Growing Focus on Patient-Centric Care

In Japan, there is a growing emphasis on patient-centric care, which is influencing the healthcare rfid market. Healthcare providers are increasingly recognizing the importance of personalized treatment and efficient patient management. RFID technology facilitates this by enabling accurate tracking of patient information and medical history, thus enhancing the overall patient experience. The ability to quickly access patient data can lead to improved treatment outcomes and higher patient satisfaction rates. As healthcare institutions prioritize patient-centric approaches, the demand for RFID solutions that support these initiatives is expected to rise, contributing to market growth.

Regulatory Support for RFID Implementation

Regulatory frameworks in Japan are increasingly supportive of the adoption of RFID technology in healthcare settings. The government has recognized the potential of RFID to enhance patient safety and streamline operations. Initiatives aimed at promoting the use of RFID for tracking medical devices and pharmaceuticals are being implemented, which is likely to bolster the healthcare rfid market. For instance, compliance with safety regulations can lead to a reduction in medication errors by up to 30%, thereby improving patient outcomes. This regulatory backing not only encourages investment in RFID solutions but also fosters a culture of innovation within the healthcare sector, further driving market growth.

Technological Advancements in RFID Systems

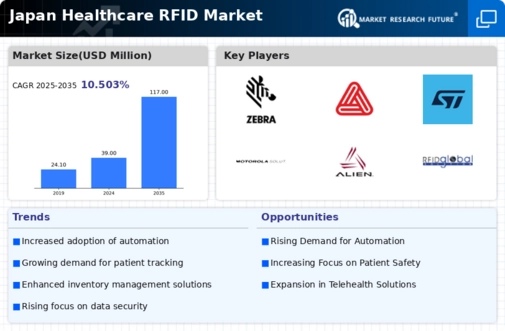

The healthcare rfid market in Japan is experiencing a surge due to rapid technological advancements in RFID systems. Innovations such as passive and active RFID tags are enhancing tracking capabilities, thereby improving inventory management and patient care. The integration of RFID with advanced data analytics allows healthcare providers to monitor assets in real-time, reducing operational costs by an estimated 20%. Furthermore, the development of miniaturized RFID tags is facilitating their use in various medical applications, including surgical instruments and pharmaceuticals. As hospitals and clinics increasingly adopt these technologies, the healthcare rfid market is projected to grow significantly, with a compound annual growth rate (CAGR) of approximately 15% over the next five years.

Increased Investment in Healthcare Infrastructure

The healthcare rfid market is benefiting from increased investment in healthcare infrastructure across Japan. The government and private sector are channeling funds into modernizing healthcare facilities, which includes the integration of advanced technologies like RFID. This investment is aimed at improving operational efficiency and enhancing patient care. For instance, the Japanese government has allocated substantial budgets for upgrading hospital systems, which is likely to include RFID implementations. As infrastructure development progresses, the healthcare rfid market is anticipated to expand, with projections indicating a potential market size increase of over 30% in the next five years.

Rising Demand for Efficient Supply Chain Management

The healthcare rfid market is being propelled by the increasing demand for efficient supply chain management in Japan's healthcare sector. Hospitals and clinics are seeking ways to optimize their supply chains to reduce waste and improve service delivery. RFID technology offers a solution by providing real-time visibility into inventory levels and locations, which can lead to a reduction in stockouts and overstock situations. It is estimated that implementing RFID can decrease supply chain costs by up to 25%. As healthcare providers strive for operational excellence, the adoption of RFID systems is likely to become a standard practice, thereby expanding the market.