In Car Audio System Size

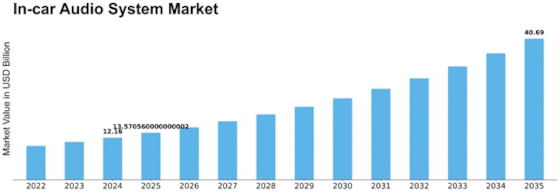

In-car Audio System Market Growth Projections and Opportunities

Customer preference, technology innovation, and the ongoing trend within this industry have created several factors that shape the market dynamics of in-car audio systems. Evolving consumer demand for better in-vehicle audio experiences acts as one primary force behind this market. Similarly, the integration of smartness and connectivity features into the automotive audio system determines its dynamics. Bluetooth, Wi-Fi, and smartphone integration are among the connectivity options that modern in-car audio systems provide so that users can access music streaming services like Tidal or Spotify and other types of audios, such as podcasts. At the same time, developments in sound technology like surround sound effects, digital signal processing (DSP), and acoustic enhancement techniques drive change in the car's audio system market. They are always working to improve sound quality, clarity, and immersive experience despite limited space inside a vehicle. Additionally, there is increasing integration between in-car audio systems with infotainment systems and driver-assist technologies, among others, such as autopilots, which influence market dynamics within which the product operates. This means that they are becoming more integrated and interconnected with other vehicle features, thus creating synergies that enhance driving pleasure overall. Furthermore, the changing landscape of automotive designs, including interior aesthetics, has significantly affected these market dynamics further. Vehicle manufacturers now consider interior design elements and cabin aesthetics since they treat an audio system as part of the aspect experience behind driving itself. In addition to delivering high-quality sound, a good car stereo also blends seamlessly with the internal styles of a vehicle while upgrading it to be luxurious looking. Moreover, the emergence of electric and autonomous vehicles impacts market dynamics. As a result, EVs' specific needs give rise to specialized on-board auto-audio devices in response to EVs rapid penetration. The development of this sector is influenced by customers' preferences for clear sounds while driving, the latest electronic advancements, the ability to connect all transportation components, fashion tendencies noticed throughout auto production industries, the appearance of self-driving cars, etc. In the future, as long as the automobile sector continues to keep its user-friendly approach and improves technology, in-car audio systems will become more sophisticated, leading to a more personalized and connected experience for both drivers and passengers. These dynamics keep fuelling rapid innovation and market growth within this car stereo system segment.

Leave a Comment