Market Trends

Key Emerging Trends in the High Performance Polyester Market

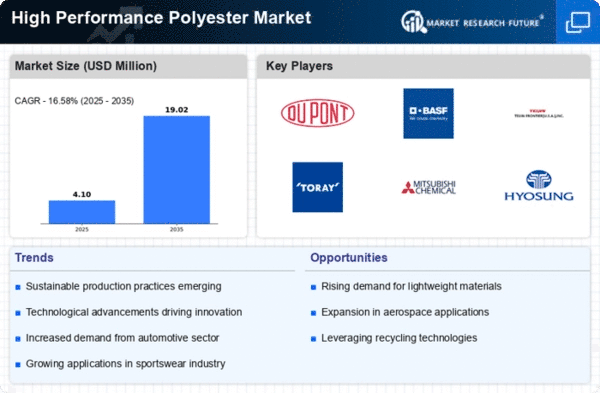

The High-Performance Polyester market is witnessing notable trends that underscore the evolving landscape of the polyester industry. Several key factors contribute to shaping the market dynamics, reflecting its growth patterns and strategic shifts.

Rising Demand in Automotive Applications:

A significant trend in the High-Performance Polyester market is the growing demand for these polymers in the automotive sector.

High-performance polyesters exhibit superior mechanical properties, heat resistance, and durability, making them ideal for various automotive components, such as engine components and interior materials.

Sustainability and Eco-Friendly Solutions:

The market is experiencing a notable shift towards sustainability, with an increasing emphasis on eco-friendly polyester solutions.

High-performance polyesters, known for their recyclability and reduced environmental impact, are gaining traction as manufacturers and consumers prioritize sustainable materials.

Advancements in Polyester Fiber Technology:

Ongoing advancements in polyester fiber technology contribute to the market's evolution.

High-performance polyester fibers are being developed with enhanced strength, moisture-wicking properties, and flame resistance, expanding their applications in the textile and apparel industry.

Growing Popularity in Packaging Industry:

High-performance polyesters are finding increased application in the packaging industry due to their excellent barrier properties and chemical resistance.

These polymers contribute to the development of high-performance packaging materials, addressing the demand for longer shelf life and improved product protection.

Focus on Electrical and Electronics Applications:

The electrical and electronics industry is a key consumer of high-performance polyesters, given their insulating properties and resistance to heat and chemicals.

Applications include electrical insulating films, connectors, and other components in electronic devices, driving demand in this sector.

Demand in Construction and Infrastructure:

High-performance polyesters are gaining traction in the construction and infrastructure sector, primarily in coatings and structural materials.

The polymers offer resistance to weathering, UV radiation, and chemicals, making them suitable for various construction applications, contributing to market expansion.

Technological Innovations and Customization:

Technological innovations in polymerization processes and customization of high-performance polyester formulations contribute to market growth.

Manufacturers are focusing on tailoring polyester properties to meet specific industry requirements, fostering product differentiation and market competitiveness.

Geographical Market Variances:

Regional dynamics play a crucial role in shaping market trends, with varying adoption rates in different parts of the world.

Economic development, industrialization, and regional regulatory landscapes contribute to the diverse market dynamics observed across geographical regions.

Challenges in Raw Material Availability:

The availability and pricing of raw materials, such as purified terephthalic acid (PTA) and monoethylene glycol (MEG), impact the High-Performance Polyester market.

Fluctuations in raw material costs can influence the overall pricing of high-performance polyester products, posing challenges for manufacturers and end-users.

Strategic Collaborations and Partnerships:

The market has witnessed strategic collaborations and partnerships between high-performance polyester manufacturers and end-users.

These alliances aim to develop innovative solutions, address specific industry needs, and ensure a stable supply chain, enhancing the overall competitiveness of market players.

Leave a Comment