Market Trends

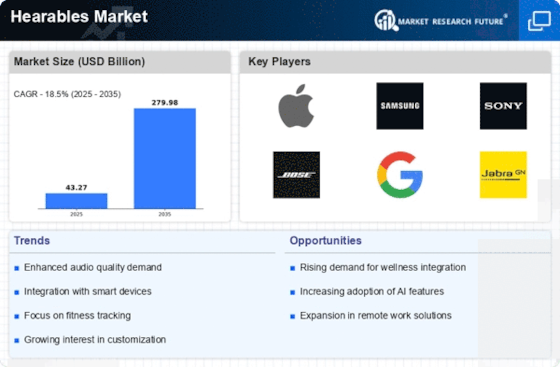

Key Emerging Trends in the Hearables Market

The Hearables market is witnessing several noteworthy trends that are reshaping the industry and influencing consumer choices. One prominent trend is the integration of advanced health and wellness features. Hearables are evolving beyond traditional audio devices, incorporating biometric sensors, fitness tracking capabilities, and health monitoring functionalities. This shift responds to the growing consumer emphasis on overall well-being, making Hearables not just audio accessories but essential components of a holistic health and fitness regimen.

Customization and personalization have become key trends in the Hearables market. Consumers increasingly seek products that cater to their unique preferences and needs. In response, manufacturers are offering customizable features, allowing users to personalize sound profiles, adjust settings, and even choose from a variety of design options. This trend enhances the user experience and fosters a deeper connection between consumers and their Hearables.

Another notable trend is the rise of true wireless earbuds. As technology advances, Hearables are becoming smaller, more compact, and completely wire-free. True wireless earbuds offer a liberating experience, eliminating the hassle of tangled wires and providing a seamless, untethered connection. This trend reflects the consumer demand for convenience and a streamlined audio experience.

Spatial audio technology is gaining traction as a significant trend in the Hearables market. This technology creates a three-dimensional audio experience, enhancing immersion and spatial awareness for users. With spatial audio, users can perceive sound from different directions, adding a new dimension to music, movies, and virtual reality content. This trend aligns with the increasing demand for immersive and high-quality audio experiences.

Environmental sustainability is emerging as a noteworthy trend in the Hearables market. Consumers are becoming more conscious of the environmental impact of electronic devices, prompting manufacturers to adopt eco-friendly practices. This includes using recyclable materials, reducing packaging waste, and implementing energy-efficient manufacturing processes. Sustainability-focused initiatives are resonating with environmentally conscious consumers, influencing their purchasing decisions in the Hearables market.

The convergence of Hearables with augmented reality (AR) and virtual reality (VR) technologies is a trend that holds significant promise. As AR and VR applications expand, Hearables are being integrated to provide immersive audio experiences. This trend enhances the overall sensory experience for users engaged in virtual environments, whether it be gaming, simulations, or interactive content consumption.

Accessibility features are gaining prominence as a trend in the Hearables market. Manufacturers are incorporating features such as real-time translation, voice commands, and audio-based navigation to make Hearables more inclusive and user-friendly. This trend aligns with the goal of providing a seamless audio experience for users with diverse needs and preferences.

The subscription-based model for Hearables is becoming increasingly popular. Some manufacturers offer premium features, continuous updates, and exclusive content through subscription services, creating an ongoing revenue stream beyond the initial hardware purchase. This trend reflects the industry's shift towards service-oriented models, providing additional value to users and fostering brand loyalty.

Leave a Comment