Market Growth Projections

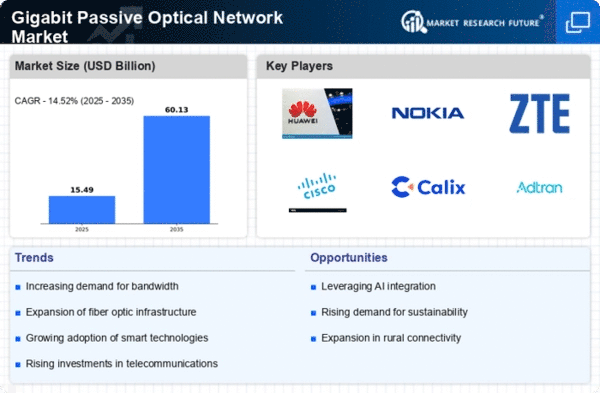

The Global Gigabit Passive Optical Network Market Industry is projected to experience substantial growth over the coming years. With a market value of 11.8 USD Billion in 2024, the industry is expected to expand significantly, reaching 60.1 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 15.95% from 2025 to 2035, indicating robust demand for high-speed internet solutions. The increasing reliance on digital services and the need for enhanced connectivity are likely to drive this expansion. As the market evolves, stakeholders must remain vigilant to emerging trends and technological advancements that could shape the future of the Global Gigabit Passive Optical Network Market Industry.

Emergence of 5G Technology

The emergence of 5G technology is set to have a profound impact on the Global Gigabit Passive Optical Network Market Industry. As telecommunications providers roll out 5G networks, the demand for complementary infrastructure, such as Gigabit Passive Optical Networks, is likely to increase. These networks can support the high data rates and low latency required by 5G applications, making them essential for the successful deployment of next-generation mobile networks. The synergy between 5G and Gigabit Passive Optical Networks may lead to enhanced connectivity solutions, further driving market growth. As the industry evolves, the integration of these technologies could redefine user experiences and connectivity standards.

Rising Adoption of Smart Technologies

The Global Gigabit Passive Optical Network Market Industry is significantly influenced by the rising adoption of smart technologies across various sectors. Industries such as healthcare, education, and smart cities increasingly rely on high-speed internet for efficient operations and enhanced user experiences. The integration of Internet of Things (IoT) devices necessitates robust connectivity solutions, which Gigabit Passive Optical Networks provide. This trend is expected to drive the market's growth, as organizations seek to leverage advanced technologies that require substantial bandwidth. The anticipated compound annual growth rate of 15.95% from 2025 to 2035 further illustrates the potential of the Global Gigabit Passive Optical Network Market Industry in meeting the demands of a digitally connected world.

Government Initiatives and Investments

Government initiatives play a pivotal role in the expansion of the Global Gigabit Passive Optical Network Market Industry. Various countries are investing in broadband infrastructure to enhance connectivity, particularly in underserved regions. These investments often include subsidies and incentives for telecommunications companies to deploy Gigabit Passive Optical Networks. Such initiatives not only aim to bridge the digital divide but also stimulate economic growth by enabling access to high-speed internet. As a result, the market is expected to witness substantial growth, with projections indicating a rise to 60.1 USD Billion by 2035, underscoring the importance of government support in the Global Gigabit Passive Optical Network Market Industry.

Increasing Demand for High-Speed Internet

The Global Gigabit Passive Optical Network Market Industry experiences a surge in demand for high-speed internet services, driven by the proliferation of digital content and online activities. As consumers and businesses alike seek faster and more reliable internet connections, the adoption of Gigabit Passive Optical Networks becomes increasingly attractive. In 2024, the market is projected to reach 11.8 USD Billion, reflecting a growing recognition of the need for enhanced bandwidth capabilities. This trend is particularly evident in urban areas, where population density and digital consumption are at their peak, further propelling the growth of the Global Gigabit Passive Optical Network Market Industry.

Growing Need for Bandwidth-Intensive Applications

The Global Gigabit Passive Optical Network Market Industry is propelled by the growing need for bandwidth-intensive applications, such as streaming services, online gaming, and cloud computing. As users increasingly engage in activities that require substantial data transfer rates, the demand for Gigabit Passive Optical Networks rises. These networks offer the necessary infrastructure to support high-definition video streaming and real-time data processing, which are becoming standard expectations among consumers. Consequently, the market is poised for growth, with projections indicating a significant increase in revenue as more users transition to high-speed internet solutions. This trend highlights the critical role of Gigabit Passive Optical Networks in facilitating modern digital experiences.