Immersive Technology In Entertainment Size

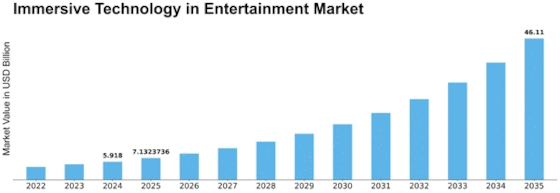

Immersive Technology in Entertainment Market Growth Projections and Opportunities

Immersive entertainment technology dynamics have changed greatly, and this has introduced a new kind of interactive and captivating experience for the audience. The entertainment landscape has transformed due to immersive technologies such as virtual reality (VR) and augmented reality (AR), which are applied in storytelling and audience engagement across different platforms. One of the main drivers behind the adoption of immersive technologies in entertainment is to make it more engaging, realistic, and memorable for consumers. VR games, virtual theme park experiences, and immersive stories enable users to enter virtual worlds with a presence unlike any traditional media can create. Immersive technology used by the gaming industry spearheaded its growth with a popularity surge of VR gaming, which is followed by other games being considered. Additionally, immersive technology has recently found its way into live events and entertainment, where it offers unique experiences that captivate people's attention. On the one hand, there are VR concerts, live sports events, and theater performances available from home in AR application format. Integration of immersion technologies into filmmaking and storytelling also affects market dynamics and their growth. Filmmakers using VR or AR are able to come up with narratives that are no longer confined within the screen frame; instead, they can include viewers in storylines while blurring boundaries between fact and fiction. This type of cinema, as well as apps based on AR, gives people a greater choice when it comes to watching since they can take part in this content through interaction, therefore changing them from passive observers to active participants. Such a shift in narration paradigms can actually be a game changer for this industry because it introduces plenty of opportunities related to narrative creation along with audience involvement. Nevertheless, within entertainment's immersive technology market, challenges lie around ensuring that there is widespread usage for this kind of device, such as VR or AR, together with the production of compelling content. Though momentum has built up around these devices, adoption rates among mainstream consumers remain uncertain. For immersive technology to be adopted, high-quality content that appeals to consumers must be created. Developers and creators of content play a pivotal role in molding the landscape of immersive entertainment by presenting their audiences with these unique experiences and demonstrating the capabilities of these technologies.

Leave a Comment