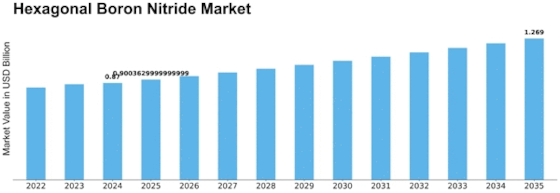

Hexagonal Boron Nitride Size

Hexagonal Boron Nitride Market Growth Projections and Opportunities

The hexagonal boron nitride (hBN) market is influenced by a variety of factors that collectively shape its dynamics and demand across diverse industries. The following key points outline the market factors contributing to the evolution and demand for hexagonal boron nitride:

Thermal Management Applications: Hexagonal boron nitride is widely utilized in thermal management applications due to its excellent thermal conductivity. It is a preferred material for high-temperature environments, making it crucial in industries such as electronics, where efficient heat dissipation is essential for device performance.

Electronics and Semiconductors Industry Growth: The growth of the electronics and semiconductors industry significantly impacts the hexagonal boron nitride market. The material is used as a thermal interface material (TIM) to enhance heat transfer in electronic devices, ensuring optimal performance and reliability.

Lubrication and Anti-Wear Properties: Hexagonal boron nitride's lubrication and anti-wear properties make it a valuable additive in lubricants and coatings. It reduces friction and wear in mechanical systems, contributing to improved efficiency and durability in applications ranging from industrial machinery to automotive components.

Rising Demand in Aerospace Applications: The aerospace industry's demand for lightweight and high-performance materials has led to the increased use of hexagonal boron nitride. It finds applications in aerospace components and materials where its thermal and structural properties contribute to enhanced performance.

Growing Demand in Ceramics and Composites: Hexagonal boron nitride is an essential component in advanced ceramics and composites. Its incorporation enhances the mechanical and thermal properties of these materials, making them suitable for demanding applications in aerospace, defense, and high-performance manufacturing.

Emergence of 2D Materials and Nanotechnology: Hexagonal boron nitride is part of the emerging field of 2D materials, akin to graphene. The material's unique properties, including its planar structure, contribute to its relevance in nanotechnology and the development of advanced materials for various applications.

Dielectric Properties for Electrical Insulation: Hexagonal boron nitride's dielectric properties make it valuable for electrical insulation applications. It is used as a dielectric material in electronic devices, capacitors, and insulating coatings, providing reliable electrical insulation in high-voltage environments.

Demand in Energy Storage Systems: The growing demand for energy storage systems, including batteries and supercapacitors, drives the use of hexagonal boron nitride. Its thermal conductivity and electrical insulation properties contribute to the efficient performance and safety of energy storage devices.

Biomedical Applications: Hexagonal boron nitride finds applications in the biomedical field, particularly in drug delivery systems and medical imaging. Its biocompatibility and stability make it suitable for use in various medical devices and formulations.

Influence of Research and Development: Ongoing research and development initiatives contribute to the market's growth by expanding the applications of hexagonal boron nitride. Researchers explore new formulations, production methods, and applications, driving innovation and opening up new possibilities for the material.

Global Supply Chain Dynamics: The hexagonal boron nitride market is influenced by global supply chain dynamics, including the availability and pricing of raw materials. Factors such as mining operations and geopolitical considerations can impact the overall cost and supply of hexagonal boron nitride.

Environmental and Regulatory Considerations: The market is increasingly influenced by environmental and regulatory considerations. Manufacturers and end-users prioritize materials with minimal environmental impact, and adherence to regulatory standards is crucial in the development and application of hexagonal boron nitride.

Leave a Comment