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

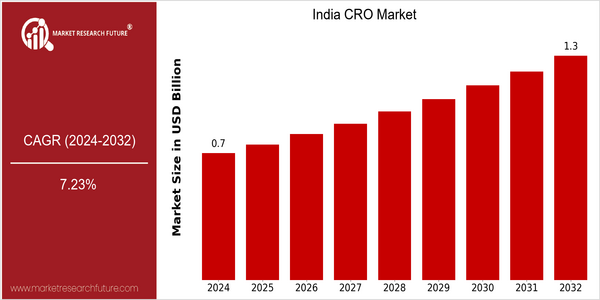

| Year | Value |

|---|---|

| 2024 | USD 0.73 Billion |

| 2032 | USD 1.32 Billion |

| CAGR (2024-2032) | 7.23 % |

Note – Market size depicts the revenue generated over the financial year

The India Contract Research Organization (CRO) market is poised for significant growth, with a current market size of USD 0.73 billion in 2024, projected to reach USD 1.32 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 7.23% over the forecast period. The increasing demand for outsourcing clinical trials and research services, driven by the rising number of pharmaceutical and biotechnology companies, is a key factor propelling this growth. Additionally, the growing emphasis on cost-effective solutions and the need for faster drug development timelines are further stimulating the market's expansion. Technological advancements, such as the integration of artificial intelligence and data analytics in clinical trials, are also contributing to the market's upward trajectory. These innovations enhance efficiency and accuracy, making CRO services more appealing to clients. Notable players in the Indian CRO market, such as Syngene International, QuintilesIMS, and Labcorp Drug Development, are actively engaging in strategic initiatives, including partnerships and investments in technology, to strengthen their service offerings and expand their market presence. These developments underscore the dynamic nature of the CRO landscape in India, positioning it as a critical hub for clinical research in the global arena.

Regional Market Size

Regional Deep Dive

The India CRO Market is characterized by a rapidly evolving landscape driven by increasing demand for outsourced research services, particularly in the pharmaceutical and biotechnology sectors. The region benefits from a large pool of skilled professionals, cost-effective services, and a growing emphasis on innovation and technology integration. As India continues to strengthen its position as a global hub for clinical research, the market is poised for significant growth, supported by favorable government policies and an expanding healthcare infrastructure.

Europe

- European pharmaceutical companies are increasingly outsourcing clinical trials to India, with firms like Novartis and Roche actively engaging Indian CROs to conduct research in a cost-effective manner while maintaining high-quality standards.

- The European Medicines Agency (EMA) has recognized the importance of international collaboration, leading to more streamlined processes for Indian CROs to conduct trials that meet European regulatory requirements.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in demand for clinical trials, with Indian CROs playing a pivotal role in supporting local biotech firms and multinational corporations in their research endeavors.

- Innovations in digital health technologies, such as telemedicine and remote monitoring, are being integrated into clinical trials by Indian CROs, enhancing patient engagement and data collection efficiency.

Latin America

- Latin American pharmaceutical companies are looking to Indian CROs for their expertise in managing complex clinical trials, particularly in areas like oncology and rare diseases, where local knowledge is crucial.

- The establishment of trade agreements between India and several Latin American countries is facilitating smoother collaboration and knowledge exchange, benefiting the CRO market.

North America

- The collaboration between Indian CROs and North American pharmaceutical companies has intensified, with organizations like Syneos Health and Parexel establishing partnerships to leverage India's cost advantages and skilled workforce.

- Regulatory changes in the U.S. FDA's approach to clinical trials have encouraged more American firms to outsource their research to India, enhancing the credibility and visibility of Indian CROs in the global market.

Middle East And Africa

- Indian CROs are increasingly entering partnerships with Middle Eastern healthcare providers to conduct clinical trials, capitalizing on the region's growing investment in healthcare infrastructure and research.

- Regulatory bodies in the Middle East are becoming more receptive to international collaborations, allowing Indian CROs to navigate the approval processes more effectively and expand their service offerings.

Did You Know?

“India accounts for approximately 20% of the global clinical trials conducted, making it one of the leading countries in the CRO market.” — Clinical Trials Registry - India

Segmental Market Size

The India Contract Research Organization (CRO) market is experiencing robust growth, driven by increasing demand for outsourced research services in the pharmaceutical and biotechnology sectors. Key factors propelling this segment include the rising need for cost-effective clinical trials and the growing emphasis on regulatory compliance, which necessitates specialized expertise. Additionally, advancements in technology, such as artificial intelligence and data analytics, are enhancing the efficiency of research processes, further fueling demand. Currently, the adoption stage of CRO services in India is transitioning from pilot phases to scaled deployment, with companies like Syngene International and Quintiles IMS leading the charge. These organizations are setting benchmarks in clinical trial management and regulatory affairs. Primary applications of CRO services include clinical trial management, data management, and regulatory submissions, particularly in therapeutic areas like oncology and cardiology. Macro trends, such as the COVID-19 pandemic, have accelerated the shift towards remote monitoring and decentralized trials, while technologies like electronic data capture and cloud-based platforms are reshaping operational methodologies in the CRO landscape.

Future Outlook

The India Contract Research Organization (CRO) market is poised for significant growth from 2024 to 2032, with a projected market value increase from $0.73 billion to $1.32 billion, reflecting a robust compound annual growth rate (CAGR) of 7.23%. This growth trajectory is underpinned by the increasing demand for outsourced research services from pharmaceutical and biotechnology companies, driven by the need for cost-effective and efficient drug development processes. As the Indian healthcare landscape evolves, the penetration of CRO services is expected to rise, with an estimated increase in usage rates among mid-sized and large pharmaceutical firms, which are increasingly relying on CROs to expedite clinical trials and regulatory compliance. Key technological advancements, such as the integration of artificial intelligence and machine learning in clinical trial management, are anticipated to further enhance the operational efficiency of CROs. Additionally, supportive government policies aimed at boosting the pharmaceutical sector, including initiatives for faster drug approvals and increased funding for research and development, will serve as critical drivers for market expansion. Emerging trends, such as the growing focus on personalized medicine and the rise of digital health solutions, are likely to create new opportunities for CROs, positioning them as essential partners in the evolving landscape of drug development in India. As a result, the India CRO market is set to become a pivotal player in the global clinical research ecosystem, attracting both domestic and international investments.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 7.50% (2023-2032) |

India CRO Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.