Rising Demand for Sustainable Practices

Sustainability is becoming a critical focus in the agricultural sector, influencing the 5g smart-farming market in India. Farmers are increasingly adopting practices that minimize environmental impact, such as precision irrigation and integrated pest management. The need for sustainable farming methods is driven by consumer preferences for organic and eco-friendly products. Reports indicate that the market for organic food in India is expected to grow at a CAGR of 25% over the next five years. This trend necessitates the use of advanced technologies that can monitor and manage resources efficiently, which in turn boosts the demand for 5g connectivity. As farmers strive to meet sustainability goals, the 5g smart-farming market is likely to expand, providing the necessary infrastructure for these initiatives.

Technological Advancements in Agriculture

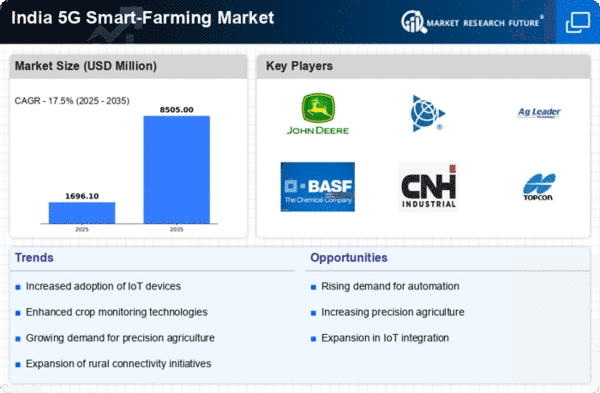

The 5g smart-farming market in India is experiencing a surge due to rapid technological advancements in agricultural practices. Innovations such as IoT devices, drones, and automated machinery are becoming increasingly integrated into farming operations. These technologies enable real-time monitoring of crop health, soil conditions, and weather patterns, thereby enhancing productivity. According to recent estimates, the adoption of smart farming technologies could increase crop yields by up to 30%. This shift towards technology-driven agriculture is likely to drive the demand for 5g connectivity, as high-speed data transmission is essential for the effective functioning of these advanced systems. As farmers seek to optimize their operations and reduce costs, the 5g smart-farming market is poised for significant growth in the coming years.

Enhanced Data Analytics and Decision-Making

The ability to harness data analytics is becoming increasingly vital in the agricultural sector, driving the 5g smart-farming market in India. Farmers are now able to collect and analyze vast amounts of data related to crop performance, soil health, and market trends. This data-driven approach allows for informed decision-making, optimizing resource allocation and improving overall farm efficiency. The integration of AI and machine learning with 5g technology enhances the capability to process data in real-time, leading to better outcomes. As the agricultural landscape becomes more competitive, the reliance on data analytics is expected to grow, further propelling the demand for 5g connectivity. The 5g smart-farming market is thus positioned to benefit from this trend, as farmers seek to leverage data for improved productivity and profitability.

Growing Urbanization and Population Pressure

Urbanization and population growth in India are exerting pressure on agricultural systems, thereby influencing the 5g smart-farming market. As urban areas expand, the demand for food production increases, necessitating more efficient farming practices. The population in India is projected to reach 1.5 billion by 2030, which will require a significant boost in agricultural output. To meet this demand, farmers are turning to smart farming solutions that utilize 5g technology for enhanced data analytics and resource management. This trend indicates a shift towards more intensive and technology-driven agricultural practices, which are essential for sustaining food security in the face of growing urbanization. Consequently, the 5g smart-farming market is likely to see substantial growth as it addresses these emerging challenges.

Increased Investment in Agricultural Technology

Investment in agricultural technology is a key driver of the 5g smart-farming market in India. Both private and public sectors are recognizing the potential of technology to transform agriculture. The Indian government has allocated substantial funds to promote digital agriculture, with initiatives aimed at enhancing rural connectivity and supporting tech-driven farming solutions. For instance, the budget for agricultural technology has seen an increase of over 15% in recent years. This financial backing is likely to facilitate the deployment of 5g networks, which are essential for the operation of smart farming technologies. As investments continue to flow into the sector, the 5g smart-farming market is expected to thrive, enabling farmers to leverage cutting-edge solutions for improved productivity.