Government Initiatives and Funding

Government initiatives and funding aimed at improving healthcare infrastructure in India are driving the cardiac imaging-software market. The Indian government has launched various programs to enhance healthcare access and quality, particularly in rural areas. Increased funding for healthcare facilities is likely to lead to the procurement of advanced imaging technologies, including cardiac imaging software. This support from the government not only encourages hospitals to upgrade their diagnostic capabilities but also fosters partnerships with software developers. As a result, the cardiac imaging-software market is expected to experience growth, driven by enhanced accessibility and affordability of advanced imaging solutions.

Increase in Healthcare Expenditure

The increase in healthcare expenditure in India is positively impacting the cardiac imaging-software market. As the country experiences economic growth, both public and private sectors are allocating more resources to healthcare. This rise in expenditure is facilitating the adoption of advanced medical technologies, including cardiac imaging software. Hospitals and diagnostic centers are more willing to invest in high-quality imaging solutions that can improve diagnostic accuracy and patient outcomes. Consequently, the cardiac imaging-software market is poised for growth, driven by the willingness of healthcare providers to enhance their technological capabilities in response to rising patient expectations.

Rising Cardiovascular Disease Prevalence

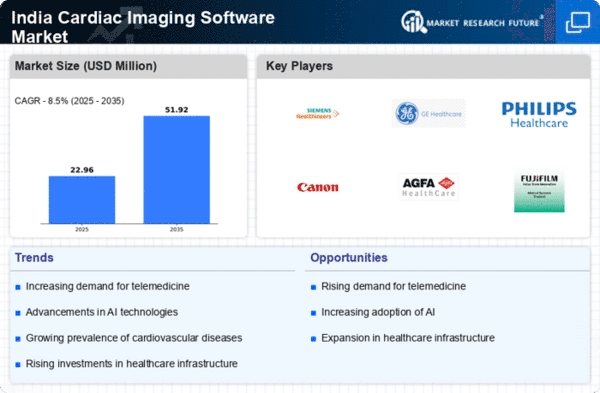

The increasing prevalence of cardiovascular diseases in India is a primary driver for the cardiac imaging-software market. According to recent health statistics, cardiovascular diseases account for approximately 28% of all deaths in the country. This alarming trend necessitates advanced diagnostic tools, including cardiac imaging software, to enhance early detection and treatment. As healthcare providers strive to improve patient outcomes, the demand for sophisticated imaging solutions is likely to rise. The cardiac imaging-software market is expected to witness substantial growth as hospitals and clinics invest in technology that can provide accurate and timely diagnoses. Furthermore, the integration of these software solutions into routine clinical practice is anticipated to become more prevalent, thereby driving market expansion.

Growing Awareness of Preventive Healthcare

The growing awareness of preventive healthcare among the Indian population is a significant driver for the cardiac imaging-software market. As individuals become more health-conscious, there is an increasing demand for regular health check-ups and screenings, particularly for cardiovascular health. This trend is prompting healthcare providers to invest in advanced imaging technologies that can facilitate early detection of heart diseases. The cardiac imaging-software market is likely to expand as more patients seek preventive measures, leading to a higher volume of imaging procedures. Additionally, educational campaigns promoting heart health are expected to further boost the demand for these software solutions.

Technological Advancements in Imaging Techniques

Technological advancements in imaging techniques are significantly influencing the cardiac imaging-software market. Innovations such as 3D imaging, enhanced resolution, and real-time imaging capabilities are transforming how cardiovascular conditions are diagnosed and monitored. These advancements not only improve the accuracy of diagnoses but also facilitate better treatment planning. The cardiac imaging-software market is likely to benefit from the continuous evolution of imaging technologies, as healthcare providers seek to adopt the latest tools to enhance patient care. Moreover, the integration of advanced algorithms and machine learning into imaging software is expected to further refine diagnostic processes, making them more efficient and reliable.