Top Industry Leaders in the Hypersonic Weapons Market

The competitive landscape of the Hypersonic Weapons market is pivotal in the defense sector, representing a paradigm shift in military capabilities with the development of high-speed and highly maneuverable weapons systems. Analyzing key players, strategies, and recent developments is crucial for understanding the dynamics of this rapidly evolving market.

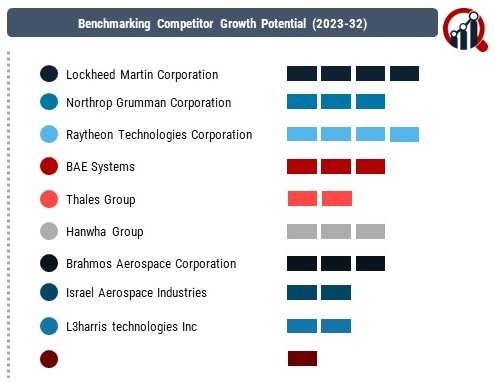

Key Players:

Lockheed Martin Corporation (US)

Northrop Grumman Corporation (US)

Raytheon Technologies Corporation (US)

BAE Systems (UK)

Thales Group (France)

Hanwha Group (South Korea)

Brahmos Aerospace Corporation (India)

Israel Aerospace Industries (Israel)

L3harris technologies Inc (US)

Strategies Adopted:

The Hypersonic Weapons market deploy diverse strategies to maintain a competitive edge. Strategies include substantial investment in research and development (R&D) to advance hypersonic technologies, strategic collaborations to enhance capabilities, and a focus on innovation. Lockheed Martin, for example, places a significant emphasis on R&D investments to develop cutting-edge hypersonic weapons tailored to meet various military requirements. Collaborations between Raytheon Technologies and government defense agencies aim to optimize hypersonic weapon applications for specific defense needs, highlighting a cooperative approach to addressing industry demands.

Market Share Analysis:

The Hypersonic Weapons market is influenced by factors such as technological advancement, successful testing, adaptability to diverse mission scenarios, and the ability to provide comprehensive solutions. Companies excelling in delivering high-quality, technologically advanced hypersonic weapons, ensuring compliance with defense standards, and offering solutions adaptable to various defense requirements are strategically positioned to capture a larger market share. Establishing strong relationships with defense agencies, participating in international collaborations, and staying ahead in hypersonic technology development are crucial factors for maintaining a competitive edge.

News & Emerging Companies:

The Hypersonic Weapons market has witnessed the emergence of new companies focused on addressing the demand for innovative and advanced hypersonic technologies. Emerging entrants, such as Aerojet Rocketdyne and BrahMos Aerospace, have gained attention for their focus on introducing cutting-edge propulsion systems and hypersonic missile technologies. These emerging companies contribute to the market by introducing fresh perspectives and agile approaches to address the evolving demands of hypersonic weapon development.

Industry Trends:

The Hypersonic Weapons market underscores ongoing investment trends, with a strong emphasis on improving hypersonic technology, successful testing, and addressing challenges related to production scalability. Companies invest significantly in the development of hypersonic technologies with increased speed, maneuverability, and advancements in propulsion systems. Successful testing milestones, including the integration of hypersonic systems with existing defense infrastructure, are trends reflecting the industry's response to the need for versatile and effective hypersonic weapons. Investments in addressing the challenges of production scalability and cost-effectiveness underscore the commitment to improving overall viability in the development and deployment of hypersonic weapons.

Competitive Scenario:

The Hypersonic Weapons market is characterized by intense competition among established players and the entry of innovative newcomers. With defense agencies increasingly prioritizing hypersonic capabilities, companies aim to differentiate themselves by offering comprehensive solutions that address the challenges of modern defense requirements. Established players focus on refining their hypersonic weapon designs, expanding their market presence through strategic collaborations with defense agencies, and staying informed about emerging technologies and regulatory requirements. The entry of emerging companies adds dynamism to the market, fostering an environment of continuous improvement and responsiveness to the changing demands of hypersonic weapon development.

Recent Development

The Hypersonic Weapons market witnessed a significant development as Lockheed Martin Corporation announced the successful completion of a series of live-fire tests for its hypersonic missile system. The tests showcased the missile's enhanced capabilities, including high-speed maneuverability and precision targeting, marking a crucial milestone in the development of hypersonic weapons. This development underscores Lockheed Martin's commitment to advancing hypersonic technologies and reinforces its position as a key player in the market. The successful live-fire tests are expected to contribute to the overall advancement of hypersonic weapon systems, offering improved capabilities for defense applications. The announcement reflects the industry's continuous efforts to evolve and provide cutting-edge solutions that address the challenges posed by the dynamic defense landscape, emphasizing the importance of advanced hypersonic weapon technologies in shaping the future of military capabilities.