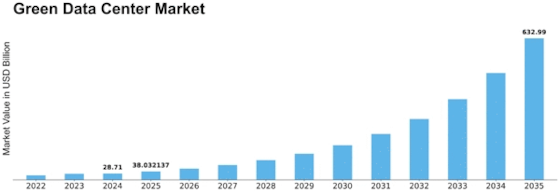

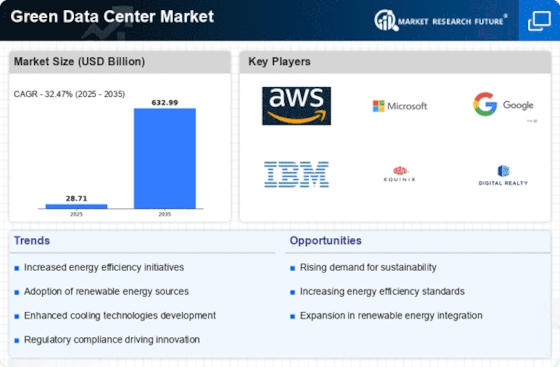

Green Data Center Size

Green Data Center Market Growth Projections and Opportunities

Various market factors influence the green data center market, which thus shapes its development and improvement. The developing worldwide attention to natural supportability and environmental change is one significant component. Eco-accommodating practices are turning out to be increasingly more significant for organizations and state-run administrations as stresses over the impacts of the conventional server farms on the climate develop. Green data center market, which are worked to decrease their carbon impression and run in a biologically mindful way, are turning out to be increasingly more famous because of this mindfulness.

Strategies and guidelines from the public authority altogether affect the green data center market. Severe natural principles and regulations are being executed in numerous countries and regions to restrict energy use and lower ozone harming substance discharges. Associations putting resources into green advances are additionally being given motivators like tax cuts and endowments. Organizations are urged to adopt economical practices to conform to government orders, which establishes a steady climate for market development. One more market factor impelling the coordination of green data center market is the rising expense of energy. Regular server farms are infamous for utilizing a ton of energy, which raises working costs fundamentally. Green data center offers a more reasonable choice in view of their accentuation on sustainable power sources and energy productivity.

Organizations are urged to change to additional harmless to the ecosystem server farm arrangements as energy costs ascend to decrease working expenses. Developments and innovative leap forwards immensely affect the market factors for green data center. More economical server farm frameworks are made conceivable by the continuous improvement of energy-productive innovations like server virtualization, high level cooling frameworks, and equipment enhancement. These mechanical advances help to decrease generally energy utilization and ecological effect as well as expanding the functional adequacy of green data centers. One significant selling point for green data center is their related monetary benefits.

Green innovations might require a bigger beginning speculation, yet they offer critical long haul cost reserve funds. For organizations executing green data centers, lower working expenses, environmentally friendly power sources, and energy-effective plans all add to a positive profit from venture. Organizations are urged to contemplate the monetary and natural benefits of manageable server farm arrangements by this monetary motivation. The market elements for green data center market are being molded by shopper interest and inclinations. Purchasers are anticipating that organizations should show their commitment to maintainability as they develop all the more earth cognizant. Organizations that run green data centers can exploit this buyer interest to attract eco-mindful clients and get an upper hand.

For organizations in different areas, meeting customer assumptions for harmless to the ecosystem tasks is transforming into a basic vital necessity. Organizations and collaboration inside the area fundamentally affect the market. Cooperation in the midst of innovation suppliers, the server farm administrators, and ecological associations turns out to be progressively significant as the market creates. Through organizations, information, assets, and best practices can be shared, prompting the production of server farm arrangements that are more viable and manageable. These helpful drives support the market's overall development and development for green data centers. Despite these advantages, there are still issues with the construction of industry. The business is as yet attempting to move beyond various difficulties, like the requirement for normalized natural measurements, the forthright expenses of incorporating green advancements, and the test of persuading partners that maintainability ought to start things out.

Leave a Comment