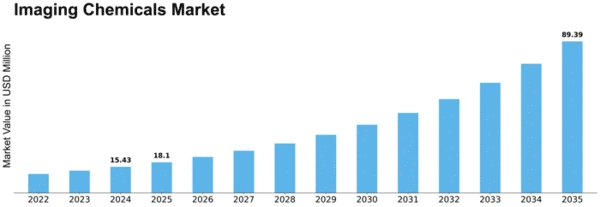

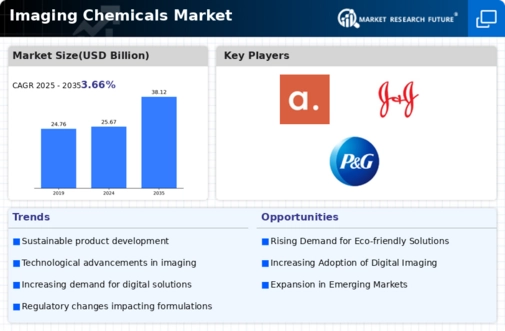

Imaging Chemicals Size

Imaging Chemicals Market Growth Projections and Opportunities

The Imaging Chemicals Market is influenced by a myriad of market factors that collectively shape its dynamics and growth trajectory. One key determinant is technological advancements in imaging technologies. As the imaging industry continues to evolve, the demand for cutting-edge imaging chemicals rises in tandem. Innovations in medical imaging, such as advanced diagnostic techniques and the increasing use of imaging in research and development, drive the need for specialized chemicals that can enhance image quality and provide more accurate results. Similarly, in the photography and printing sectors, the push for higher resolutions and improved color reproduction fuels the demand for sophisticated imaging chemicals.

Economic factors also play a crucial role in shaping the Imaging Chemicals Market. The overall economic health of a region or country influences spending patterns on healthcare, research, and development, and photography-related services. When economies thrive, there tends to be more investment in advanced medical imaging equipment and technologies, leading to an increased demand for imaging chemicals. Conversely, during economic downturns, there may be a temporary decline in spending on non-essential services, impacting the market for imaging chemicals.

Government regulations and policies represent another significant factor affecting the Imaging Chemicals Market. Stringent regulations in healthcare, environmental standards, and product safety can impact the formulation and use of imaging chemicals. For instance, the introduction of regulations promoting environmentally friendly chemicals can drive the development and adoption of greener alternatives in the market. Additionally, changes in reimbursement policies in healthcare can influence the adoption of certain imaging techniques and, consequently, the demand for specific imaging chemicals.

The competitive landscape within the Imaging Chemicals Market is shaped by factors such as market consolidation, mergers, and acquisitions. Large companies acquiring smaller players can lead to a concentration of market share, altering the competitive dynamics. Market players must adapt to these changes by exploring strategic partnerships or focusing on niche markets to maintain their relevance and competitiveness. Furthermore, the emergence of new entrants and startups with innovative solutions can disrupt the market, prompting established players to adapt or face potential challenges to their market share.

Consumer preferences and trends contribute significantly to the fluctuations in the Imaging Chemicals Market. As consumers increasingly prioritize sustainable and eco-friendly products, the demand for environmentally conscious imaging chemicals rises. Similarly, changing preferences in the healthcare sector, such as a growing inclination towards non-invasive imaging techniques, impact the demand for specific types of imaging chemicals. Market players must stay attuned to these shifts to anticipate and meet evolving consumer needs.

Global events and crises, such as the COVID-19 pandemic, can also exert considerable influence on the Imaging Chemicals Market. The pandemic highlighted the critical role of medical imaging in healthcare, leading to increased investments in diagnostic imaging equipment and related chemicals. However, disruptions in the supply chain and manufacturing processes due to lockdowns and restrictions posed challenges for the market. Adapting to such unforeseen circumstances becomes essential for market players to navigate uncertainties and maintain resilience.

Leave a Comment