Granite Marble And Stone Two Size

Granite, Marble and Stone Market Growth Projections and Opportunities

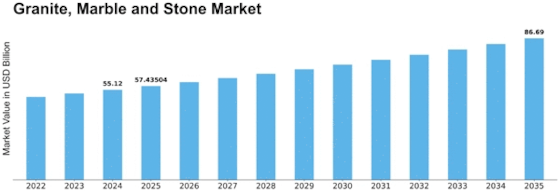

The global granite, marble and stone market is accounted to register a CAGR of 4.20% during the forecast period and is estimated to reach USD 73.5 billion by 2032.

The Granite, Marble, and Stone market are influenced by a diverse array of market factors that shape its dynamics and growth. One fundamental factor is the construction and real estate industry. The demand for granite, marble, and stone products is closely tied to construction activities, as these materials are integral to building structures, countertops, flooring, and other architectural elements. Economic fluctuations, housing market trends, and infrastructure development projects significantly impact the demand for these materials.

Technological advancements play a key role in shaping the market for granite, marble, and stone. Innovations in extraction, cutting, and processing technologies enhance the efficiency and precision of the stone industry. Additionally, digital tools and software are employed for designing and planning, allowing for more intricate and customized use of these materials. The adoption of advanced technologies is crucial for companies in the granite, marble, and stone market to stay competitive and meet the evolving needs of architects, designers, and builders.

Environmental considerations are increasingly influencing the market for granite, marble, and stone. Sustainability has become a priority, leading to a greater emphasis on responsibly sourced and processed materials. Companies in the industry are implementing eco-friendly practices, including recycling water used in processing, reducing waste, and ensuring ethical sourcing of raw materials. As environmental consciousness continues to grow, the market is likely to see a shift towards more sustainable practices.

Architectural trends and consumer preferences significantly impact the market for granite, marble, and stone. Design aesthetics and preferences for natural, durable, and aesthetically pleasing materials drive the selection of these stones in construction and interior design. The popularity of granite and marble countertops, intricate stone flooring patterns, and natural stone accents in landscaping are examples of how architectural trends influence the market. Companies in this sector need to stay attuned to design preferences to offer products that align with current market demands.

Global trade and geopolitical factors also play a role in the granite, marble, and stone market. The extraction and processing of these materials often occur in specific regions, and geopolitical events or trade restrictions can impact the availability and pricing of these resources. Companies operating in this market need to navigate international trade dynamics and anticipate potential disruptions in the supply chain to ensure a stable and consistent flow of materials.

Regulatory compliance is a significant consideration in the granite, marble, and stone industry. Safety standards, environmental regulations, and labor practices are subject to scrutiny, and companies must adhere to these regulations to ensure responsible and ethical operations. Changes in regulatory requirements can affect production processes, sourcing practices, and overall business strategies within the market.

Market competition is intense within the granite, marble, and stone industry. Companies vie for market share by offering a wide range of products, competitive pricing, and quality services. Differentiation through unique stone varieties, finishes, and customized solutions is a common strategy. Establishing strong relationships with distributors, contractors, and designers is crucial for companies seeking a competitive edge in this market.

Leave a Comment