Hydrofluoric Acid Size

Hydrofluoric Acid Market Growth Projections and Opportunities

The need for certain chemical compounds, specifically those containing fluorine, is on the rise due to their use in various industries. One such compound is hydrofluoric acid, a key ingredient in the production of Fluoxetine, commonly known as Prozac. This chemical is gaining significance as depression becomes more prevalent globally.

According to the World Health Organization (WHO), a significant portion of the world's population, approximately 3.8%, is currently grappling with depression. This condition affects around 280 million people globally. The impact is not limited to adults, as data from the Depression and Bipolar Support Alliance reveals that approximately 17.3 million adults in the United States were diagnosed with depressive disorder in 2017. The issue extends to younger age groups, with 1.9 million individuals aged 3 to 17 facing depression in 2018. This rise in depression cases is noted in various countries, including Australia, the UK, and India.

In the United States, the Professor of the Graduate School of Public Health and Health Policy at the University of New York points out that depression has become a more common health problem. The National Survey on Drug Use and Health from 2015 to 2020 shows a continuous increase in the incidence of depression, with 17.2% of young adults aged 18-25 experiencing depression.

Similar trends are observed globally, with Australia reporting that 21.4% of its population suffered from a mental disorder in the 12 months leading up to 2020-2021. In the UK, the Health and Safety Executive data indicates that around 17 million workdays were lost in 2021-2022 due to issues like depression, stress, or anxiety related to work. India, according to the WHO's 2014 report, has the highest number of depressed individuals, with 15% of the adult population needing intervention, as highlighted by the National Mental Health Survey 2015-2016.

This surge in depression cases has led to an increased demand for Fluoxetine, a medication that uses hydrofluoric acid in its synthesis. Hydrofluoric acid is not only vital in pharmaceuticals but also plays a crucial role in various industrial processes. It is utilized in the production of pesticides, insecticides, and herbicides that contain fluorine. Additionally, the acid acts as a catalyst in the alkylation process during the manufacturing of petroleum, boosting crude oil yield, process efficiency, and petrol quality. The growing demand for nutrient-rich pesticides and the rising need for petroleum oil and its by-products are contributing positively to the market's growth.

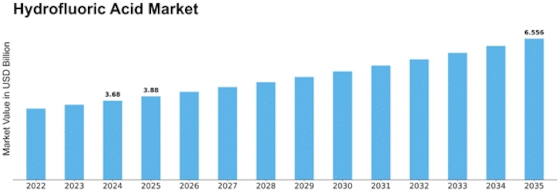

In conclusion, the escalating prevalence of depression worldwide has led to an increased demand for Fluoxetine, driving the demand for hydrofluoric acid. This compound's importance extends beyond pharmaceuticals, playing a crucial role in the production of pesticides and the petroleum industry. The growing requirements in these industrial sectors are fueling the overall demand for fluorine compounds, contributing to market growth during the forecast period. The global hydrofluoric acid market is poised for substantial growth in the coming years, with a projected Compound Annual Growth Rate (CAGR) of 5.35%. In 2021, the market size was estimated at USD 3.18 billion, and forecasts indicate a surge to USD 5.04 billion by the conclusion of the review period spanning from 2022 to 2030.

Hydrofluoric acid finds versatile applications across several industries, including mineral digestion, surface cleaning, chlorofluorocarbons, biological staining, aluminum production, and glass etching. Despite its widespread use, the unique characteristics of hydrofluoric acid render it more hazardous compared to other acids.

The global hydrofluoric acid market is segmented based on grade into anhydrous, diluted (<50% Conc.), and diluted (>50% Conc.). The anhydrous segment claimed a leading market share of 62.5% in 2021. Following closely is the diluted (<50% Conc.) segment, securing the second position with a market value of USD 824.80 million, while the diluted (>50% Conc.) segment is poised to experience a CAGR of 4.96% during the forecast period.

Application-wise, the hydrofluoric acid market is categorized into fluorocarbons production, fluoro-polymers production, fluorinated derivative production, battery electrolyte salts, steel/metal pickling, glass etching & cleaning, petroleum alkylation, refrigerant gases, uranium fuel production, and others. Among these, fluorocarbon production dominates with a substantial market share of 47.48% and a value of USD 1,512.79 million in 2021. The refrigerant gases segment is anticipated to reach USD 104.95 million by 2030, while fluorocarbons remain the most lucrative application segment with a projected CAGR of 4.74%. The battery electrolyte segment accounted for a 3.12% market share and USD 102.93 million in 2022, while fluorinated derivative production holds a 15.73% market share in 2021 and is expected to grow at a CAGR of 6.87% until 2030.

Geographically, the global hydrofluoric acid market is scrutinized across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Asia Pacific leads in consumption volume with a commanding share of 45.10%, establishing itself as the global leader in the hydrofluoric acid market. Europe and North America show promising growth prospects, driven by increased applications in the fluorocarbon sector. The Asia Pacific region boasts a significant number of local manufacturers with robust global distribution networks, contributing to its dominant position. Manufacturers in the global hydrofluoric acid market are actively investing in research and development to enhance the functional properties of their product portfolios.

The market's growth is propelled by the rising demand for hydrofluoric acid in refrigerants. However, challenges such as negative health hazards and the volatility of raw material prices pose restraints. Despite these impediments, the surge in demand for various fluorine molecules across sectors is anticipated to be a key driver for the overall growth of the global hydrofluoric acid market.

Leave a Comment