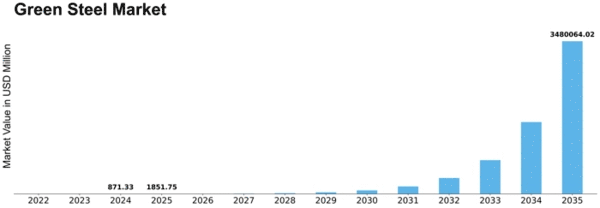

Green Steel Size

Green steel Market Growth Projections and Opportunities

The Green Steel Market is the present process of considerable differences prompted by a combination of environmental issues, technological innovations, and evolving consumer options. As metal enterprises face pressure to reduce their carbon footprint, numerous key marketplace factors shape the panorama of inexperienced metal manufacturing.

The number one driver for the inexperienced metal market is the worldwide vital to gain carbon neutrality. Traditional metallic manufacturing techniques, in particular blast furnaces, emit great carbon dioxide. The shift closer to green metal is motivated by the need to cope with weather change and reduce the environmental impact of metal manufacturing.

The improvement and adoption of low-carbon technology, which includes hydrogen-based totally direct discount and electric arc furnaces powered with the aid of renewable energy, are key individuals to the growth of the green metal market. These technologies offer options to standard methods and significantly lessen carbon emissions within the steelmaking manner.

Stringent environmental guidelines and authority incentives play a pivotal role in encouraging the adoption of inexperienced steel. Countries and regions are implementing guidelines to encourage metal enterprises to transition to cleaner manufacturing strategies. Incentives, along with carbon pricing and subsidies for green projects, accelerate this transition.

Increasing patron cognizance and call for sustainable merchandise have an impact on industries such as metal manufacturing. Manufacturers and purchasers alike are prioritizing merchandise with decreased carbon footprints, prompting metallic producers to adopt greener practices to fulfill market expectations and enhance emblem photography.

The idea of a round financial system, emphasizing aid performance and recycling affects the inexperienced steel marketplace. Steel recycling reduces the reliance on uncooked materials, conserves power, and minimizes waste. Steelmakers incorporating circular economy ideas make contributions to the sustainability desires of the enterprise.

Collaborations between steel producers, era vendors, and governments boost the development and implementation of green metallic solutions. Partnerships facilitate knowledge exchange, shared sources, and the scaling up of green steel production, contributing to the general growth of the marketplace.

Green metal gives an aggressive advantage and a unique selling proposition for metallic producers. Companies adopting sustainable practices can differentiate themselves inside the marketplace, attracting environmentally conscious clients and securing partnerships with green industries.

Economic trends and market conditions affect the tempo of the adoption of green metallic technology. Economic balance and boom can impact investments in sustainable metallic production, while economic downturns may additionally pose demanding situations.

Educating consumers about the environmental impact of steel production and the benefits of choosing green steel products is essential. Awareness campaigns contribute to changing consumer perceptions and fostering a preference for eco-friendly steel, further driving the demand for green steel in the market.

Leave a Comment