Top Industry Leaders in the Halal Cosmetics Market

Market share analysis in the halal cosmetics sector revolves around several critical factors. The credibility of halal certification, product quality, and adherence to ethical and sustainable practices significantly influence consumer preferences, impacting brand loyalty and market share. Pricing strategies are also pivotal, with companies offering a range of halal cosmetics across different price points to cater to a diverse consumer base. The ability to establish strong partnerships with retailers, both online and offline, plays a crucial role in market share, ensuring wider product accessibility and visibility.

While established players dominate the halal cosmetics market, new and emerging companies are gaining traction with innovative approaches. These entrants often focus on niche segments, unique formulations, and ethical sourcing of ingredients to distinguish themselves. The agility of these emerging companies allows them to respond swiftly to evolving consumer demands, challenging the market dominance of established brands and introducing fresh perspectives to the industry.

Industry news within the halal cosmetics market underscores the dynamism of the sector, with frequent product launches, collaborations, and regulatory developments. Companies consistently introduce new halal cosmetic products, incorporating trending ingredients and addressing specific consumer needs. Collaborations with halal certification bodies and endorsements from religious leaders play a significant role in enhancing product credibility. Regulatory updates related to halal standards also impact industry dynamics, prompting companies to adapt their formulations and practices to comply with evolving requirements.

Current trends in company investments within the halal cosmetics market highlight a substantial focus on research and development. Companies are directing resources toward developing innovative and high-quality halal formulations, exploring sustainable and cruelty-free ingredients, and ensuring compliance with halal standards. Strategic marketing initiatives, including social media campaigns and influencer partnerships, are leveraged to amplify brand presence and resonate with the halal-conscious consumer demographic. Investments in eco-friendly packaging solutions align with the growing demand for sustainable and ethical products.

The overall competitive scenario in the halal cosmetics market remains dynamic, with companies navigating changing consumer expectations and evolving regulatory landscapes. Established players face the challenge of maintaining trust and relevance in a market where emerging companies are capitalizing on specific niches within the halal cosmetics sector. The competition is expected to intensify as new entrants gain recognition, introducing fresh perspectives and challenging the market share of established brands. In this environment, adaptability, responsiveness to consumer preferences, and a commitment to halal principles will be critical for companies to maintain and enhance their competitive positions in the halal cosmetics market.

Industry News and Investment Landscape

- There is potential for growth in this industry, as seen by recent investments in halal cosmetics startups and alliances between well-known companies and local halal operators.

- Venture capital investments are drawn to the sector by the growing demand for ethical beauty goods and the growing awareness of halal certification standards.

- Certain Muslim-majority nations have government programs to assist local halal cosmetics firms and increase market potential for halal industries.

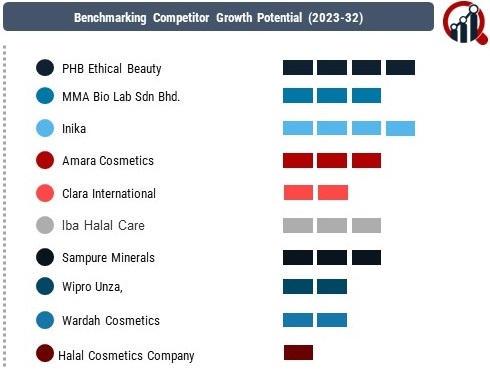

Key Companies in the Halal Cosmetics market include –

- PHB Ethical Beauty

- MMA Bio Lab Sdn Bhd.

- Inika

- Amara Cosmetics

- Clara International

- Iba Halal Care

- Sampure Minerals

- Wipro Unza,

- Wardah Cosmetics

- Halal Cosmetics Company

- Talent Cosmetics Ltd

- One Pure

- Ivy Beauty Corporation Sdn Bhd.

- Brataco Group of Companies

- Mena Cosmetics

- Paragon Technology and Innovation

- Martha Tilar Group

- Saaf Skincare