Market Trends

Key Emerging Trends in the Hybrid Composites Market

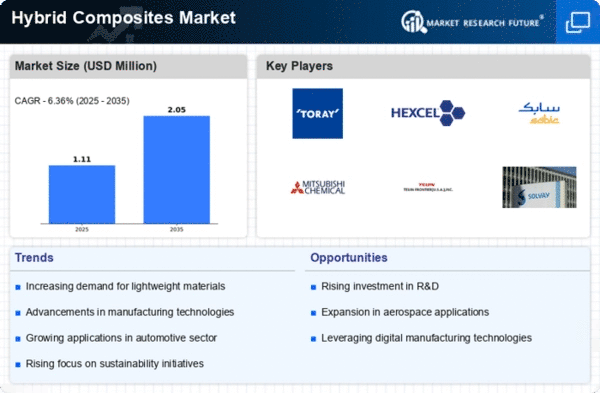

The Hybrid Composites Market is currently witnessing significant trends that are reshaping the landscape across various industries. One notable trend is the increasing adoption of hybrid composites in the automotive sector. As automakers seek lightweight materials to enhance fuel efficiency and reduce emissions, hybrid composites, combining different types of fibers and matrices, are gaining popularity for manufacturing lightweight and high-strength automotive components. This trend aligns with the global automotive industry's push towards sustainability and the production of electric and hybrid vehicles, where weight reduction is crucial for optimizing performance and range.

Environmental sustainability is a key driver influencing market trends in the Hybrid Composites Market. With a growing emphasis on eco-friendly and recyclable materials, there is a shift towards the development of sustainable hybrid composites. Manufacturers are exploring the use of bio-based and recycled fibers in hybrid composites to reduce the environmental impact of the materials. This trend responds to the increasing demand for green and sustainable solutions in industries like automotive, aerospace, and construction, aligning with broader efforts towards circular economy principles.

Technological advancements play a pivotal role in shaping market trends in the Hybrid Composites Market. Ongoing research and development efforts focus on enhancing the performance and processing capabilities of hybrid composites. Innovations in manufacturing processes, such as automated lay-up and advanced molding techniques, contribute to improving the efficiency and cost-effectiveness of producing hybrid composite components. These technological trends cater to the demand for high-performance materials with improved mechanical properties and processing characteristics.

The aerospace industry is another significant influencer of market trends in the Hybrid Composites Market. With the aerospace sector's emphasis on lightweight materials for aircraft components, hybrid composites find applications in structural elements and interior components. The combination of different fibers, such as carbon and glass, allows for a tailored balance of strength, stiffness, and weight reduction, meeting the stringent requirements of the aerospace industry. This trend is driven by the continuous need for fuel-efficient and high-performance aircraft.

Supply chain dynamics and raw material costs are critical factors impacting market trends in the Hybrid Composites Market. The availability and pricing of raw materials, including various fibers and matrices, can influence the overall cost of hybrid composite production. Fluctuations in raw material prices and supply chain disruptions can pose challenges for manufacturers. Companies in the Hybrid Composites Market are actively managing their supply chains, exploring alternative materials, and seeking strategic partnerships to ensure a stable and cost-effective production process.

Moreover, there is a growing trend towards customization and application-specific solutions in the Hybrid Composites Market. As industries recognize the unique advantages offered by hybrid composites, there is an increasing demand for tailored solutions that meet specific performance criteria. Manufacturers are responding to this trend by offering customization options in terms of fiber combinations, matrix materials, and manufacturing processes, allowing customers to benefit from hybrid composites optimized for their particular applications.

Leave a Comment