Market Share

Heavy Construction Equipment Market Share Analysis

The Europe Heavy Construction Equipment market has been witnessing dynamic trends that are reshaping the industry landscape. In recent years, sustainability and technological advancements have become key drivers, steering the market towards a more efficient and eco-friendly future. One prominent trend is the growing emphasis on environmentally conscious construction practices, leading to an increased demand for equipment with lower carbon footprints. This shift aligns with the broader global movement towards sustainable development and is evident in the integration of innovative technologies, such as hybrid and electric engines, into heavy construction equipment.

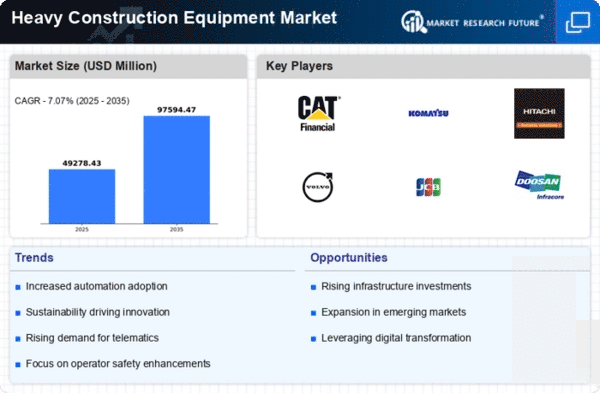

Another noteworthy trend is the surge in demand for automation and connectivity solutions in construction machinery. With the advent of Industry 4.0, construction equipment is increasingly equipped with advanced telematics, sensors, and IoT connectivity, enabling real-time monitoring and data-driven decision-making. This not only enhances operational efficiency but also contributes to preventive maintenance practices, reducing downtime and overall operational costs. The adoption of such smart technologies is expected to continue shaping the market, driving manufacturers to invest in research and development to stay competitive in this rapidly evolving landscape.

Furthermore, the Europe Heavy Construction Equipment market is experiencing a paradigm shift in customer preferences towards rental and leasing models. Economic uncertainties, coupled with the desire for flexibility and cost-effectiveness, have led construction companies to opt for renting equipment rather than making large capital investments. This trend is reshaping the business models of equipment manufacturers and rental service providers, fostering collaborations and partnerships to cater to the rising demand for flexible equipment solutions.

Government initiatives and regulations are also playing a crucial role in influencing market dynamics. The European Union's focus on infrastructure development, coupled with stringent emission norms, has prompted both manufacturers and end-users to align their strategies with sustainability goals. This has resulted in the development and adoption of construction equipment that not only meets regulatory standards but also addresses the growing need for energy efficiency and reduced environmental impact.

The ongoing COVID-19 pandemic has had its impact on the Europe Heavy Construction Equipment market as well. While the initial phases saw disruptions in supply chains and project delays, the latter stages witnessed a rebound as governments across the region announced stimulus packages to boost infrastructure development and revive economic growth. The construction industry, being a key driver of economic activity, received considerable attention, leading to a resurgence in demand for heavy construction equipment.

In conclusion, the Europe Heavy Construction Equipment market is navigating through a transformative phase characterized by sustainability, technology integration, changing customer preferences, and regulatory influences. Manufacturers are increasingly focusing on innovation to meet the evolving needs of the industry, emphasizing green solutions, smart technologies, and flexible business models. As the market continues to evolve, stakeholders need to stay agile and proactive to capitalize on emerging opportunities and overcome potential challenges in this dynamic landscape.

Leave a Comment