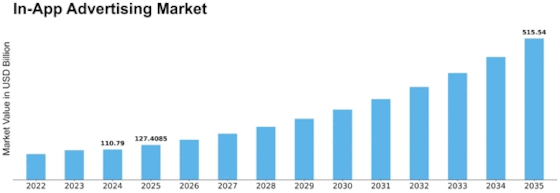

In App Advertising Size

In-app Advertising Market Growth Projections and Opportunities

Amazingly enough, the market dynamics of in-app advertising are a meld of technological innovation, consumer behavior, and business strategies. The increase in mobile app usage has seen greater demand for in-app advertising. Among other things, personalized and targeted advertising is one of the main factors determining trends in in-app advertising. Advertisers currently rely on user data as well as advanced analytics to accomplish reliable and interesting ads to persons using the applications. This trend is driven by the desire to maximize ad effectiveness and ROI, as well as the increasing emphasis on privacy and data protection regulations. An intensely competitive environment characterizes this sector between app developers, ad exchanges, and ad networks. In return, advertisers compete for premium ad inventory within popular apps, leading to dynamic pricing models and innovative ad formats between such entities as Ad Networks & Ad Exchanges. At the same time, App Developers try seeking nonintrusive and contextually relevant alternatives. Also, programmatic advertising is one of the forces behind recent changes that have affected how companies engage with their customers. Programmatic technology allows real-time bidding, while automated placements permit advertisers to reach their target audience precisely yet efficiently. The shift from traditional media buying methods into programmatic selling has, however, allowed for more transparency, efficiency, and scalability within the advertising ecosystem through which in-app advertisement inventories get traded. Another important dynamic operating within the in-app advertising market space revolves around ad fraud & brand safety landscape that continuously keeps evolving. Fraudulent activities are now more rampant than ever, necessitating brands to protect themselves against them but also be aware of everything happening within such environments as these once they adopt any online application platform. This ultimately steered leading apps towards implementing advanced technologies like multi-layered fraud detection tools and brand safety measures, among other industry-wide initiatives aimed at promoting transparency (IAB 2016). In addition, there was also ongoing evolution when it came to ad formats along with creative strategies that influenced this marketplace. Advertisers have had to look for new ways of capturing the attention of the users of these applications and increasing their engagement levels due to the introduction of interactive and immersive ad experiences. The diversity in ad formats, from playable ads to augmented reality, contributes significantly to its being considered dynamic since it presents both challenges and opportunities for creative innovation.

Leave a Comment