Increased Use in Oil and Gas Industry

The Hydrochloric Acid Market is witnessing growth due to its application in the oil and gas sector. Hydrochloric acid is employed in acidizing processes to enhance oil recovery and improve well productivity. As energy demands continue to rise, the oil and gas industry is likely to invest in technologies that utilize hydrochloric acid for efficient extraction processes. Current projections indicate that the oil and gas sector may experience a growth rate of around 3.5% annually, which could positively impact the hydrochloric acid market. This trend suggests that the ongoing exploration and production activities in the energy sector will sustain the demand for hydrochloric acid.

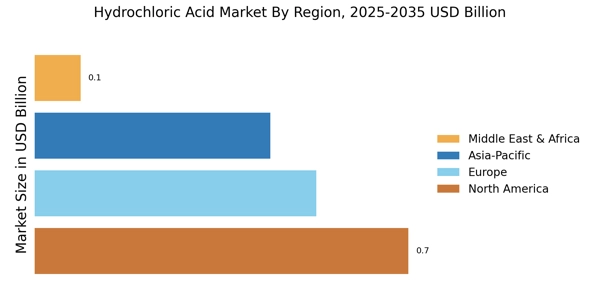

Emerging Markets and Industrialization

The Hydrochloric Acid Market is poised for growth as emerging markets undergo rapid industrialization. Countries in Asia and Africa are increasingly adopting industrial processes that require hydrochloric acid, particularly in manufacturing and construction. The rise of these markets is expected to contribute to a substantial increase in hydrochloric acid consumption. Recent reports indicate that industrial production in these regions is anticipated to grow at a CAGR of approximately 5.5%, which could significantly bolster the hydrochloric acid market. This trend highlights the potential for manufacturers to expand their operations and cater to the burgeoning demand for hydrochloric acid in developing economies.

Growth in Water Treatment Applications

The Hydrochloric Acid Market is significantly influenced by the growing need for water treatment solutions. Hydrochloric acid is widely used to adjust pH levels in water treatment facilities, ensuring the effective removal of contaminants. As water quality regulations become more stringent, municipalities and industries are investing in advanced water treatment technologies, which in turn boosts the demand for hydrochloric acid. Recent statistics reveal that the water treatment sector is projected to grow at a CAGR of around 6% in the coming years, indicating a robust market for hydrochloric acid. This growth is likely to be driven by increasing awareness of water quality issues and the necessity for sustainable water management practices.

Rising Demand in Chemical Manufacturing

The Hydrochloric Acid Market is experiencing a notable increase in demand due to its essential role in chemical manufacturing processes. Hydrochloric acid is a key reagent in the production of various chemicals, including vinyl chloride for PVC, and is utilized in the synthesis of organic compounds. As industries expand and diversify, the need for hydrochloric acid is projected to grow. Recent data indicates that the chemical manufacturing sector is expected to witness a compound annual growth rate (CAGR) of approximately 4.5% over the next five years, further driving the hydrochloric acid market. This trend suggests that manufacturers are increasingly relying on hydrochloric acid to enhance production efficiency and meet the rising consumer demand for chemical products.

Expansion of the Food and Beverage Sector

The Hydrochloric Acid Market is also benefiting from the expansion of the food and beverage sector. Hydrochloric acid is utilized in food processing for various applications, including pH control and the production of food additives. As consumer preferences shift towards processed and packaged foods, the demand for hydrochloric acid in food production is expected to rise. Market analysis suggests that the food and beverage industry is set to grow at a CAGR of approximately 5% over the next few years, which could lead to increased consumption of hydrochloric acid. This trend indicates that manufacturers in the food sector are increasingly relying on hydrochloric acid to ensure product safety and quality.