Government Initiatives and Policies

Government initiatives and policies play a pivotal role in shaping the HVDC Transmission Market. Many countries are implementing regulations and incentives to promote the adoption of HVDC technology as part of their energy transition strategies. For instance, various governments are setting ambitious renewable energy targets, which necessitate the integration of HVDC systems to connect remote renewable energy sources to urban centers. The International Energy Agency indicates that investments in HVDC infrastructure could reach trillions of dollars by 2040, highlighting the potential for growth in the HVDC Transmission Market driven by supportive governmental frameworks.

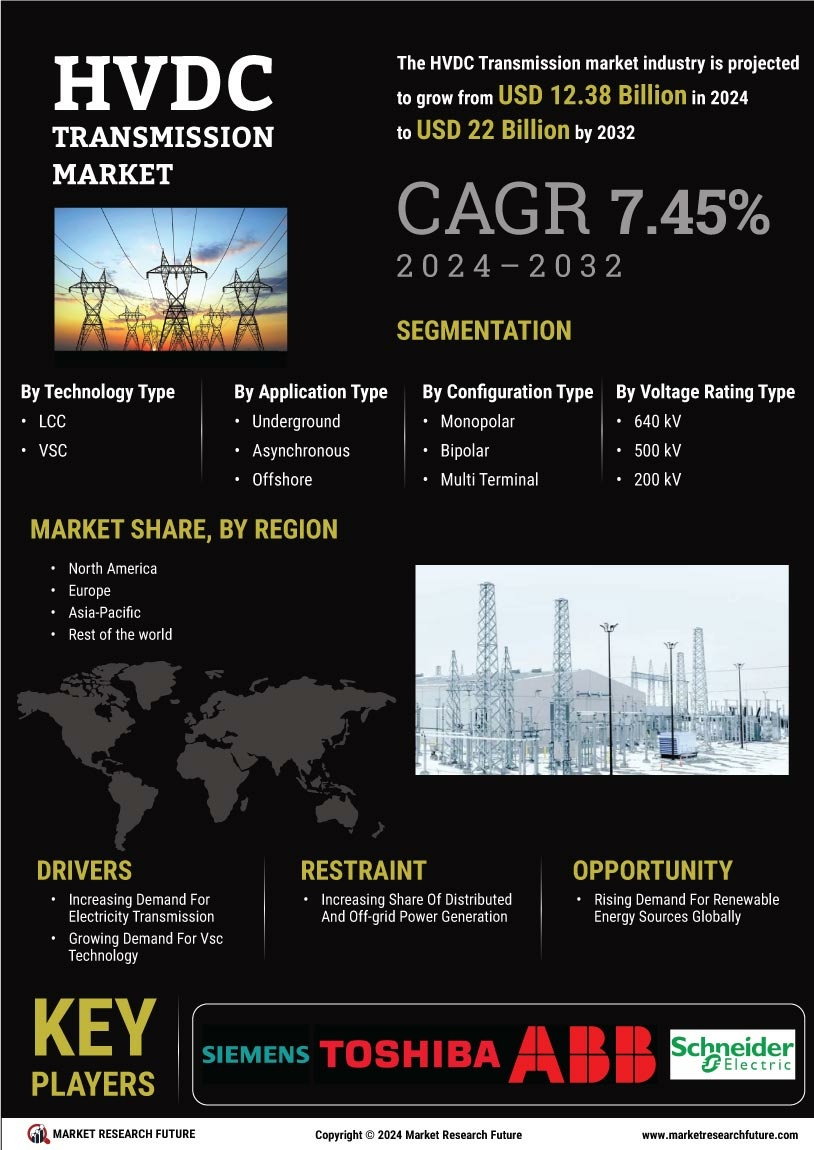

Technological Advancements in HVDC Systems

Technological advancements are transforming the HVDC Transmission Market, making systems more efficient and cost-effective. Innovations such as Voltage Source Converters (VSC) and improved control systems are enhancing the performance of HVDC technology. These advancements allow for greater flexibility in power flow management and the ability to connect renewable energy sources more effectively. As technology continues to evolve, the cost of HVDC systems is expected to decrease, further driving adoption. The integration of smart grid technologies with HVDC systems is also anticipated to enhance operational efficiency, thereby bolstering the HVDC Transmission Market.

Growing Need for Interconnected Power Grids

The growing need for interconnected power grids is a significant driver of the HVDC Transmission Market. As countries seek to enhance energy security and reliability, the interconnection of national and regional grids becomes essential. HVDC technology facilitates the connection of asynchronous grids, allowing for the exchange of electricity across borders. This interconnectivity not only improves energy access but also enables countries to share renewable resources more effectively. The increasing focus on energy independence and collaboration among nations is likely to propel the demand for HVDC systems, thereby fostering growth in the HVDC Transmission Market.

Rising Investment in Renewable Energy Projects

The HVDC Transmission Market is significantly influenced by the rising investment in renewable energy projects. As the world shifts towards sustainable energy sources, the need for efficient transmission systems to connect these sources to the grid becomes paramount. It is projected that investments in renewable energy will exceed 2 trillion dollars annually by 2030, necessitating the deployment of HVDC technology to manage the increased energy flow. This trend not only supports the growth of the HVDC Transmission Market but also enhances the overall stability and efficiency of power systems.

Increasing Demand for Efficient Power Transmission

The HVDC Transmission Market is experiencing a surge in demand for efficient power transmission solutions. This demand is primarily driven by the need to reduce transmission losses and enhance the reliability of electricity supply. With traditional AC systems facing limitations in long-distance transmission, HVDC technology offers a viable alternative. It is estimated that HVDC systems can reduce transmission losses by up to 30% compared to AC systems. As urbanization and industrialization continue to escalate, the need for efficient power transmission becomes increasingly critical, thereby propelling the growth of the HVDC Transmission Market.