Focus on Customer Experience Enhancement

Enhancing customer experience is a primary focus for many organizations in India, which is driving the analytics as-a-service market. Companies are utilizing analytics to understand customer preferences, personalize offerings, and improve service delivery. By analyzing customer data, businesses can identify trends and patterns that inform their strategies. This focus on customer-centricity is reflected in the increasing investment in analytics solutions, with projections indicating that the market could reach a valuation of $2 billion by 2026. As organizations prioritize customer satisfaction, the analytics as-a-service market is likely to see sustained growth.

Advancements in Technology Infrastructure

The analytics as-a-service market in India is benefiting from advancements in technology infrastructure, particularly in cloud computing and big data technologies. The increasing availability of high-speed internet and affordable cloud services is enabling organizations to adopt analytics solutions without significant upfront investments. As a result, businesses can access sophisticated analytics tools and platforms that were previously out of reach. This technological evolution is expected to drive the growth of the analytics as-a-service market, as more organizations leverage these innovations to enhance their analytical capabilities.

Regulatory Compliance and Data Governance

In India, the analytics as-a-service market is influenced by the growing emphasis on regulatory compliance and data governance. Organizations are required to adhere to various regulations concerning data privacy and security, which necessitates robust analytics capabilities. The implementation of frameworks such as the Personal Data Protection Bill is prompting businesses to invest in analytics solutions that ensure compliance while deriving actionable insights. This trend is likely to propel the analytics as-a-service market, as companies seek to balance regulatory requirements with the need for effective data utilization.

Rise of Small and Medium Enterprises (SMEs)

The proliferation of small and medium enterprises (SMEs) in India is significantly impacting the analytics as-a-service market. SMEs are increasingly adopting analytics solutions to optimize their operations and enhance customer engagement. With limited resources, these businesses find analytics as-a-service offerings appealing due to their cost-effectiveness and scalability. Reports indicate that SMEs contribute to over 30% of India's GDP, highlighting their importance in the economy. As more SMEs recognize the potential of data analytics, the demand for analytics as-a-service solutions is expected to rise, driving market growth and innovation.

Growing Demand for Data-Driven Decision Making

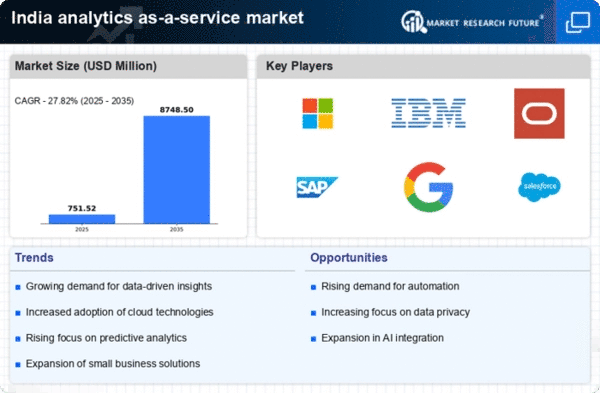

The analytics as-a-service market in India is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Businesses across various sectors are leveraging analytics to gain insights into customer behavior, operational efficiency, and market trends. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by the need for organizations to remain competitive and agile in a rapidly changing business environment. As companies seek to harness the power of data, the analytics as-a-service market is positioned to play a pivotal role in enabling informed decision-making processes.