High Performance Polyamide Size

High Performance Polyamide Market Growth Projections and Opportunities

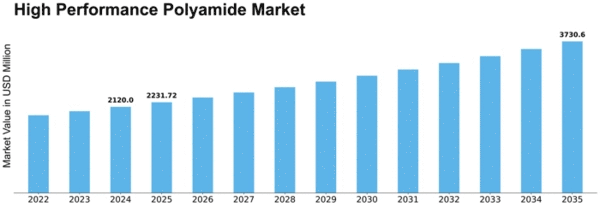

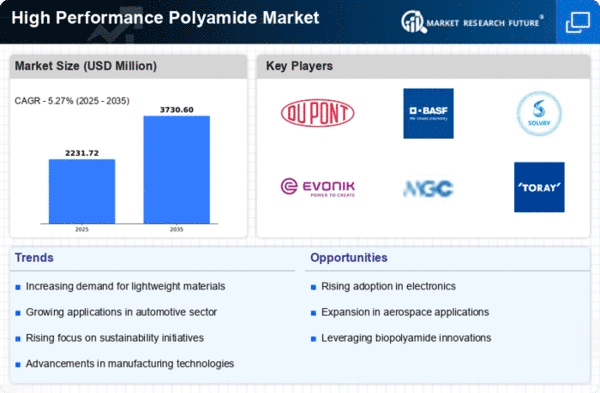

High-Performance Polyamides Market size was valued at USD 1.9 Billion in 2022. The High-Performance Polyamides industry is projected to grow from USD 2.0 Billion in 2023 to USD 3.2 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.10%

The market for high-performance polyamide, often known as nylon, is shaped by various factors that collectively define its dynamics. One of the primary drivers is the increasing demand from industries such as automotive, aerospace, electronics, and consumer goods. High-performance polyamides, known for their exceptional mechanical strength, chemical resistance, and thermal stability, find applications in a wide range of high-stress and demanding environments. In the automotive sector, for instance, these polyamides are utilized in engine components, fuel systems, and lightweight structural parts, contributing significantly to the overall demand for high-performance polyamide.

Technological advancements and innovation play a crucial role in driving the growth of the high-performance polyamide market. Continuous research and development efforts focus on enhancing the properties and performance of polyamide formulations, including improvements in heat resistance, impact strength, and flame retardancy. The development of new grades and blends of high-performance polyamides allows manufacturers to meet the evolving needs of industries that require materials with superior characteristics.

Global economic conditions significantly influence the high-performance polyamide market. Economic growth and stability often lead to increased industrial activities, infrastructure development, and investments in high-performance applications. Conversely, economic downturns may impact industries such as automotive and electronics, affecting the demand for high-performance polyamide. The market's correlation with overall economic health underscores the importance of monitoring global economic trends for stakeholders in the high-performance polyamide industry.

Raw material availability and pricing are critical considerations in the high-performance polyamide market. The primary raw materials for these polymers include adipic acid, hexamethylenediamine, and specialty chemicals. Fluctuations in the prices and availability of these raw materials can impact the overall production cost of high-performance polyamide. Manufacturers closely monitor raw material markets to adapt their strategies and maintain cost-effectiveness in a competitive market.

Geographical factors also play a role in shaping the high-performance polyamide market. The concentration of manufacturing facilities, end-use industries, and regulatory frameworks varies across regions. Different regions may have varying standards and regulations related to the use of high-performance polyamides, influencing market dynamics and product formulations. Additionally, regions with a strong presence in automotive or electronics manufacturing may witness higher demand for these materials.

Environmental considerations are increasingly influencing the high-performance polyamide market. As industries strive to adopt more sustainable practices, there is a growing focus on developing polyamide formulations with reduced environmental impact. Manufacturers are exploring ways to enhance the sustainability profile of high-performance polyamides, including the incorporation of bio-based or recycled content, to align with the evolving expectations of environmentally conscious industries.

Leave a Comment