Top Industry Leaders in the High Voltage Cables Accessories Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Competitive Landscape of High Voltage Cables and Accessories Market: Navigating a Dynamic Terrain

Key Players and Strategies:

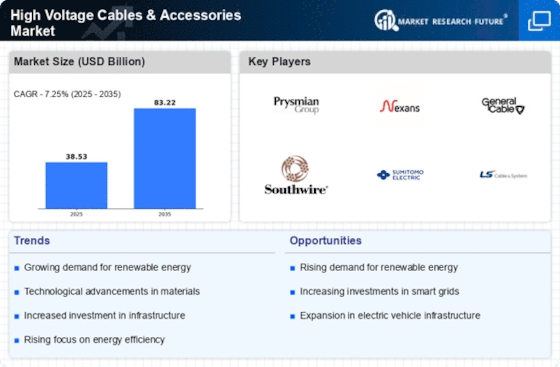

The global arena boasts a mix of established giants and regional disruptors. Nexans, Prysmian Group, NKT Cables, Sumitomo Electric, and General Cable Corporation occupy the top tiers, leveraging their extensive experience, robust R&D capabilities, and global reach. However, regional players like Hengtong Group, Shanghai Cables, and Tata Power Company Limited are rapidly carving their niches, capitalizing on cost-competitiveness and localized expertise.

Strategic maneuvering is key in this dynamic space. Acquisitions and mergers are on the rise, as players seek to diversify their offerings, expand geographically, and acquire critical technologies. Nexans' acquisition of Cimteq, Prysmian Group's joint venture with Siemens for HVDC systems, and NKT Cables' focus on offshore wind farm connections exemplify this trend.

Market Share Analysis: Deciphering the Winners:

Several factors influence market share dynamics. Technological prowess plays a pivotal role, with companies like Sumitomo Electric pushing the boundaries with UHVDC (Ultra High Voltage Direct Current) cables for long-distance power transmission. Geographical dominance matters too, with Chinese giants like Hengtong Group capitalizing on the domestic boom in renewable energy infrastructure. Cost-effectiveness remains a critical differentiator, especially in emerging markets, where players like Tata Power cater to price-sensitive segments.

New Trends and Emerging Technologies:

The high voltage cables and accessories market is abuzz with innovation. Sustainability is taking center stage, with players like Prysmian Group developing bio-based cable materials and NKT Cables focusing on recyclable solutions. Automation and digitization are transforming operations, with ABB's Powerlink HV cable monitoring system enhancing transmission efficiency. The integration of smart grid technologies holds immense potential, as companies like General Cable develop intelligent accessories for real-time data acquisition and optimized network management.

Competitive Outlook: A Shifting Landscape:

The competitive landscape of the high voltage cables and accessories market is characterized by constant flux. Technological advancements, geopolitical shifts, and evolving customer demands necessitate agility and adaptability. Collaboration across the value chain, from raw material suppliers to installation contractors, is becoming increasingly crucial. Partnerships like NKT Cables' collaboration with Ørsted for offshore wind projects exemplify this trend.

In conclusion, the high voltage cables and accessories market presents a compelling picture of dynamic competition. Understanding the strategies of key players, the factors influencing market share, and the emerging trends shaping the future are essential for navigating this challenging yet lucrative terrain. By embracing innovation, forging strategic partnerships, and catering to evolving customer needs, players can secure a sustainable foothold in this electrifying marketplace.

Siemens AG (Germany):

- October 2023: Siemens Energy and Nexans partner to develop and produce high-voltage DC (HVDC) accessories for offshore wind applications.

Hitachi Ltd. (Japan):

- September 2023: Hitachi ABB Power Grids launches a new generation of XLPE cables for underground transmission with improved efficiency and reduced environmental impact.

General Electric (U.S.):

- July 2023: GE Renewable Energy announces a collaboration with Prysmian Group to develop and test next-generation HVDC cables for offshore wind.

NKT Holdings A/S (Denmark):

- October 2023: NKT wins a €500 million contract to supply and install submarine and underground cables for the Viking Link interconnector project between Denmark and Norway.

Top listed global companies in the industry are:

Siemens AG (Germany)

Hitachi Ltd. (Japan)

General Electric (U.S.) NKT Holdings A/S (Denmark)

Nexans S.A. (France)

Prysmian Group (Italy)

Finolex Cables Ltd (India)

RPG Cables (India)

Cable Corporation of India Ltd. (India)

Brugg Kabel AG (Switzerland)

Synergy Cables Ltd. (Israel)