-

Executive summary

-

Market Introduction

-

Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Research Methodology

-

Overview

-

Data Mining

-

Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

-

Forecasting Modality

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

-

Data Triangulation

-

Validation

-

Market Dynamics

-

Overview

-

Drivers

-

Restraints

-

Opportunities

-

Market Factor Analysis

-

Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

GLOBAL Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component

-

Overview

-

Hardware

- Head-Mounted Display (HMD)

- Gesture Tracking Devices (GTD)

- Projectors & Display Walls (PDW)

-

Software/Platform

-

Services

- Professional

- Managed

-

GLOBAL Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Technology

-

Overview

-

Mixed Reality (MR)

-

Virtual Reality (VR)

-

Augmented Reality (AR)

-

360 Film

-

GLOBAL Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Application

-

Overview

-

Training & Learning

-

Emergency Services

-

Product Development

-

Sales & Marketing

-

GLOBAL Immersive Technology in Military & Immersive Technology in Military & Defense Market, by Region

-

Overview

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

Competitive Landscape

-

Overview

-

Competitive Analysis

-

Market Share Analysis

-

Major Growth Strategy in the Global Immersive Technology in Military & Defense Market,

-

Competitive Benchmarking

-

Leading Players in Terms of Number of Developments in the Global Immersive Technology in Military & Defense Market,

-

Key developments and Growth Strategies

- New Component Launch/Technology Application

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales & Operating Income, 2022

- Major Players R&D Expenditure. 2022

-

Company ProfileS

-

ACER INC.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Atheer, Inc.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AVEVA Group PLC

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Barco NV

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Blippar Ltd.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Carl Zeiss AG

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

CM Labs Simulations Inc.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

EON Reality, Inc.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

FAAC Incorporated

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Google, LLC

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

HCL Technologies Limited

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Honeywell International, Inc.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

HTC Corporation

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Immersive Media Company

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Immersive Technologies Pty Limited

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Lockheed Martin Corporation

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Magic Leap, Inc.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

NCTech Limited

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Oculus (Facebook Technologies, LLC.)

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Samsung Group

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sony Corporation

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Unity Software Inc.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Varjo Technologies Oy

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

VI-grade GmbH

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zeality Inc.

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Appendix

-

References

-

Related Reports

-

LIST OF TABLES

-

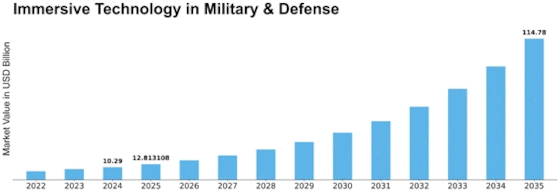

Global Immersive Technology in Military & Defense Market, Synopsis, 2018-2032

-

Global Immersive Technology in Military & Defense Market, Estimates & Forecast, 2018-2032 (USD BILLION)

-

GLOBAL Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

GLOBAL Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

GLOBAL Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

North America Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

North America Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

North America Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

North America Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Country, 2018-2032 (USD BILLION)

-

U.S. Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

U.S. Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

U.S. Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Canada Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Canada Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Canada Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Europe Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Europe Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Europe Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Europe Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Country, 2018-2032 (USD BILLION)

-

Germany Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Germany Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Germany Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

France Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

France Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

France Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Italy Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Italy Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Italy Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Spain Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Spain Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Spain Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

U.K Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

U.K Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

U.K Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Rest of Europe Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Rest of Europe Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Rest of Europe Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Asia Pacific Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Asia Pacific Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Asia Pacific Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Asia Pacific Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Country, 2018-2032 (USD BILLION)

-

Japan Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Japan Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Japan Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

China Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

China Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

China Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

India Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

India Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

India Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Australia Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Australia Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Australia Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

south korea Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

south korea Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

south korea Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Rest of asia-pacific Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Rest of asia-pacific Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Rest of asia-pacific Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Rest of WOrld Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Rest of WOrld Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Rest of WOrld Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Rest of WOrld Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Country, 2018-2032 (USD BILLION)

-

Middle east Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Middle east Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Middle east Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Africa Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Africa Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Africa Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

Latin america Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY Component, 2018-2032 (USD BILLION)

-

Latin america Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY TECHNOLOGY, 2018-2032 (USD BILLION)

-

Latin america Immersive Technology in Military & Immersive Technology in Military & Defense Market, BY APPLICATION, 2018-2032 (USD BILLION)

-

LIST OF FIGURES

-

Research Process

-

Market Structure for the Global Immersive Technology in Military & Defense Market

-

Market Dynamics for the Global Immersive Technology in Military & Defense Market

-

Global Immersive Technology in Military & Defense Market, Share (%), BY Component, 2022

-

Global Immersive Technology in Military & Defense Market, Share (%), BY TECHNOLOGY, 2022

-

Global Immersive Technology in Military & Defense Market, Share (%), BY APPLICATION, 2022

-

Global Immersive Technology in Military & Defense Market, Share (%), by Region, 2022

-

north AMERICA: Immersive Technology in Military & Defense MARKET, SHARE (%), BY REGION, 2022

-

Europe: Immersive Technology in Military & Defense MARKET, SHARE (%), BY REGION, 2022

-

Asia-Pacific: Immersive Technology in Military & Defense MARKET, SHARE (%), BY REGION, 2022

-

Rest of the world: Immersive Technology in Military & Defense MARKET, SHARE (%), BY REGION, 2022

-

Global Immersive Technology in Military & Defense Market: Company Share Analysis, 2022 (%)

-

ACER INC.: FINANCIAL OVERVIEW SNAPSHOT

-

ACER INC.: SWOT ANALYSIS

-

Atheer, Inc.: FINANCIAL OVERVIEW SNAPSHOT

-

Atheer, Inc., Inc.: SWOT ANALYSIS

-

AVEVA Group PLC.: FINANCIAL OVERVIEW SNAPSHOT

-

AVEVA Group PLC: SWOT ANALYSIS

-

Barco NV: FINANCIAL OVERVIEW SNAPSHOT

-

Barco NV: SWOT ANALYSIS

-

Blippar Ltd.: FINANCIAL OVERVIEW SNAPSHOT

-

Blippar Ltd.: SWOT ANALYSIS

-

Carl Zeiss AG: FINANCIAL OVERVIEW SNAPSHOT

-

Carl Zeiss AG: SWOT ANALYSIS

-

CM Labs Simulations Inc.: FINANCIAL OVERVIEW SNAPSHOT

-

CM Labs Simulations Inc.: SWOT ANALYSIS

-

EON Reality, Inc.: FINANCIAL OVERVIEW SNAPSHOT

-

EON Reality, Inc.: SWOT ANALYSIS

-

FAAC Incorporated: FINANCIAL OVERVIEW SNAPSHOT

-

FAAC Incorporated: SWOT ANALYSIS

-

Google, LLC: FINANCIAL OVERVIEW SNAPSHOT

-

Google, LLC.: SWOT ANALYSIS

-

HCL Technologies Limited: FINANCIAL OVERVIEW SNAPSHOT

-

HCL Technologies Limited: SWOT ANALYSIS

-

Honeywell International, Inc.: FINANCIAL OVERVIEW SNAPSHOT

-

Honeywell International, Inc.: SWOT ANALYSIS

-

HTC Corporation: FINANCIAL OVERVIEW SNAPSHOT

-

HTC Corporation: SWOT ANALYSIS

-

Immersive Media Company: FINANCIAL OVERVIEW SNAPSHOT

-

Immersive Media Company.: SWOT ANALYSIS

-

Immersive Technologies Pty Limited: FINANCIAL OVERVIEW SNAPSHOT

-

Immersive Technologies Pty Limited, LLC: SWOT ANALYSIS

-

Lockheed Martin Corporation: FINANCIAL OVERVIEW SNAPSHOT

-

Lockheed Martin Corporation: SWOT ANALYSIS

-

NCTech Limited: FINANCIAL OVERVIEW SNAPSHOT

-

NCTech Limited: SWOT ANALYSIS

-

Oculus (Facebook Technologies, LLC.): FINANCIAL OVERVIEW SNAPSHOT

-

Oculus (Facebook Technologies, LLC.): SWOT ANALYSIS

-

Samsung Group: FINANCIAL OVERVIEW SNAPSHOT

-

Samsung Group: SWOT ANALYSIS

-

Sony Corporation: FINANCIAL OVERVIEW SNAPSHOT

-

Sony Corporation: SWOT ANALYSIS

-

Unity Software Inc.: FINANCIAL OVERVIEW SNAPSHOT

-

Unity Software Inc.: SWOT ANALYSIS

-

Varjo Technologies Oy: FINANCIAL OVERVIEW SNAPSHOT

-

Varjo Technologies Oy: SWOT ANALYSIS

-

VI-grade GmbH: FINANCIAL OVERVIEW SNAPSHOT

-

VI-grade GmbH: SWOT ANALYSIS

-

VI-grade GmbH: FINANCIAL OVERVIEW SNAPSHOT

-

VI-grade GmbH: SWOT ANALYSIS'

Leave a Comment