Ground Penetrating Radar Market Summary

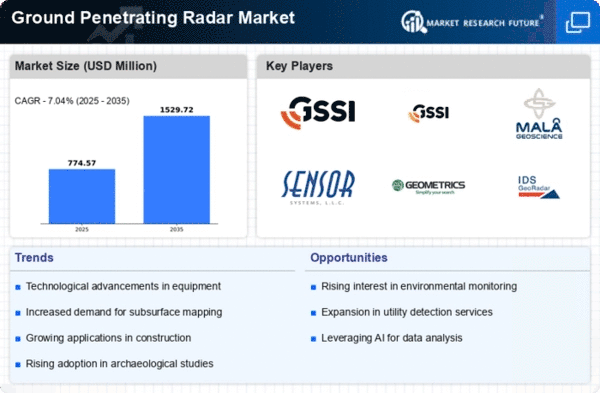

As per MRFR analysis, the Ground Penetrating Radar Market Size was estimated at 723.63 USD Million in 2024. The Ground Penetrating Radar industry is projected to grow from 774.59 in 2025 to 1529.72 by 2035, exhibiting a compound annual growth rate (CAGR) of 7.04% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Ground Penetrating Radar Market is poised for substantial growth driven by technological advancements and increasing applications across various sectors.

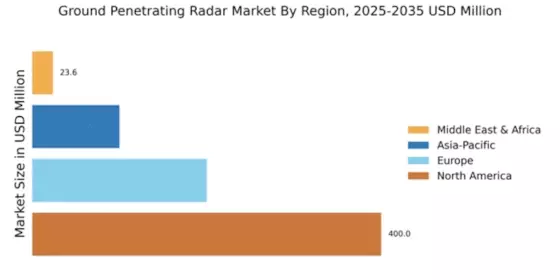

- North America remains the largest market for ground penetrating radar, driven by extensive infrastructure projects and technological innovations.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization and increasing investments in construction and utility detection.

- Utility detection continues to dominate the market, while concrete inspection is witnessing the fastest growth due to heightened safety regulations and quality assurance demands.

- Technological advancements and increased adoption in infrastructure projects are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 723.63 (USD Million) |

| 2035 Market Size | 1529.72 (USD Million) |

| CAGR (2025 - 2035) | 7.04% |

Major Players

SSI (US), Geophysical Survey Systems Inc. (US), Mala Geoscience (SE), Sensors & Software Inc. (CA), Geometrics Inc. (US), IDS GeoRadar (IT), UAVOS (RU), Zond (RU), representing leading ground penetrating radar companies, gpr companies, and ground penetrating radar manufacturers