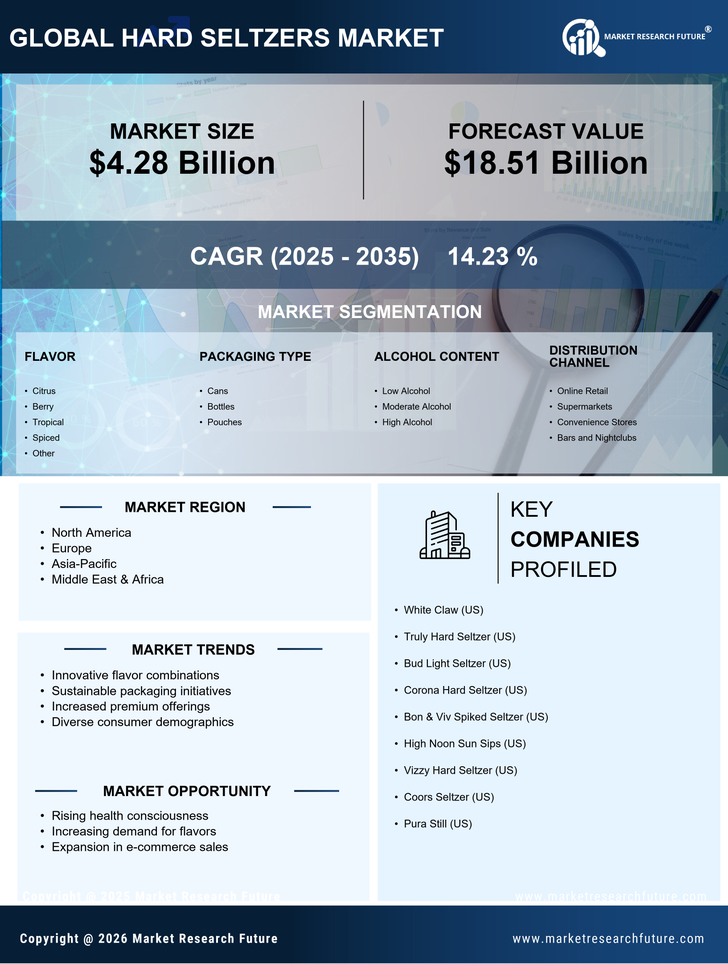

E-commerce Growth

The Hard Seltzers Market is witnessing a significant shift towards e-commerce as a primary distribution channel. With the rise of online shopping, consumers are increasingly purchasing hard seltzers through digital platforms. Recent statistics reveal that e-commerce sales of alcoholic beverages, including hard seltzers, have seen substantial growth, driven by convenience and accessibility. This trend suggests that brands must adapt their marketing strategies to leverage online platforms effectively. As the Hard Seltzers Market embraces e-commerce, companies that invest in digital marketing and online sales channels are likely to enhance their reach and engage with a broader audience.

Flavor Innovation

Flavor innovation plays a pivotal role in the Hard Seltzers Market, as brands strive to differentiate themselves in a crowded marketplace. The introduction of unique and exotic flavors has become a key strategy for attracting consumers. Recent market data suggests that hard seltzers with innovative flavors, such as hibiscus, mango, and even spicy variants, are gaining traction. This trend indicates that consumers are not only looking for refreshing beverages but also for novel taste experiences. As the Hard Seltzers Market continues to evolve, companies that prioritize flavor innovation may find themselves better positioned to capture market share and cater to adventurous palates.

Social Media Influence

The influence of social media on the Hard Seltzers Market cannot be understated. Platforms such as Instagram and TikTok have become vital for brand promotion and consumer engagement. The visual nature of these platforms allows brands to showcase their products creatively, often leading to viral trends and increased visibility. Recent analyses indicate that hard seltzers featuring eye-catching packaging and engaging social media campaigns tend to perform better in terms of sales. This suggests that companies in the Hard Seltzers Market must invest in social media marketing strategies to effectively reach and connect with their target audience.

Health-Conscious Choices

The Hard Seltzers Market is experiencing a notable shift towards health-conscious choices among consumers. As individuals increasingly prioritize wellness, the demand for low-calorie and low-sugar beverages has surged. Hard seltzers, often marketed as a healthier alternative to traditional alcoholic beverages, align well with this trend. Recent data indicates that hard seltzers typically contain fewer than 100 calories per serving, appealing to those seeking lighter options. This health-oriented approach is not merely a passing trend; it appears to be reshaping consumer preferences and driving growth within the Hard Seltzers Market. As a result, brands are likely to continue innovating to meet the evolving demands of health-conscious consumers.

Sustainability Initiatives

Sustainability initiatives are becoming increasingly relevant within the Hard Seltzers Market, as consumers express a growing preference for environmentally friendly products. Brands that adopt sustainable practices, such as using recyclable packaging and sourcing ingredients responsibly, may resonate more with eco-conscious consumers. Recent surveys indicate that a significant portion of consumers is willing to pay a premium for products that align with their values regarding sustainability. This trend suggests that companies in the Hard Seltzers Market that prioritize sustainability could enhance their brand loyalty and appeal to a demographic that values environmental responsibility.