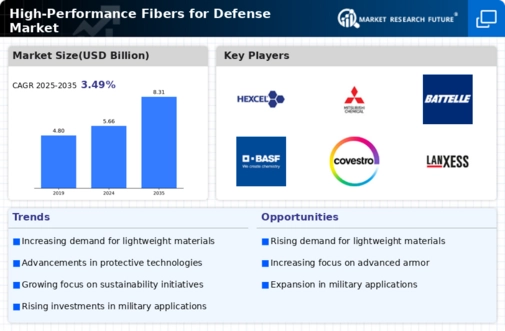

High Performance Fibers for Defense Market

ID: MRFR/CnM/32919-HCR

128 Pages

February 2026

High Performance Fibers for Defense Market Research Report By Application (Ballistic Protection, Aerospace Components, Clothing and Textiles, Composite Materials, Ropes and Cables), By Fiber Type (Aramid Fiber, Carbon Fiber, Glass Fiber, Polyethylene Fiber), By End Use (Military, Law Enforcement, Aerospace, Industrial), By Form (Fibers, Yarns, Fabrics, Prepregs) and By Regional (North America, Europe, South America, Asia Pacific, Middle East and Africa) - Forecast to 2035.