Top Industry Leaders in the Gourmet Salt Market

Strategies Adopted by Gourmet Salt Key Players

The gourmet salt market has experienced a significant transformation, driven by evolving culinary preferences and a growing interest in unique flavors and textures. This niche segment within the larger salt industry has attracted various players aiming to capitalize on consumers' inclination towards specialty salts for culinary enhancement and health-conscious choices.

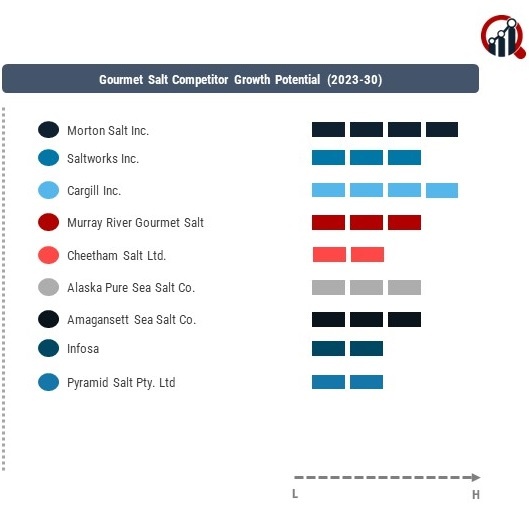

Key Players Dominating :

- Morton Salt Inc. (US)

- Saltworks Inc. (US)

- Cargill Inc. (US)

- Murray River Gourmet Salt (Australia)

- Cheetham Salt Ltd. (China)

- Alaska Pure Sea Salt Co. (US)

- Amagansett Sea Salt Co. (US)

- Infosa (Spain)

- Pyramid Salt Pty. Ltd. (Australia)

- Maldon Crystal Salt Company Ltd (UK), among others

Strategies adopted by players in the gourmet salt market encompass innovation in product offerings and expanding distribution channels. These strategies aim to capture market share by introducing new varieties of gourmet salts infused with herbs, spices, or other natural ingredients. Additionally, partnerships with restaurants, celebrity chefs, and culinary influencers serve as effective marketing tools, influencing consumer preferences and driving sales. Moreover, emphasis on eco-friendly packaging and sustainable sourcing practices has become a focal point for many companies, aligning with the increasing consumer demand for ethically produced gourmet salts.

Market Share Analysis

Market share analysis in the gourmet salt industry considers several factors. Brand recognition and reputation for quality and purity significantly impact consumer preferences. Unique flavor profiles, texture, and the mineral content of salts contribute to their market appeal. Pricing strategies, while often higher due to the premium nature of gourmet salts, must still align with consumer perceptions of value. Furthermore, accessibility through various distribution channels, including specialty stores, online platforms, and high-end grocery chains, influences a company's market reach and potential for growth.

Emerging Companies

In this landscape, new and emerging companies are making notable strides. Startups and artisanal producers are entering the market with small-batch, hand-harvested, or uniquely flavored salts. These companies differentiate themselves by focusing on specific regional salts or introducing innovative processing techniques that preserve the salts' natural mineral content and flavors. Their agility and ability to cater to niche consumer demands enable them to carve a niche within this competitive market.

Industry news often highlights technological advancements in salt harvesting and processing, sustainable sourcing practices, and the introduction of exotic salt varieties. Innovations such as solar evaporation methods, which reduce environmental impact, and the discovery of new salt deposits garner attention within the industry. Additionally, shifts in consumer preferences towards healthier alternatives and clean-label products influence the introduction of low-sodium gourmet salt options or salts rich in trace minerals.

Industry Trends:

Current company investment trends within the gourmet salt market reflect a focus on sustainability, innovation, and market expansion. Investments are directed towards eco-friendly production methods, such as reducing water and energy consumption during salt production, and adopting packaging solutions that minimize environmental impact. Companies are also investing in research and development to create new flavor profiles, innovative packaging designs, and exploring digital marketing strategies to connect with a wider consumer base.

Competitive Scenario:

The gourmet salt market underscores a balance between established players leveraging their brand reputation and newcomers disrupting the market with unique offerings. The industry's growth is fueled by a combination of factors including consumer interest in premium culinary experiences, health-conscious choices, and sustainability. As consumer tastes continue to evolve, companies in this sector will need to remain agile, innovating to meet shifting demands while maintaining a commitment to quality and sustainability to thrive in this competitive market.

Recent Development

In 2023, Morton Salt introduced a range of flavoured salts, such as Chipotle Lime and Tuscan Herb, to capitalise on the growing popularity of stronger flavour profiles.