Glycoprotein Size

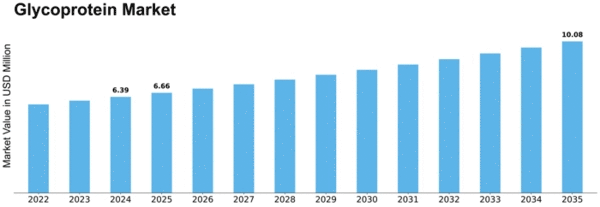

Glycoprotein Market Growth Projections and Opportunities

Many are the determinants of glycoprotein market which take its form and growth trajectory. One of the determining factor is escalating prevalence of long term illnesses, for example cancers, diabetes and autoimmune disorders. These health conditions continue to rise at global scale thus demand for therapeutic interventions like glycoprotein based drugs has increased as well. Additionally, biotechnology and genetic engineering advancements also drive the market.

Manipulating and engineering glycoproteins for specific therapeutic purposes improves their efficiencies hence expanding the markets in general.

The size Glycoprotein Market Size is estimated to reach USD 5320 Million by end of 2028 at CAGR of about 2.6%

Competitive landscape and consolidation are other factors that influence this industry. Mergers and acquisitions, partnerships or collaborations among major stakeholders shape how the market looks like. This affects companies’ shares as well as driving forces behind R&D activities in this market as well whole strategies concerned with it. To search for new treatments or technologies on the basis of glycoproteins it often has to be done collectively through collaboration which means pooling resources together with exchange of knowledge that result in desirable outcomes more efficiently.

Technological breakthroughs and research advances are critical in influencing the direction taken by this industry known as the glycoprotein market. On-going research initiatives regarding structure and functions of these molecules bring fresh ideas for innovative products development process to life. Cutting-edge technological integration like CRISPR-Cas9 gene editing allows precise modification of particular aspects within glycoproteins making them more effective medicaments possibly curing different diseases completely rather than merely mitigating them. Continuous stream of discoveries due to science’s dynamism keeps pushing this field forward.

The affordability and accessibility are key factors determining penetration into this product segment consisting of drugs developed on the basis of these complex compounds like glycoproteins. Disparities in healthcare provision together with lack access to advanced medical treatment can affect adoption rates of glycoprotein-based medications in different regions. To ensure an all-inclusive and sustainable market growth, there are initiatives to improve healthcare facilities, reduce treatment costs and increase the accessibility of patients.

Finally, environmental as well as ethical concerns are coming to the fore within the field of glycoproteins’ use. Various aspects such as sourcing raw materials or production processes used in production of these glycoprotein based products have increasingly been put under scrutiny for their environmental implications and whether they adhere to ethical standards. Sustainable socially responsible practices that align with societal expectations are eco-friendly thus help maintain a market in the long run where consumers and stakeholders prefer more eco-friendly solutions.

Leave a Comment